Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jan 27, 2021

Weekly Pricing Pulse: Commodity prices drop for a change

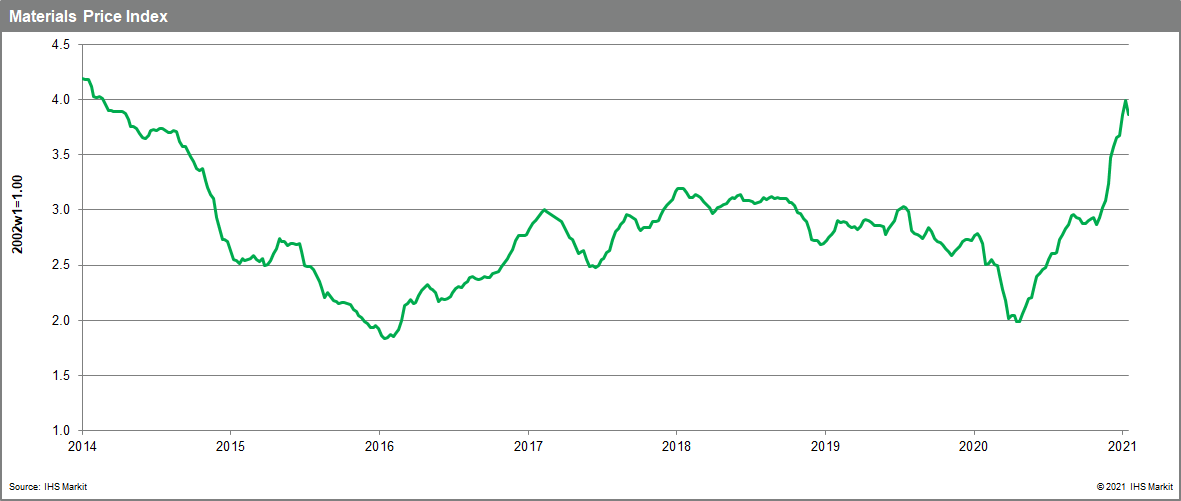

Our Materials Price Index (MPI) fell 3.2% last week, its first decline since early November and its biggest weekly drop since March 2020, which was the height of COVID-19 shutdowns. Notwithstanding last week's retreat, the MPI is still at its highest point since April 2014 and still stands 39.5% higher than in early 2020.

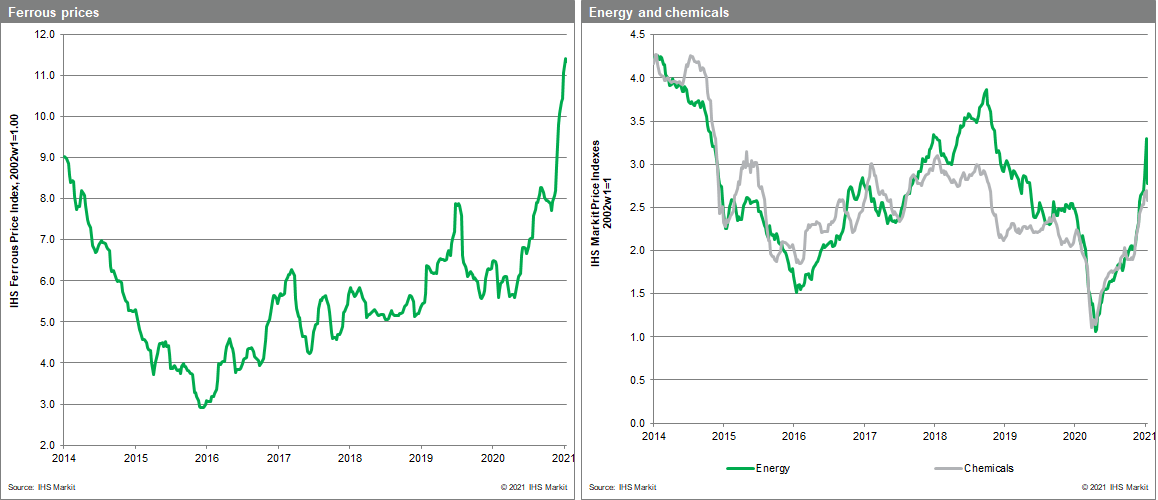

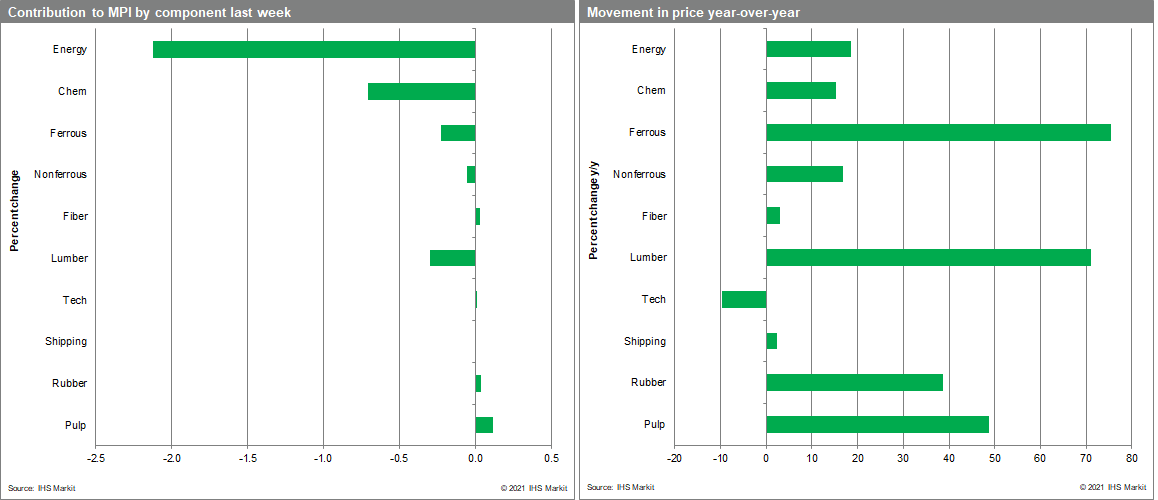

Six of the MPI's ten sub-components posted decreases last week with energy and chemicals recording sizable drops. The energy index declined 16.1%, fully reversing the increase recorded the previous week. The decline was also the second biggest drop in the history of the series and was only beaten by the plunge in April 2020 when oil markets were in freefall. LNG prices declined on milder weather projected for China and Japan combined with a better supply picture, especially for the Panama Canal, where congestion is expected to be alleviated by early March. The chemicals index declined by 4.2% as US ethylene prices fell because of weaker feedstock costs. Supply also improved with several longstanding plant outages expected to be resolved in the first quarter. Asian ethylene prices were likewise weaker on expectations that supply will improve in the short term. Bucking the general trend in the MPI for the week, our DRAMS index increased 3.5% as a global shortage of semiconductors pushed up prices. An unexpected increase in demand from carmakers at the end of last year has challenged supply chains, which were already tight because of strong demand from phone and computer manufacturers. Long semiconductor lead times suggests further upward price pressure in the near term.

While markets did receive some good news last week on US housing markets and did exhibit some general optimism around President Biden's inauguration, these positives were offset at week's end by weak flash January Purchasing Manager Index (PMI) reports for Japan, the U.K. and the Eurozone. The PMI data highlight the damage being done by the COVID-19 second wave and signal a recession for the European economy is now underway. With Asian buyers soon to be away from markets because of the Lunar New year holiday, a run of bad news in the weeks ahead could expose markets to a correction.

Want more on what's happening to material prices and labor shortages? Listen to our latest podcast with our pricing team.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-drop-for-a-change.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-drop-for-a-change.html&text=Weekly+Pricing+Pulse%3a+Commodity+prices+drop+for+a+change+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-drop-for-a-change.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Commodity prices drop for a change | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-drop-for-a-change.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Commodity+prices+drop+for+a+change+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-drop-for-a-change.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}