Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Apr 15, 2021

Mixed 2020 results signal uncertain 2021 for North African banks

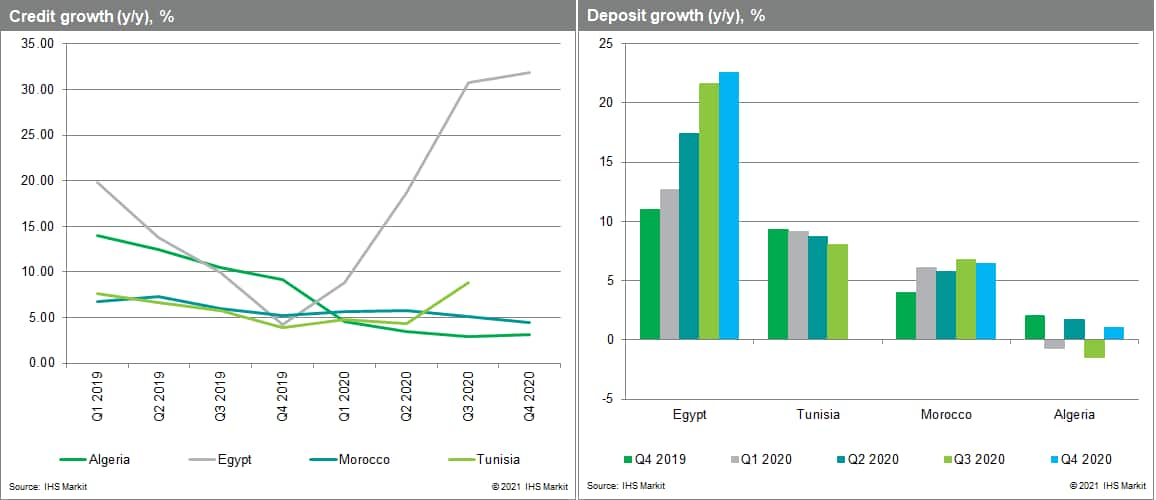

Year-end data for Morocco, Egypt, and Algeria show mixed results for the North African region on the back of the coronavirus disease 2019 (COVID-19)-virus pandemic in 2020. Credit and deposit growth remained positive throughout the region; however, both decelerated significantly in Algeria. In Egypt, conversely, state involvement in the banking sector drove a dramatic increase in credit and deposits.

In Egypt, state-directed lending caused credit growth to increase by more than 700%.

Credit growth reached 31.9% year on year (y/y) at the end of 2020, compared with 4.2% in 2019. This credit growth was directed largely to the government, where growth increased by 59.7% in 2020. Furthermore, sovereign debt holdings increased more rapidly than banking-sector asset growth, and total exposure to the government, including through sovereign debt holdings, loans to the government, and loans to state-owned enterprises (SOEs) reached 52% of total assets. This compares with the total exposure of 45% of total assets as of end-2019. On the funding side, government deposits helped to propel a headline deposit growth of 22.6% in 2020 (over double the growth rate in 2019), with government deposits increasing by 34.4% y/y.

Elsewhere in the region, credit growth decelerated but remained positive.

Credit provision remained positive for Morocco and Algeria, but slowed significantly, reaching 4.4% and 3.1% y/y, respectively, compared with 5.2% and 9.2% in 2019. In Algeria, the reduction in oil revenue recycling through the economy likely made a significant impact on banks' loan books, particularly credit to SOEs, which amounted to more than half of total banking-sector credit. In Morocco, contractions in lending to services and SOEs continued from 2019 to drive the slowdown in headline credit growth. Although Tunisia's fourth-quarter data have not been released, lending resurged in the third quarter prior to the government's renewal of the loan moratorium in December 2020. As such, IHS Markit forecasts that credit growth increased in 2020, reaching 8% compared with 3.9% in 2019.

Overall, liquidity conditions tightened in Algeria, with a loan-to-deposit ratio (LDR) of 93%, as credit growth outpaced deposit mobilization despite the slowdown.

In Morocco, deposit growth reached 6.2% y/y, driven by an uptick in demand deposits. Conversely, in Algeria deposit growth halved from its end-2019 value of 1.1%, likely the result of a government and SOE deposit drawdown. Unlike in Algeria and Egypt, liquidity conditions loosened in Morocco in 2020 as deposit mobilization increased more substantially than loan growth. This underscores the prevalence of state-directed lending in the Egyptian and Algerian banking sectors, and the role of loans to governments and SOEs in propping up lending throughout the COVID-19 slowdown. We expect that deposit mobilization will outpace loan growth in Tunisia when the year-end data is released, ending the year with an LDR of 107% compared with 110% in 2019.

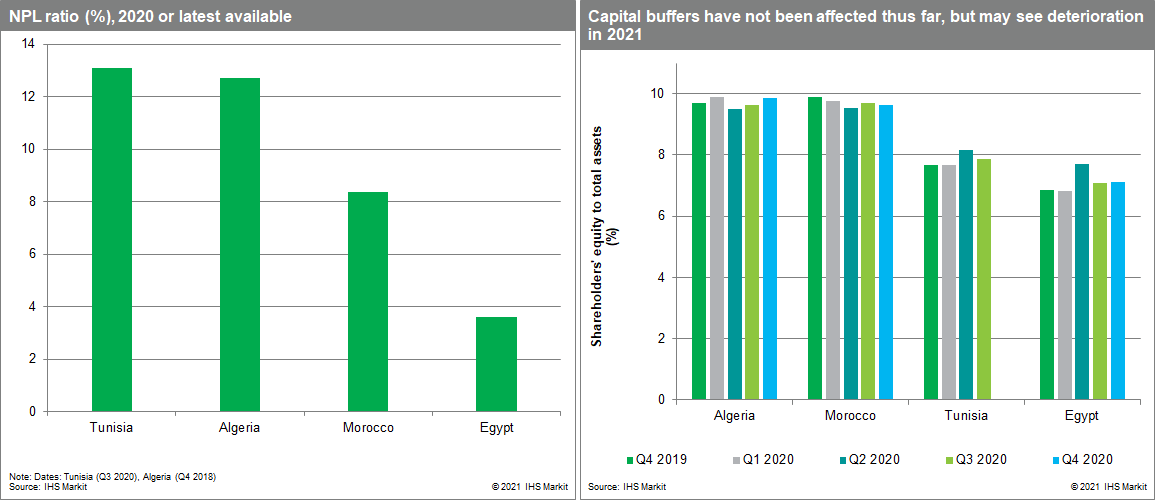

NPLs have begun to accumulate despite extensive forbearance measures in place in the region.

In Egypt, the NPL ratio actually decreased in the first three quarters of 2020, before a slight uptick in the final quarter of the year. Notably, amid the credit boom of 2020, the stock of NPLs increased significantly, although the ratio remained relatively steady as a result of the base effects of rapid credit growth. In Morocco, the NPL ratio increased by slightly less than 1 percentage point, reaching 8.4% at the end of 2020. Notably, there are still loan moratoria in place in Algeria and Tunisia, preventing the full materialization of credit risks on banks' balance sheets. Additionally, pre-existing forbearance measures, particularly for tourism-sector lending, in place in Egypt and Morocco indicate that NPL ratios do not accurately represent the full extent of asset-quality deterioration.

Outlook

- The positive credit growth rates reported by North African banking sectors for 2020 were better than the deleveraging that was initially anticipated. However, credit growth was propped up by government support measures for much of 2020 and into 2021 in some countries.

- We expect that regional banking sectors will pull back on lending in 2021 as COVID-19-virus-related impairments compound pre-existing elevated NPLs in several banking sectors. However, given that lingering forbearance measures were in place prior to the COVID-19 shock, risks may take an extended period to accumulate on banks' balance sheets.

- Going forward, Algeria and Tunisia will be more vulnerable to the COVID-19-virus-related downturn in the short term than their peers in North Africa. This is a result of previously elevated NPL ratios, low levels of provisioning, and overstated capital buffers.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmixed-2020-results-signal-uncertain-2021-north-african-banks.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmixed-2020-results-signal-uncertain-2021-north-african-banks.html&text=Mixed+2020+results+signal+uncertain+2021+for+North+African+banks+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmixed-2020-results-signal-uncertain-2021-north-african-banks.html","enabled":true},{"name":"email","url":"?subject=Mixed 2020 results signal uncertain 2021 for North African banks | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmixed-2020-results-signal-uncertain-2021-north-african-banks.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Mixed+2020+results+signal+uncertain+2021+for+North+African+banks+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmixed-2020-results-signal-uncertain-2021-north-african-banks.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}