Published December 2023

High-intensity sweeteners (HIS) are a structurally diverse set of compounds that share an important attribute: they are much sweeter than sucrose (table sugar). Unlike sugar, HIS are noncaloric and noncariogenic (they do not contribute to dental caries). Most HIS — including acesulfame K, aspartame, cyclamate, saccharin and sucralose — are artificial sweeteners, produced by chemical synthesis; a few, including stevia and monk fruit extract, are natural products.

Worldwide consumption of HIS is largely dependent on the production of diet carbonated soft drinks and food. Beverages make up the majority of world HIS consumption; other important end uses include food, tabletop sweeteners, personal care products (mainly toothpaste and mouthwash) and pharmaceuticals. A few HIS have industrial applications as well; saccharin, for example, is used in electroplating and cyclamate serves as a fruit-ripening agent.

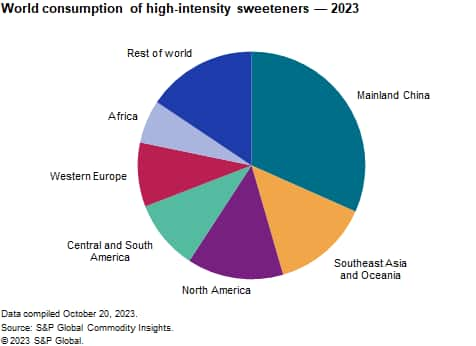

The following pie chart shows world consumption of high-intensity sweeteners in 2023:

The outlook for high-intensity sweetener consumption during 2023–28 varies by region and by sweetener. Demand for the most mature, highest-volume HIS — cyclamate — is increasing in Asia (excluding mainland China), the Middle East and Africa, but stagnant or declining in the Americas, Europe and mainland China because of a shift to more intensely sweet HIS. Consumption of two other mature sweeteners — saccharin and aspartame — is flat or declining in several regions as well. In contrast, consumption of acesulfame K, sucralose, and stevia extract is growing in all regions; sucralose is experiencing especially robust demand growth.

Consumption of natural HIS such as stevia and monk fruit extract is expected to increase at above-average rates during 2023–28, largely because of consumer preferences for natural sweeteners. Nonetheless, their share of the total HIS market remains small. The increased availability of next-generation stevia sweeteners with improved taste profiles will support continued demand growth.

For more detailed information, see the table of contents, shown below.

S&P Global’s Chemical Economics Handbook –High-Intensity Sweeteners is the comprehensive and trusted guide for anyone seeking information on this industry. This latest report details global and regional information, including

Key benefits

S&P Global’s Chemical Economics Handbook –High-Intensity Sweeteners has been compiled using primary interviews with key suppliers and organizations, and leading representatives from the industry in combination with S&P Global’s unparalleled access to upstream and downstream market intelligence and expert insights into industry dynamics, trade, and economics.

This report can help you

- Identify trends and driving forces influencing chemical markets

- Forecast and plan for future demand

- Understand the impact of competing materials

- Identify and evaluate potential customers and competitors

- Evaluate producers

- Track changing prices and trade movements

- Analyze the impact of feedstocks, regulations, and other factors on chemical profitability