Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 08, 2023

Sub-Saharan Africa’s role in global supply chain of critical minerals for green energy transition

The energy transition is focused on building green, low-carbon and resilient economies using clean energy technologies. These are set to become the fastest-growing segment of demand for most critical minerals.

Recent analysis by S&P Global predicts a doubling of global demand for copper by 2035, driven by decarbonization initiatives aimed at meeting the goal of net-zero emissions by 2050. Sub-Saharan Africa (SSA) has a potentially important role in the global supply chain of critical minerals, having very sizeable reserves of minerals needed for the green economy transition.

SSA's development of critical minerals extractive industries is constrained by weak infrastructure, unhelpful regulatory frameworks, and narrow financial markets, as well as close scrutiny over compliance with sustainability standards. Such weaknesses reduce the region's ability to compete for investment in development of critical minerals against global rivals in more-developed economies.

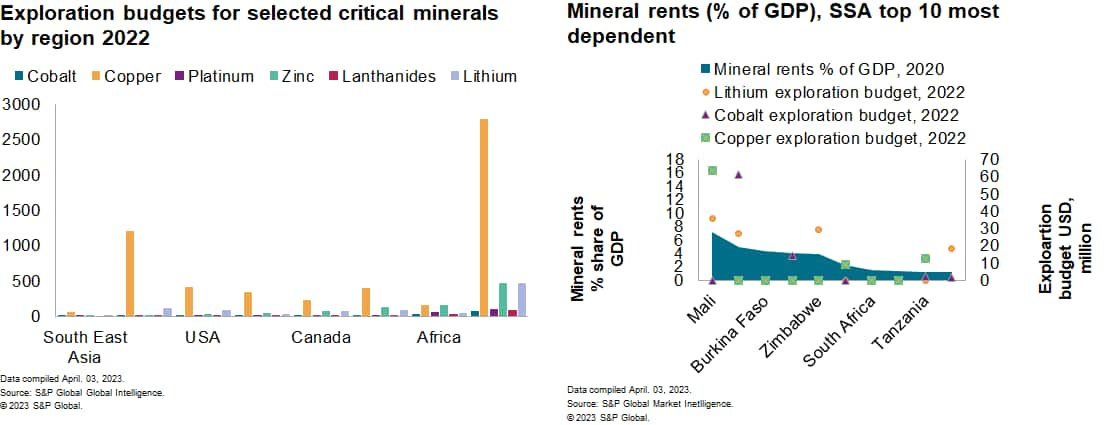

Mali had the largest copper and lithium exploration budgets within the region in 2022, previously evidenced by sizeable high foreign direct investment inflows during 2021-22. However, in 2023, exploration budgets are focusing outlays on lower-risk and low-cost exploration at mine sites and on more-advanced projects, so the region faces near-term challenges in continuing to attract investment for greenfield projects.

We expect SSA governments to seek to diversify their mining sectors and increase their contribution to GDP, exemplified by recent policy actions in Ghana and Tanzania. Various SSA countries such as Gabon and Namibia have begun to modify their mining codes to include tax incentives for investors.

Sustainability requirements

South Africa continues to lead the region for sustainability requirements, with ongoing development of rigorous reporting rules aligned with meeting stakeholders' expectations. By contrast, larger exporters of critical minerals such as the Democratic Republic of the Congo, Gabon and Zimbabwe continue to underperform in respect of sustainability standards, with problems over governance, transparency, and corruption.

From a policy and regulatory standpoint, Zimbabwe stands out for its need to develop its regulatory framework. Zimbabwe imposed a moratorium on the export of lithium in December 2022, to allow the government more time to develop adequate fiscal-capture arrangements on taxation and royalties.

Mineral exploration budgets grew in absolute

terms in SSA during 2022, but the region's share of global spending

on exploration declined. With ongoing uncertainty over geopolitical

developments in 2023 to 2024, global exploration spending is likely

to continue to focus on lower-risk and low-cost exploration and

favor more advanced projects. Such prioritization threatens to

deter near-term investment into SSA. Overall, S&P Global has

identified an adverse trend in which the reduced focus on

grassroots projects threatens a significant decline in new major

discoveries globally.

Our outlook

SSA's critical minerals sector is expected to face stronger competition with countries such as Australia, Canada and the United States. Project locations in developed economies have better infrastructure generally than in SSA, which may affect significantly the ability to extract and process minerals efficiently.

A major challenge faced by mining in SSA is the limited capacity to process and extract minerals, given inadequate funding for mining projects. In addition, SSA's global competitors such as Australia have domestic policies better aligned with the critical minerals strategies of international partners in the mining sector, paving the way for increased coordination on supply chains for critical minerals.

The US Inflation Reduction Act (IRA), passed by Congress in August 2022, uses a mix of subsidies, tax incentives and other measures to create incentives for investment in clean energy generation in the US. The IRA also imposes requirements regarding the sourcing of critical minerals and offers incentives to encourage their sourcing from countries with a free-trade agreement (FTA) with the US. In Africa, only Morocco has an FTA with the US, although several countries are likely to be considered eligible for incentives under the IRA due to their eligibility under the US Africa Growth and Opportunity Act. Countries with substantial critical minerals resources that are part of AGOA include the DRC, South Africa and Zambia.

Listen to our podcast episode on critical minerals and geopolitical risks

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsubsaharan-africa-role-in-global-supply-chain-critical-minerals.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsubsaharan-africa-role-in-global-supply-chain-critical-minerals.html&text=Sub-Saharan+Africa%e2%80%99s+role+in+global+supply+chain+of+critical+minerals+for+green+energy+transition+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsubsaharan-africa-role-in-global-supply-chain-critical-minerals.html","enabled":true},{"name":"email","url":"?subject=Sub-Saharan Africa’s role in global supply chain of critical minerals for green energy transition | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsubsaharan-africa-role-in-global-supply-chain-critical-minerals.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Sub-Saharan+Africa%e2%80%99s+role+in+global+supply+chain+of+critical+minerals+for+green+energy+transition+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsubsaharan-africa-role-in-global-supply-chain-critical-minerals.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}