Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Mar 24, 2021

Weekly Pricing Pulse: Oil reverses on new lockdowns in Europe

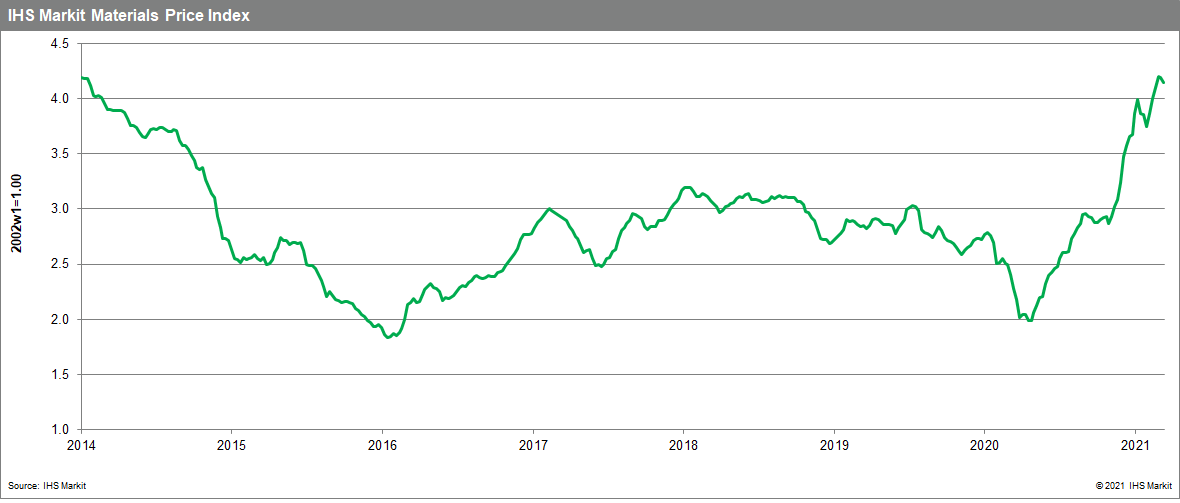

Our Materials Price Index (MPI) declined 1.1% last week, ending a five-week streak of increases. Although commodity markets have become choppy recently, declines were not widespread last week - only four of the MPI's ten subcomponents fell. Commodity prices as measured by the MPI are still up 13.5% year-to-date.

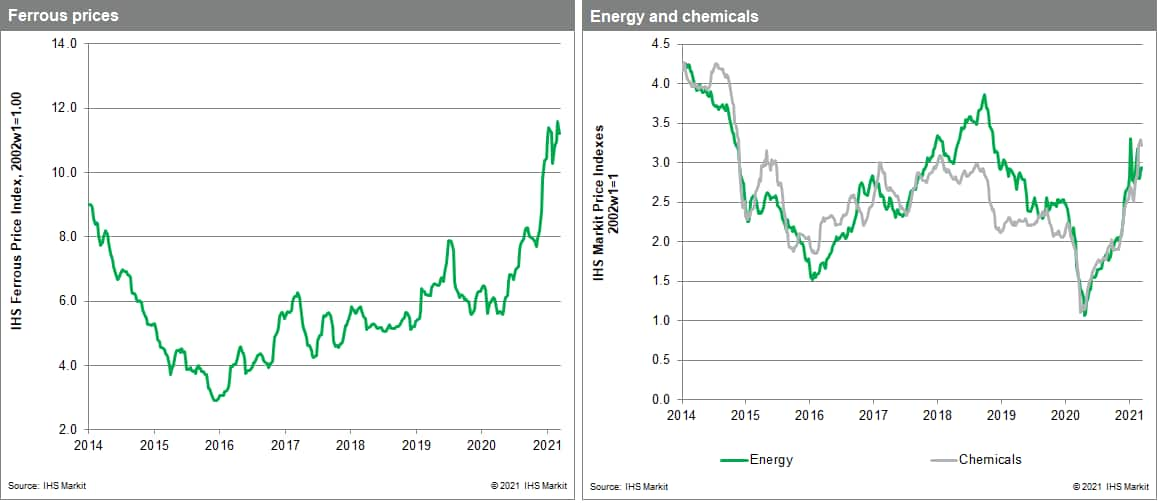

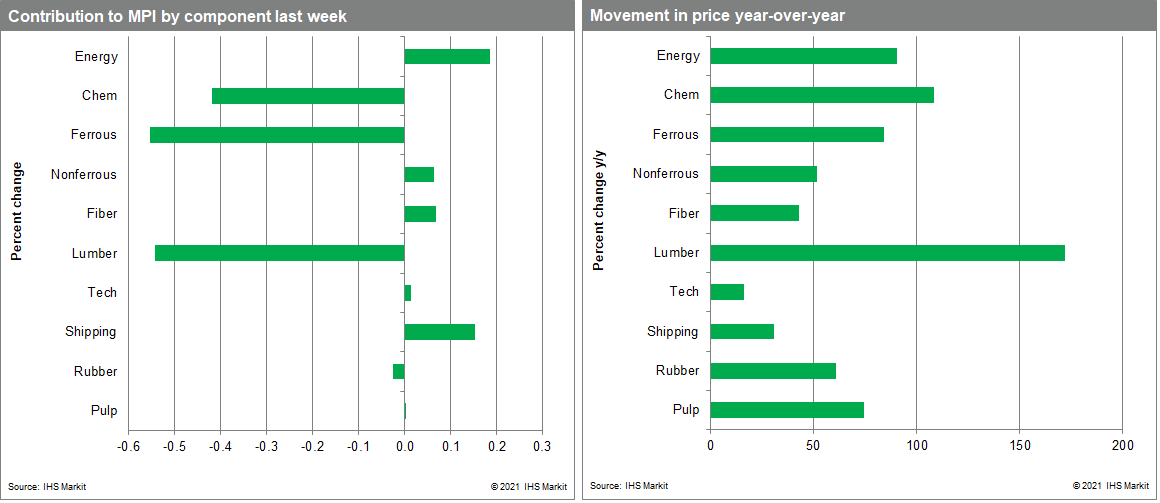

The largest declines were in lumber and chemicals. North American lumber prices fell 13.1% as the lingering effects of February's cold weather and high prices weighed on demand. Despite the large drop, lumber prices remain 172% higher than a year ago. Chemicals prices followed crude oil prices down. Although the energy component of the MPI increased last week, the rise was driven by coal and natural gas prices. Crude oil prices fell 2.2% for the week, with chemicals dropping 2.1%. The downward slide in oil prices was mostly a factor of pared back expectations for a quick demand rebound. This change reflects new widespread lockdowns in Europe that cast doubt on how quickly transportation activity will recover. In addition to the drop in oil prices, weakening sentiment in Northeast Asia added to the drop in chemicals prices, with the ethylene market facing both buyer resistance and increasing supply. Elements of the MPI showing strength last week included freight, with rates increasing 6% and DRAMs prices, which increased 3.2%. Strong demand and tight supply continue to support prices in both categories.

As vaccine rollouts continue, enabling a recovery in the global economy, inflation risks are increasing. The bad news is that the past year of rising commodity prices already ensures higher goods price inflation this summer. Whether this burst of inflation is prolonged or only temporary will depend on how quickly problems in production and with logistics services are resolved. At the moment, supply chains are fragile and a source of upside price risk. But assuming disruptions and bottlenecks fade as the pandemic recedes, markets look to be in a better balance by the end of the year with cost pressures becoming manageable even as a broader recovery gains traction.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-oil-reverses-on-new-lockdowns-in-europe.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-oil-reverses-on-new-lockdowns-in-europe.html&text=Weekly+Pricing+Pulse%3a+Oil+reverses+on+new+lockdowns+in+Europe+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-oil-reverses-on-new-lockdowns-in-europe.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Oil reverses on new lockdowns in Europe | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-oil-reverses-on-new-lockdowns-in-europe.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Oil+reverses+on+new+lockdowns+in+Europe+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-oil-reverses-on-new-lockdowns-in-europe.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}