Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Feb 23, 2021

Weekly Pricing Pulse: Supply problems send commodities higher

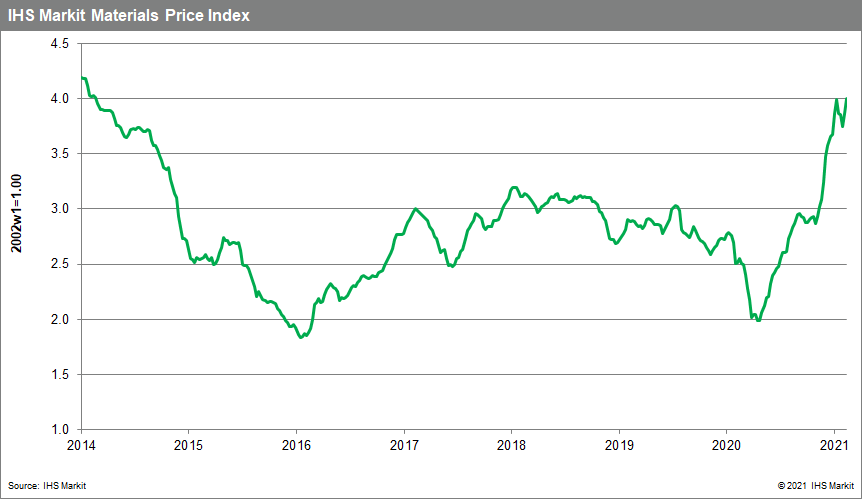

Our Materials Price Index (MPI) climbed 3.5% last week, building on its 3% gain the previous week. It was another week when prices collectively recorded a significant weekly gain sending the MPI to a seven-year high. The MPI now stands 57% higher than in late February 2020.

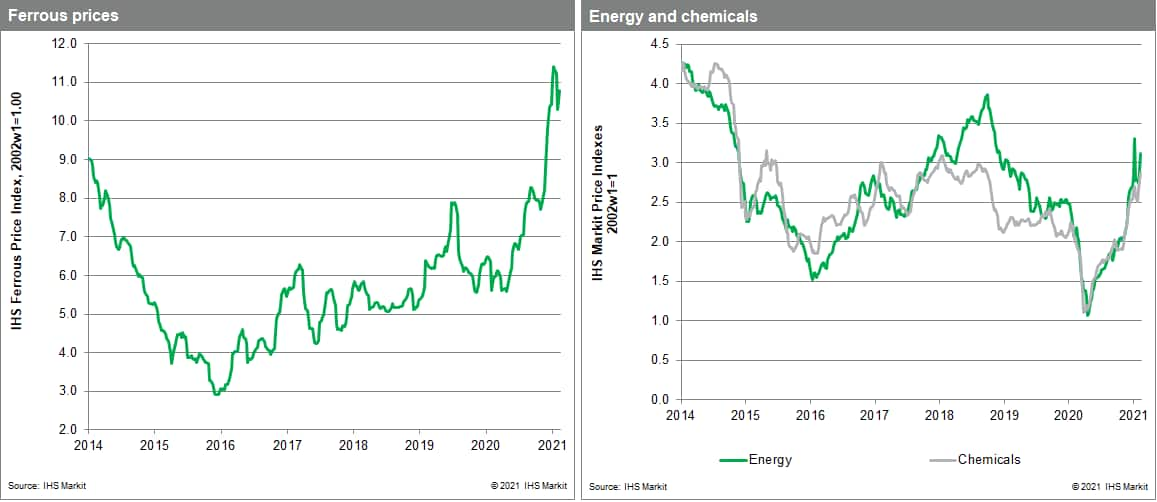

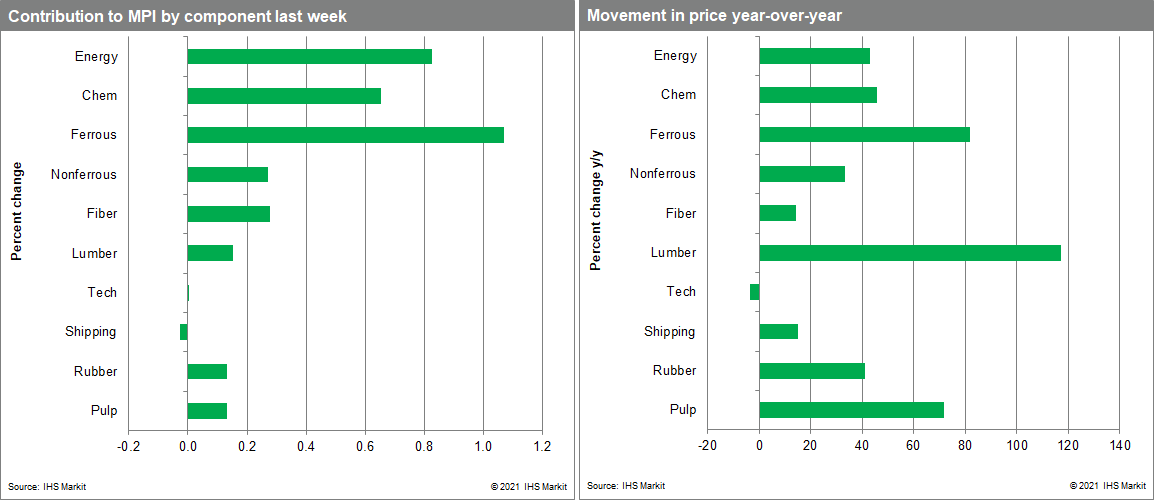

All but one of the MPI's ten sub-components posted increases last week with energy, metals and chemicals the notable movers. Our energy index was up 6.8% as cold weather in Texas froze pipelines and forced 20% of US natural gas supply offline. This sent the Henry Hub spot price to $10.33/MMBtu from $4.63/MMbtu in the preceding week, an unprecedented 123% increase. The severe winter weather also impacted chemical markets with over 60% of US ethylene production offline. The result was a 3.7% climb in our chemical sub-index last week. Metal exchanges remained extremely active with our steelmaking raw materials index increasing 2.5% and the nonferrous index up 3.4%. Iron ore prices soared because Chinese economic activity was higher than usual since many workers did not travel home for Lunar New Year. Copper prices reached $8,930 a tonne last week, the highest level since 2011 amid expectations of a future rise in green infrastructure projects where copper will be an important raw material. The price of tin also soared as high demand from the electronics industry sent stockpiles to near record lows. Spot prices reached $29,349 per tonne, a ten-year high, and a global tin shortage means upward pressure is likely to persist.

It was a muted week for equity markets as investors swung between vaccine rollout positivity and fears over a spike in inflation. Yields on 10-year US Treasury bonds climbed and the sell-off pushed investors towards commodities. The return of Asian buyers to the market after the Lunar New Year also provided a further boost to commodity markets. The broad-based gains in industrial metals have led to further speculation that a commodity supercycle is beginning. Evidence of a sustained increase in goods price inflation remains limited thus far. However, the sharp increase in the MPI over the past eight months guarantees a rise in goods price inflation through at least the second quarter. Once this becomes apparent in official data the question is whether equity investors will accept the risk or, as happened last week, pour into commodity markets. The answer to this will determine level of commodity price inflation in the near term.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-supply-problems-send-commodities-higher.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-supply-problems-send-commodities-higher.html&text=Weekly+Pricing+Pulse%3a+Supply+problems+send+commodities+higher+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-supply-problems-send-commodities-higher.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Supply problems send commodities higher | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-supply-problems-send-commodities-higher.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Supply+problems+send+commodities+higher+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-supply-problems-send-commodities-higher.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}