Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 08, 2024

Emerging markets activity expands at fastest pace in ten months

Emerging markets growth accelerated at the end of the first quarter of 2024, rising in March at the fastest pace since May of last year. Supporting the latest expansion were improvements across both the manufacturing and service sectors, with India continuing to lead growth in both sectors among the biggest emerging market economies.

Forward-looking indicators meanwhile outlined the likelihood of sustained expansion in emerging market activity in the near term, which - alongside an easing of price pressures - have supported further improvements in sentiment among emerging market firms.

Broad-based and balanced emerging market expansion in March

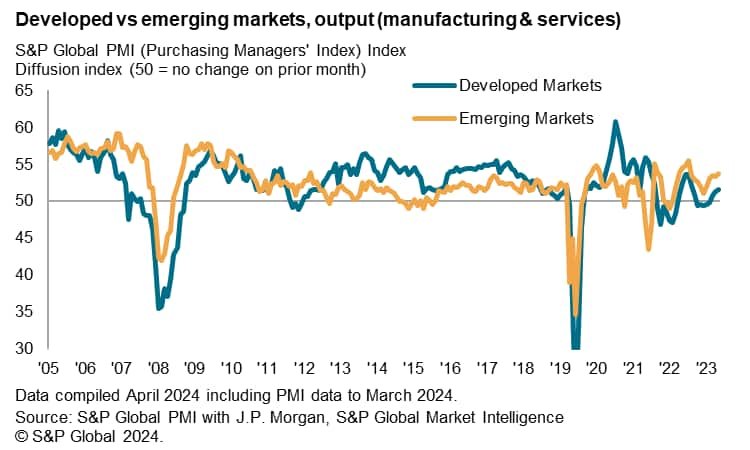

The PMI surveys compiled globally by S&P Global found the emerging markets to have collectively expanded in March at the most pronounced rate since May 2023. The GDP-weighted Emerging market PMI Output Index rose from 53.4 in February to 53.7. This also marked the twenty-second successive month in which emerging markets have outperformed developed economies, helping propel overall global growth to the fastest in nine months.

Detailed emerging market sector data revealed quicker expansions across both manufacturing and service sectors, which saw similar robust rates of growth in March. The rate at which emerging markets manufacturing output increased was notably the fastest in ten months and represented further gradual improvement in the goods producing sector in line with the global trend. The service sector expansion was meanwhile among the fastest seen over the past eight months.

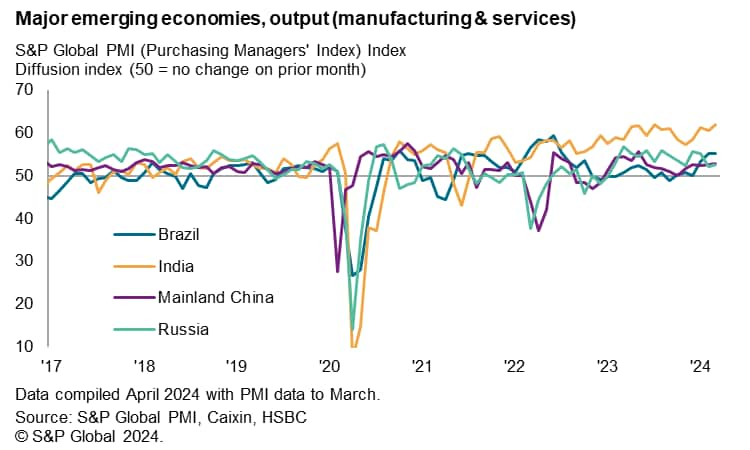

Of the four major emerging market economies, India retained the top spot once again with growth unfolding at the most pronounced rate since last July, thereby signalling that we have yet to see the peak of the current growth cycle. India has led the major economies continually since July 2022. Brazil followed with an unchanged rate of growth from February's 19-month high. Mainland China and Russia meanwhile registered similar rates of expansions, with both economies having improved at a faster rate compared to the prior month.

Forward-looking indicators signal sustained near-term growth

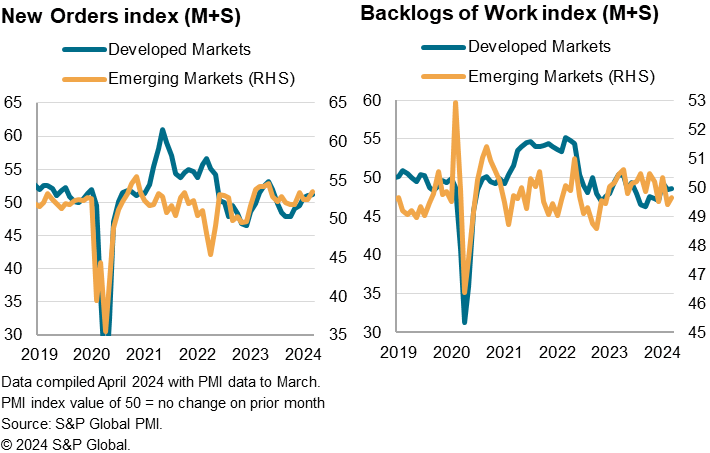

Central to the latest uptick in emerging market activity growth is an improvement in demand conditions. Incoming new business for emerging market goods and services rose in March at the quickest pace since last May, supported by the fastest rise in new export business in nearly three years. And although the level of backlogged work remained in contraction territory, the pace of decline eased in March amid increased workforce capacity. This is altogether supportive of the likelihood that we will continue to see business activity increasing. Indeed, the level of positive sentiment across emerging markets edged higher in the latest survey period, indicating rising expectations of output growth in the 12 months ahead.

Inflation pressures ease

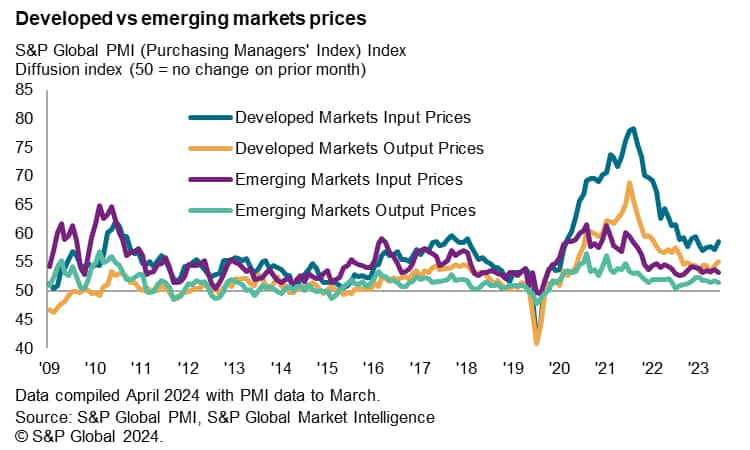

A reduction in inflationary pressures partially supported the latest improvement in sentiment across emerging markets. Overall input prices rose across the emerging markets at the slowest pace in four months, enabling output price inflation to ease in March. This was mainly attributed to falling manufacturing sector cost inflation amid reports of slower raw material cost increases, which further led to unchanged rates of average output prices. Meanwhile service sector cost inflation eased only slightly but remained well below the pre-pandemic average to signal relatively muted inflation.

The easing inflation trend is thereby supportive of global central banks' rate cut trajectories in 2024. That said, developed market price inflation picked up slightly in the latest survey period to signal stubborn inflation, though likewise not at rates that are worth heightened concern at present.

Access the global PMI press releases.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

jingyi.pan@spglobal.com

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-markets-expands-at-fastest-pace-in-ten-months-Apr24.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-markets-expands-at-fastest-pace-in-ten-months-Apr24.html&text=Emerging+markets+activity+expands+at+fastest+pace+in+ten+months++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-markets-expands-at-fastest-pace-in-ten-months-Apr24.html","enabled":true},{"name":"email","url":"?subject=Emerging markets activity expands at fastest pace in ten months | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-markets-expands-at-fastest-pace-in-ten-months-Apr24.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Emerging+markets+activity+expands+at+fastest+pace+in+ten+months++%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-markets-expands-at-fastest-pace-in-ten-months-Apr24.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}