Published September 2023

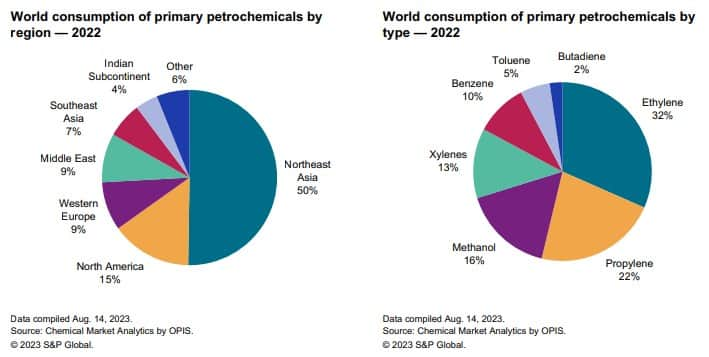

For the purpose of this report, basic petrochemicals include methanol, ethylene, propylene, butadiene, benzene, toluene and xylenes. Ethylene, propylene and butadiene are collectively called olefins, which belong to a class of unsaturated aliphatic hydrocarbons with the general formula CnH2n. Olefins contain one or more double bonds, which make them chemically reactive. Benzene, toluene and xylenes, commonly referred to as aromatics, are unsaturated cyclic hydrocarbons containing one or more rings. Olefins, aromatics and methanol are precursors to a variety of chemical products and are generally referred to as primary petrochemicals. Given the number of organic chemicals and the variety and multitude of ways by which they are converted to consumer and industrial products, this report focuses primarily on these seven petrochemicals and their end uses.

The following charts present the consumption of primary petrochemicals by type and by region:

Basic chemicals and plastics are the key building blocks for the manufacture of a wide variety of durable and nondurable consumer goods. Considering the items encountered daily — clothes, construction materials used to build homes and offices, a variety of household appliances and electronic equipment, packaging for food and beverages, and many products used in various modes of transportation — chemical and plastic materials provide the fundamental building blocks that enable the manufacture of most of these goods. Demand for chemicals and plastics is driven by global economic conditions, which are directly linked to demand for consumer goods.

Although investments in new chemical assets are occurring on a global basis, the primary focus over the past decade has been in mainland China, the Middle East and North America, each with its own unique drivers for these investments, including fast-developing markets and domestic energy and feedstock advantages. Mainland Chinese investment has been focused on coal-to-chemicals production and on-purpose propylene processes, but growth has slowed with the recent implementation of environmental controls, especially for coal-based chemicals. The Middle East, originally focused on oil and gas exports, began to develop its petrochemical assets to capitalize on its cheap and readily available ethane; the units are generally large scale, relatively new and forward integrated into derivatives, the output of which is primarily for export. The developments in the North American nonconventional oil and gas markets have reignited investment in new petrochemical capacity after more than a decade of very limited activity. Recent shale gas discoveries in the United States and Canada have significantly increased the supply of natural gas liquids, which have transformed North America into a low-cost region for chemicals production again. Many global chemical companies are now expanding or building facilities in the region.

The petrochemical industry continues to be influenced by the globalization and integration of the world economy. The COVID-19 pandemic, which has affected every region of the world, had a significant effect on economies in 2020 because of the strict government-ordered lockdowns, travel restrictions, changing consumer habits and diminished trade flows. Since 2022, the Russia-Ukraine conflict has cast a shadow over world energy markets, adding volatility and uncertainty. This report provides insights into the effects of the pandemic on the global petrochemical industry as well as the impact of current geopolitical events, exploring every region and covering the seven basic petrochemicals.

For more detailed information, see the table of contents, shown below.

S&P Global’s Chemical Economics Handbook –Petrochemical Industry Overview is the comprehensive and trusted guide for anyone seeking information on this industry. This latest report details global and regional information, including

Key benefits

S&P Global’s Chemical Economics Handbook –Petrochemical Industry Overview has been compiled using primary interviews with key suppliers and organizations, and leading representatives from the industry in combination with S&P Global’s unparalleled access to upstream and downstream market intelligence and expert insights into industry dynamics, trade, and economics.

This report can help you

- Identify trends and driving forces influencing chemical markets

- Forecast and plan for future demand

- Understand the impact of competing materials

- Identify and evaluate potential customers and competitors

- Evaluate producers

- Track changing prices and trade movements

- Analyze the impact of feedstocks, regulations, and other factors on chemical profitability