Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 05, 2024

Week Ahead Economic Preview: Week of 8 April 2024

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

Central bank meetings, UK output, US and China inflation in focus

Central bank meetings including those of policymakers in the eurozone and Canada will be in focus alongside key inflation updates in the US and mainland China. Additionally, minutes from the March FOMC meeting will be released midweek. Other noteworthy data releases in the week include February UK GDP figures, in addition to trade statistics from Germany and mainland China. S&P Global also publishes April's US Investment Manager Index (IMI) for survey-based insights into investor sentiment at the start of Q2 2024.

April's IMI survey will be eyed at the start of the week for any change in sentiment towards central bank policy as a driver for equity markets after March's survey revealed that risk-off sentiment has gathered amid reduced rate cut expectations. With US markets continuing to live and breathe monetary policy guidance, the minutes from the March FOMC meeting will likewise be scrutinised for insights (despite more recent comments from Fed officials). If nothing else, policymakers are data dependent, hence the additional focus on the upcoming US CPI data, which are expected to help confirm early PMI data indications of easing of inflationary pressures in March, ahead of risks of more stubborn inflation later in the year.

Key central bank meetings meanwhile unfold in the eurozone, Canada, New Zealand and South Korea. Amid heightened speculation that the European Central Bank (ECB) may lower rates in June, the April meeting may well be used to set the conditions for the start of any pivot. This is set against indications of easing, but still-elevated, inflation in the euro area, reflecting the uncertainties regarding the path forward for the ECB.

Additionally, a busy economic calendar also sees UK GDP data for February due Friday, which are expected to reinforce the growth picture - and revival from recession -preluded by PMI data.

Finally, mainland China updates its first set of trade numbers post the Lunar New Year period. This comes after Caixin China PMI data revealed that exports orders expanded at the fastest rate in 13 months in March. Inflation figures will also be due, though more subdued price increases were observed by the PMI amid falling manufacturing sector costs.

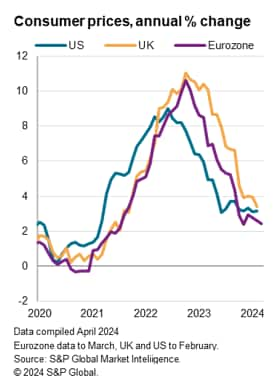

Will Europe's central banks be in position to cut rates before the Fed?

Recent data hint at the possibility that the ECB and Bank of England could be seeing inflation targets met sooner than the US Fed.

Looking at consumer price inflation, headline rates have fallen to 2.4% in the eurozone (as of March), and 3.2% and 3.4% respectively in the US and UK (as of February). As things currently stand, the ECB is therefore seeing headline inflation cool closer to target than both the FOMC and Bank of England. However, base effects are important in the annual rates of change.

To see how base effects might impact the data, we assume in all three cases there are no month-on-month increases going forward. In this scenario, US headline inflation falls below 2% in August. But 2% is breached in both the UK and eurozone in April. A similar divergence is also seen under a scenario which assumes future monthly changes in each economy based on prior six-month averages (i.e. 0.3% in the US and 0.1% in both the UK and eurozone). Again, in the US 2% is not breached until August but in the UK and eurozone 2% is beaten in April.

It is also useful to assess the recent trends in PMI survey data, which act as a leading indicator of consumer price inflation rates. The latest March PMI data showed average prices charged for goods and services rising in the eurozone at a markedly slower rate than in the US and UK, with the US also being noteworthy in reporting an accelerated rate of increase.

Taken together, the CPI and PMI data therefore hint at the ECB being the first to see inflation hitting (and remaining below) target, followed by the UK, with the US lagging behind in the inflation battle. We will, however, know more this week with updated US CPI.

Key diary events

Monday 8 Apr

Indonesia, Thailand, Saudi Arabia Market Holiday

Australia Judo Bank SME Business Activity Report* (Mar)

Malaysia Industrial Production (Feb)

Germany Trade and Industrial Production (Feb)

Philippines BSP Interest Rate Decision

United States Consumer Inflation Expectations (Mar)

Tuesday 9 Apr

Indonesia, Malaysia, Philippines, Turkey, Saudi Arabia Market

Holiday

Australia NAB Business Confidence (Mar)

Japan Consumer Confidence (Mar)

Taiwan Inflation (Mar)

Mexico Inflation (Mar)

United States S&P Global Investment Manager Index* (Apr)

Wednesday 10 Apr

Singapore, Indonesia, Malaysia, Philippines, Turkey, Saudi

Arabia Holiday

Japan PPI (Mar)

New Zealand RBNZ Interest Rate Decision

Thailand BoT Interest Rate Decision

Taiwan Trade (Mar)

Brazil Inflation (Mar)

United States CPI (Mar)

Canada BoC Interest Rate Decision

United States Wholesale Inventories (Feb)

United States FOMC Minutes (Mar)

Thursday 11 Apr

India, Indonesia, Malaysia, Turkey, Saudi Arabia Market

Holiday

Philippines Trade (Feb)

China (Mainland) CPI, PPI (Mar)

China (Mainland) M2, New Yuan Loans, Loan Growth (Mar)

Italy Industrial Production (Feb)

Brazil Retail Sales (Feb)

Mexico Industrial Production (Feb)

Eurozone ECB Interest Rate Decision

United States PPI (Mar)

OPEC Monthly Report

Friday 12 Apr

Indonesia, Turkey, Saudi Arabia Market Holiday

South Korea Unemployment (Mar)

Singapore GDP (Q1, adv.)

Philippines Industrial Production (Feb)

South Korea BoK Interest Rate Decision

China (Mainland) Trade (Mar)

Japan Industrial Production (Feb, final)

Germany Inflation (Mar, final)

United Kingdom monthly GDP, incl. Manufacturing, Services and

Construction Output (Feb)

United Kingdom Trade (Feb)

France Inflation (Mar, final)

India Industrial Production (Feb)

India Inflation (Mar)

United States UoM Sentiment (Apr, prelim.)

GEP Global Supply Chain Volatility Index* (Mar)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

What to watch in the coming week

Americas: BoC meeting, Fed minutes, US CPI, PPI and UoM sentiment

The Bank of Canada (BoC) convenes but no changes to rates are expected by the markets until the second half of 2024. Meanwhile Fed minutes from the March FOMC meeting will be closely watched, with the latest comments from fed chair Powell stressing how the fight against inflation is not yet done, thereby emphasizing the need for further confirmation from upcoming data of its 2% target being met sustainably.

The key data release of the week will therefore be US inflation figures with both headline and core CPI readings expected to ease. Monthly gains of 0.3% are expected according to consensus in both cases against 0.4% increases in February. This is in line with the trend suggested by US PMI prices data, though flash figures have earlier indicated that inflation may remain rather sticky in the coming months.

EMEA: ECB meeting, UK output data, Germany trade

The European Central Bank (ECB) April meeting unfolds in the week with no changes to monetary policy expected on the back of still-elevated inflation and tight labour markets. That said, policymaker comments have ramped up expectations that cuts could come as soon as June and the official statistics and the latest HCOB Eurozone PMI have pointed to cooling inflation.

UK GDP data will meanwhile be updated. According to S&P Global UK PMI data for February, private sector output rose at the fastest pace in nine months, led by services, suggesting that the technical recession endured by the UK late last year has already ended.

APAC: RBNZ, BoK, BSP, BoT meetings, China inflation, trade data

Central banks meetings in New Zealand, South Korea, Philippines and Thailand are set to take place in the week though no changes are expected according to consensus. That said, the Bank of Korea may be amongst which close to lowering rates and the rhetoric will be in focus.

Key data releases out of mainland China including inflation data and trade numbers will be watched after the Caixin Manufacturing PMI showed lower factory gate inflation and improvements in trade conditions.

US Investment Manager Index and Global Supply Chain Volatility Index

Updates of the S&P Global Investment Manager Index and GEP Global Supply Chain Volatility Index are due Tuesday and Friday respectively.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-8-april-2024.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-8-april-2024.html&text=Week+Ahead+Economic+Preview%3a+Week+of+8+April+2024+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-8-april-2024.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 8 April 2024 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-8-april-2024.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+8+April+2024+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-8-april-2024.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}