Published July 2021

Printing inks are a customer- and applications-specific formulations business. A reputation for both quality products and technical service is essential for a printing ink company. There are two major end-use segments— commercial printing/publishing and packaging. Printing inks can also be categorized by process, such as lithography, gravure, flexography, and digital; inkjet printing, a form of digital printing, is the newest and highest-growth process.

The five most common printing processes (in order of their worldwide market shares) are lithography (frequently referred to as offset), gravure (also called rotogravure), screen printing, and letterpress. Several other traditional printing processes account for a very small portion of printing revenues. Increasingly, nonimpact imaging processes—inkjet printing and electrostatic printing—are gaining a larger share of the print market. Since nonimpact, digital imaging is cost-effective for short runs and individualized printing and has essentially instant turnaround, its competitive space is different from that of conventional printing processes.

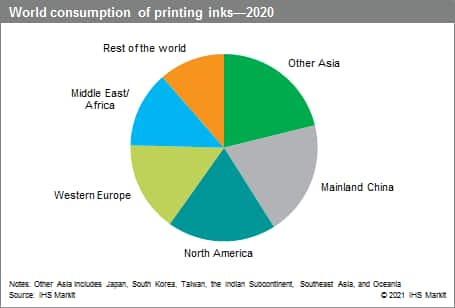

The following pie chart shows world consumption of printing inks:

Offset/lithography, flexography, and gravure are the three most-used printing processes in the world, accounting for about 84% of the world market in 2020.

Lithographic printing remains the largest process, supplying inks for newspapers, flyers, and magazines; commercial printing; and package printing. Offset printing will continue to be the preferred method for producing large run lengths. However, the market is demanding increasingly shorter run lengths, where plateless digital (inkjet and electrophotographic) printing is gaining wide acceptance with customers in addition to plate offset printing. However, because of the advantages and disadvantages of each system, there is a trade-off between plate offset printing and plateless digital printing.

Flexographic processes include solvent- and waterborne inks and are used for packaging (mainly), as well as commercial and publication applications. Water-based flexo printing inks have been increasingly used in place of solvent-based printing inks, especially in food-contact packaging applications. Flexo will benefit from its increasing use for packaging, which continues to be a growth area for the printing industry worldwide.

Gravure uses primarily solvent-based liquid inks, and the major applications are commercial publication and film packaging. Packaging gravure has lost some market share to flexo as shorter runs in packaging became popular. However, the high quality of gravure continues to be a competitive advantage in the packaging sector. Some growth opportunities for gravure ink in packaging are seen, particularly in mainland China, India, and South America. There are good opportunities for gravure where high-volume print runs are required.

The rise of electronic media has permanently altered the market for ink-on-paper printing, as well as fragmented the advertising market, reducing advertising spending in print media and causing the closure of magazine and newspaper businesses. However, digital imaging, especially through inkjet printing, is increasingly becoming a major part of the “traditional” printing business. Computerized platemaking and printing stations (typically inkjet) that customize each printed product are becoming common technologies. Customization and quick turnaround for short runs are major customer demands being placed on the printing industry, and ink manufacturers must produce inks that accommodate these needs. The transition toward high-value digital and energy-cured inks will continue.

By the end-use sector, packaging will have moderate to high growth, whereas the publications market continues to decline, with the shift from print media to the internet and other electronic alternatives. Overall, the challenges facing the industry include cost reduction, securing raw material supply, complying with regulations, and sustainability issues. The printing ink market continues to face severe pricing pressures.

For more detailed information, see the table of contents, shown below.

S&P Global’s Specialty Chemicals Update Program – Printing Inks is the comprehensive and trusted guide for anyone seeking information on this industry. This latest report details global and regional information, including

Key benefits

S&P Global’s Specialty Chemicals Update Program – Printing Inks has been compiled using primary interviews with key suppliers and organizations, and leading representatives from the industry in combination with S&P Global’s unparalleled access to upstream and downstream market intelligence and expert insights into industry dynamics, trade, and economics.

This report can help you

- Identify the competitive environment and key players

- Assess key issues facing both suppliers and their end-use customers

- Understand industry integration strategies

- Keep abreast of industry structure changes, regulatory requirements, and other factors affecting profitability

- Identify new business opportunities and threats

- Follow important commercial developments

- Recognize trends and driving forces influencing specialty chemical markets