Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 07, 2023

Source pans: Mainland China leads kitchenware supply chains

Consumer goods firms are facing a challenging combination of a market downturn and the need to deal with the lessons about supply chain resilience learned during the pandemic.

Put simply: Reshoring and inventory management strategy changes are expensive for many industries, as outlined for apparel in our recent "Tighter fit: Resilience versus cost in apparel supply chains" report.

Pans panned: Declining demand for kitchenware

The kitchenware segment is typical of consumer durables in experiencing a decline. EU retail sales by household equipment specialists fell by 8% in January versus their March 2022 peak.

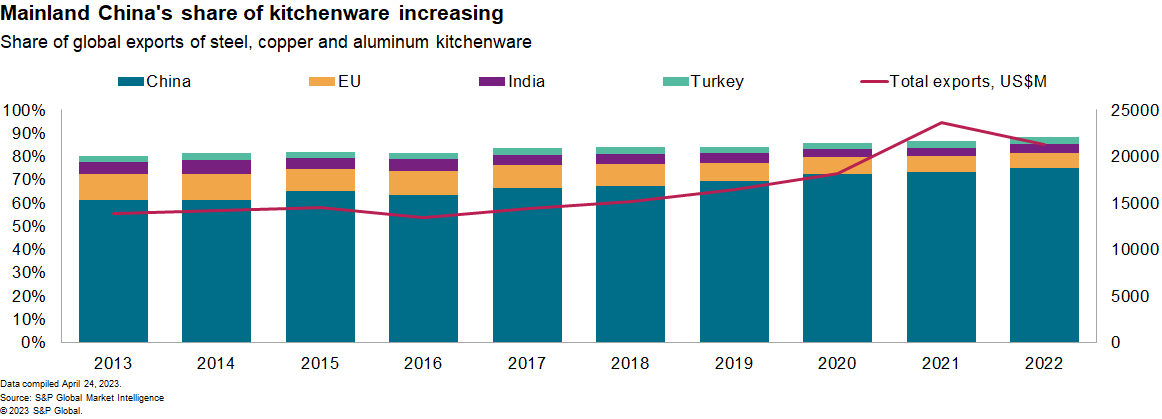

The downturn can also be seen in global exports of kitchenware products, which fell by 10% year over year in 2022, according to S&P Global Market Intelligence data.

While corporations can offset falling sales in the short term with lower prices, in the long term they need to pursue other routes to build competitive advantage. These can include alternative sourcing strategies.

Thus far, those strategies appear focused on consolidation of manufacturing in mainland China rather than "reshoring" or "multi-shoring" approaches. The share of global exports of kitchenware accounted for by mainland China increased to 75% of the total in 2022 from 67% in 2017.

The main losers were suppliers from the EU, whose share fell below 7% in 2022 from 10% in 2017. Smaller supplier nations included India and Turkey with shares of 4% and 3% respectively in 2022. Both countries' suppliers have struggled to build their market share over the past five years.

The right recipe: Mainland China's cost and risk advantages

There's no single reason why suppliers of kitchenwares from mainland China have been able to expand their global market share over time. In broad terms, they have outperformed EU manufacturers on cost while besting those in India and Turkey on a mixture of cost and risk factors.

A period of rapid commodity price inflation in 2021 and 2022 led to a broad increase in producer price indices, including for manufacturers of metal hardware such as kitchenware.

European manufacturers may still be at a cost disadvantage on labor costs if mainland Chinese manufacturers can match quality and brand considerations.

India has a manufacturing labor cost advantage versus mainland China. It also has a steel and aluminum industry with $248 billion of gross annual output in 2022, according to S&P Global Market Intelligence estimates, which provides a base of raw materials for value-added manufacturing.

Still, there are a limited number of retailers exporting kitchenware from India currently, according to Panjiva data. The top five exporters have cut their shipments in Q1'23 by 31% versus Q1'19.

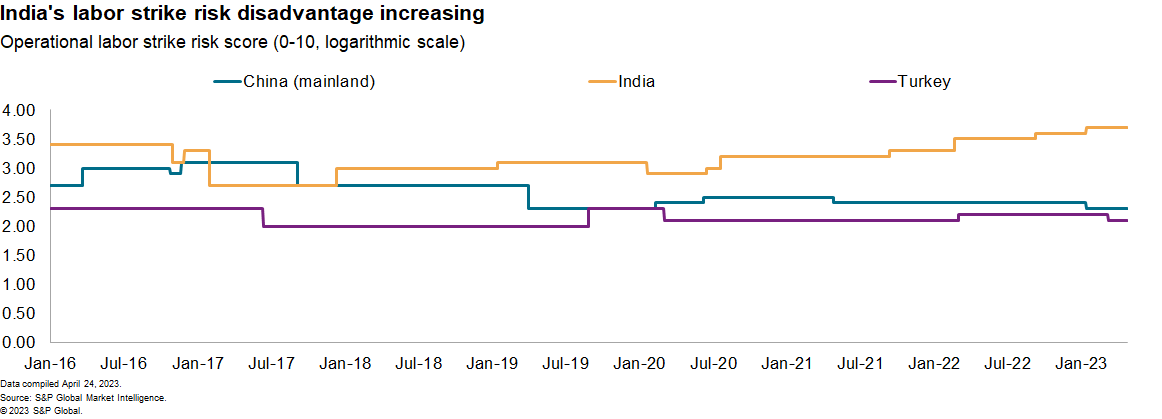

Retailers and manufacturers looking to build a competitive advantage in their supply chain have to balance cost and operational risks, which vary over a multiyear period.

A major difference between India and mainland China is the risk of labor strikes — India's risks have increased over the past two years and is higher than mainland China's. Notably, the scores for both mainland China and Turkey have declined.

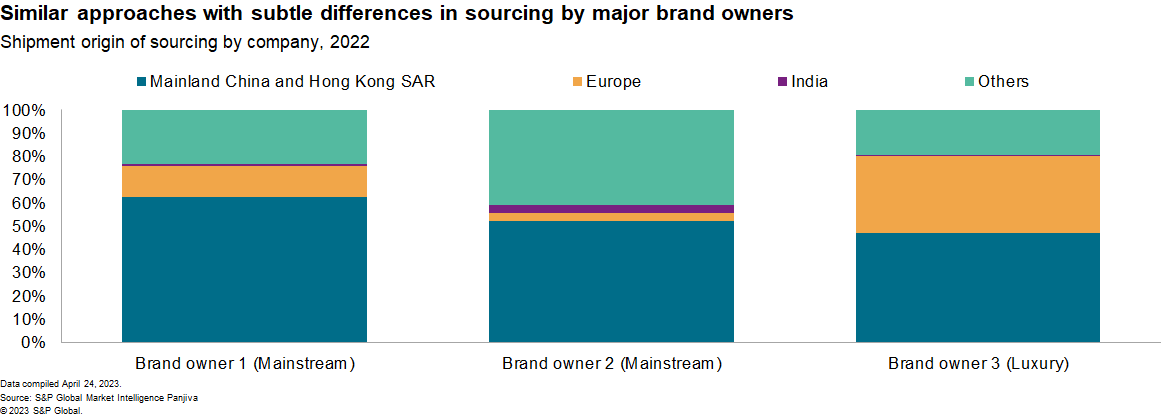

Among the major brand owners, there are similar sourcing strategies with some differences at the margin.

The sourcing for two mainstream brand owners' supply chains, assessed across 20 datasets available on Panjiva, leans towards mainland China and Hong Kong SAR with the remainder mostly from southeast Asia.

Luxury brandowners, by contrast, favor a higher proportion of sourcing from Europe, though mainland China and Hong Kong SAR are still significant suppliers.

Sign up for our Supply Chain Essentials newsletter

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsource-pans-mainland-china-leads-kitchenware-supply-chains.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsource-pans-mainland-china-leads-kitchenware-supply-chains.html&text=Source+pans%3a+Mainland+China+leads+kitchenware+supply+chains+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsource-pans-mainland-china-leads-kitchenware-supply-chains.html","enabled":true},{"name":"email","url":"?subject=Source pans: Mainland China leads kitchenware supply chains | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsource-pans-mainland-china-leads-kitchenware-supply-chains.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Source+pans%3a+Mainland+China+leads+kitchenware+supply+chains+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsource-pans-mainland-china-leads-kitchenware-supply-chains.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}