Published December 2019

The principal distinction between explosives and blasting agents is their sensitivity to initiation. Explosives are cap-sensitive, whereas blasting agents are not and therefore require a primer. Water gels and slurries may be either explosives or blasting agents.

The many industrial and military uses for explosives and blasting agents—ranging from earth moving to seismic wave generation to materials modification to munitions to propulsion—have generated a host of sophisticated and specialized explosives products and delivery packages. However, in terms of overall revenues, markets, and products, the business is overwhelmingly dominated by chemical materials based on the intermediate production of nitric acid (principally ammonium nitrate [AN]) that are used by the world’s mining and quarrying industries.

Ammonium nitrate consumption for explosives has grown because of its safety advantage over other products such as dynamite. Ammonium nitrate can be shipped and stored and mixed with fuel oil when needed. Ammonium nitrate fuel oil (ANFO) is made of about 94% ammonium nitrate and 6% fuel oil. ANFO is widely used as an explosive in mining, quarrying, and tunneling construction or wherever dry conditions exist.

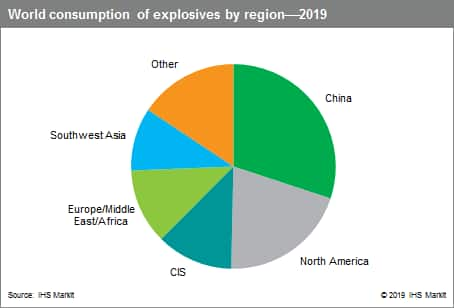

The following pie chart shows world consumption of explosives:

The largest consumers of explosives in industrial applications are China, the United States, the Commonwealth of Independent States, and Central and South America. In addition to consumption by the mining industry, a significant volume of explosives is also consumed by the construction industry and in miscellaneous applications.

Coal mining is by far the largest consuming sector for industrial explosives, accounting for just under 40% of total consumption. The coal mining output started to decrease a few years ago as a consequence of the global effort to reduce carbon dioxide emissions. Coal mining and use of explosives in this segment is expected to continue to decrease in the forecast period.

The second-largest end use, metal mining, accounts for about 33% of the total. World consumption of explosives by this sector of the mining industry is projected to increase during the 2019–24 forecast period. Because metallic minerals are generally low-grade ores found only in geologically favorable areas of the world, consumption of explosives by this sector of the mining industry follows their geographical distribution.

Production of stone for construction and production of cement from quarrying operations accounts for an additional 16% of the world mining market for explosives. Consumption of explosives in quarrying materials is forecast to stagnate over the next five years, mainly because of an expected stagnation in this sector in China.

For more detailed information, see the table of contents, shown below.

S&P Global’s Chemical Economics Handbook – Explosives and Blasting Agents is the comprehensive and trusted guide for anyone seeking information on this industry. This latest report details global and regional information, including

Key Benefits

S&P Global’s Chemical Economics Handbook – Explosives and Blasting Agents has been compiled using primary interviews with key suppliers, organizations and leading representatives from the industry in combination with S&P Global’s unparalleled access to upstream and downstream market intelligence, expert insights into industry dynamics, trade and economics

This report can help you:

- Identify trends and driving forces influencing chemical markets

- Forecast and plan for future demand

- Understand the impact of competing materials

- Identify and evaluate potential customers and competitors

- Evaluate producers

- Track changing prices and trade movements

- Analyze the impact of feedstocks, regulations, and other factors on chemical profitability