Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Apr 14, 2021

Weekly Pricing Pulse: Commodity prices rise once more

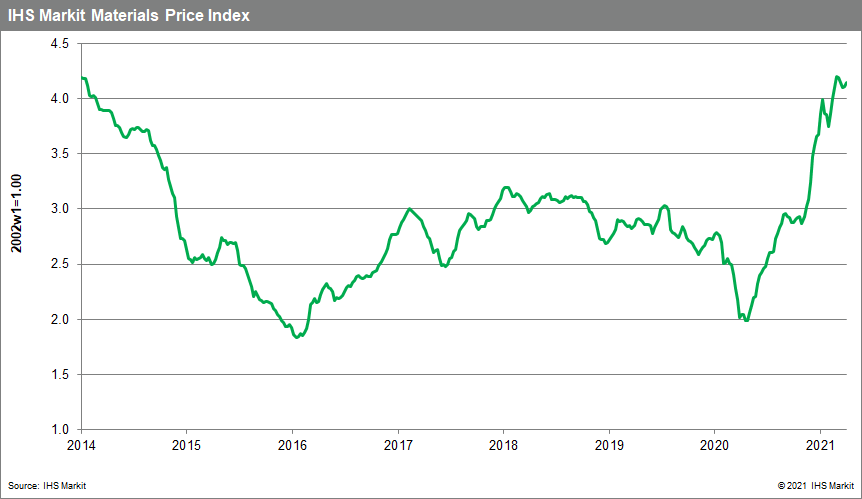

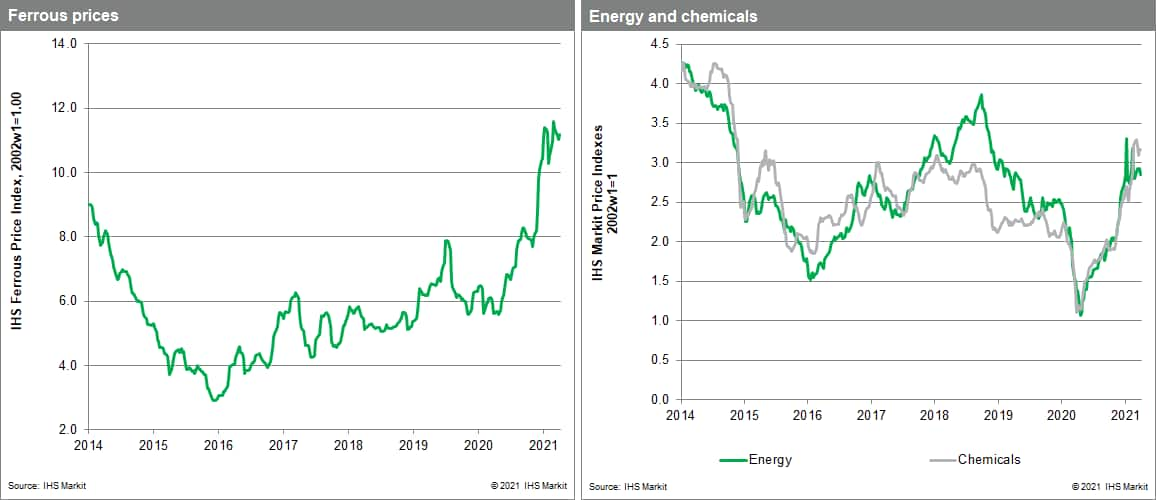

Our Materials Price Index (MPI) climbed 1% last week, following a 0.1% increase the previous week. The volatility in the MPI witnessed at the start of the year, when weekly prices were changing by more than 2%, has eased but the overall price level remains elevated. Prices, as measured by the MPI, have more than doubled since early April 2020.

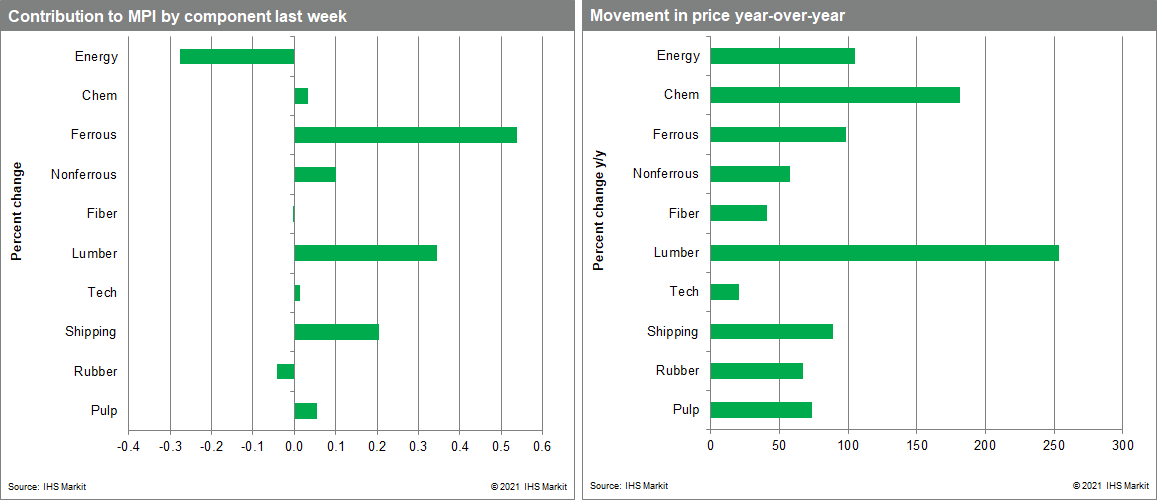

Eight of the MPI's ten sub-components posted increases last week with lumber seeing the biggest upward move. The lumber index climbed 8.1% as demand continues to outstrip supply. Low-interest rates and a desire for single-family homes because of the pandemic have boosted homebuilding rates in the United States. Supply has been unable to keep pace, in part because sawmills were either maintaining production or only increasing it in the face of strong orders. At current price levels, the National Association of Home Builders estimates that higher lumber prices are adding $24,000 to the overall construction cost of new homes. Our shipping index was also a strong performer last week, increasing 6.7%, its sixth consecutive weekly increase as the blockage in the Suez Canal added to already stretched global supply chains. Although the Ever Given is no longer blocking the canal, prices have experienced upward pressure as restocking and even pre-buying are taking place as organizations try to make up or hedge against delays. Nonferrous metal prices returned to growth last week with our sub-index climbing 1.3% overall. Nickel prices, which had been challenged by fears of oversupply, rebounded on news that the United States plan to incentivize EV manufacturing in future stimulus proposals.

It was a strong week for equity markets with stock indices on both sides of the Atlantic reaching record highs. Market optimism remained despite stronger than expected producer price data from China and the United States, the evident belief being that these increases will be able to be passed along in the current environment. Higher goods price inflation is certain this summer but still looks to be related to bottlenecks and disruptions in supply chains that will not persist once these conditions are resolved. If so, cost pressures will begin to recede by year-end. The worry for policymakers is that the release of pent-up demand with a shift back toward services keeps markets off-balance, with pressures emerging in service industries that to date have largely been spared from strong cost increases.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-rise-once-more.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-rise-once-more.html&text=Weekly+Pricing+Pulse%3a+Commodity+prices+rise+once+more+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-rise-once-more.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Commodity prices rise once more | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-rise-once-more.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Commodity+prices+rise+once+more+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-rise-once-more.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}