Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 08, 2023

Weekly Pricing Pulse: Commodity price slide continues

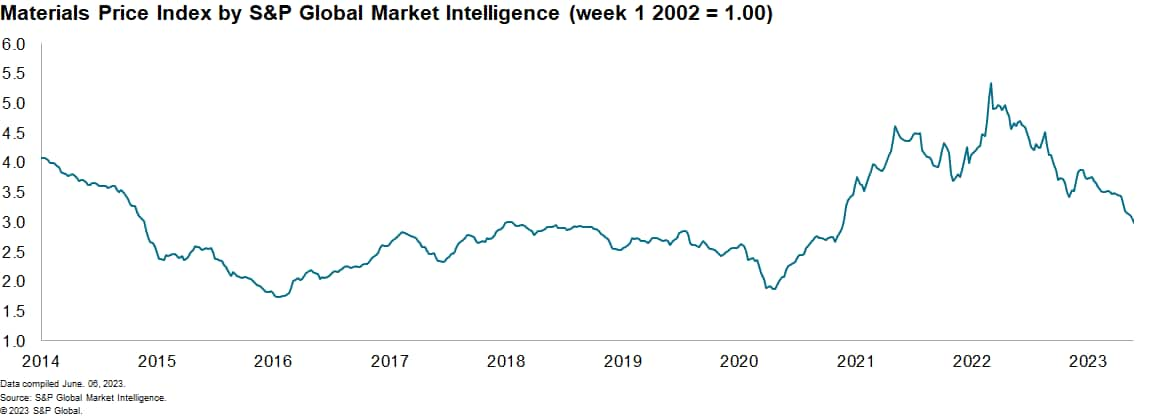

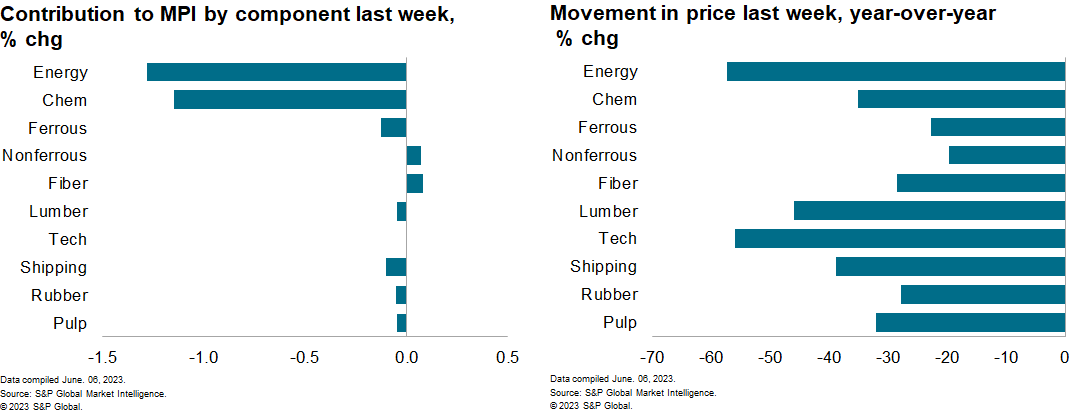

The Materials Price Index (MPI) by S&P Global Market Intelligence decreased 2.7% last week, the ninth consecutive weekly decline. The decrease was broad, as eight of the ten subcomponents fell. The story so far in 2023 has been one of falling commodity prices with the MPI decreasing in 17 out of the last 21 weeks. The index also sits 36% below its year-ago level.

Falling chemical prices were one of the major drivers of last week's decrease in the MPI. The chemical sub-index fell 6.1% with ethylene, propylene, and benzene all declining. Asian ethylene spot prices dropped to $775/metric ton from $810/metric ton the previous week. Prices were above $1000/metric ton as recently as February. Markets are oversupplied and weak demand in mainland China is creating downward pressure on prices. Estimates suggest available supply is around 10% higher than demand in mainland China. Producers are lowering operating rates but are unable to set a price floor. Chemical prices are also being impacted by lower oil costs and Brent Crude Oil, the international benchmark, fell to $72/barrel up from a high of $78/barrel the week before. The announcement by OPEC+ (5th June) that it would make further production cuts starting in July, will provide some upside price pressure that will show up in next week's MPI.

Sign up for our Supply Chain newsletter

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-price-slide-continues.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-price-slide-continues.html&text=Weekly+Pricing+Pulse%3a+Commodity+price+slide+continues+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-price-slide-continues.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Commodity price slide continues | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-price-slide-continues.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Commodity+price+slide+continues+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-price-slide-continues.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}