Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Mar 16, 2022

Weekly Pricing Pulse: “Everything” rally as Russia-Ukraine conflict rattles commodity markets

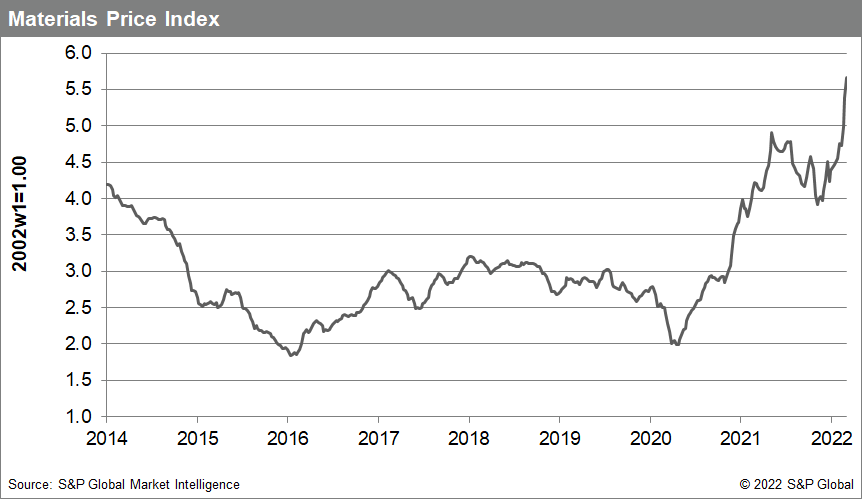

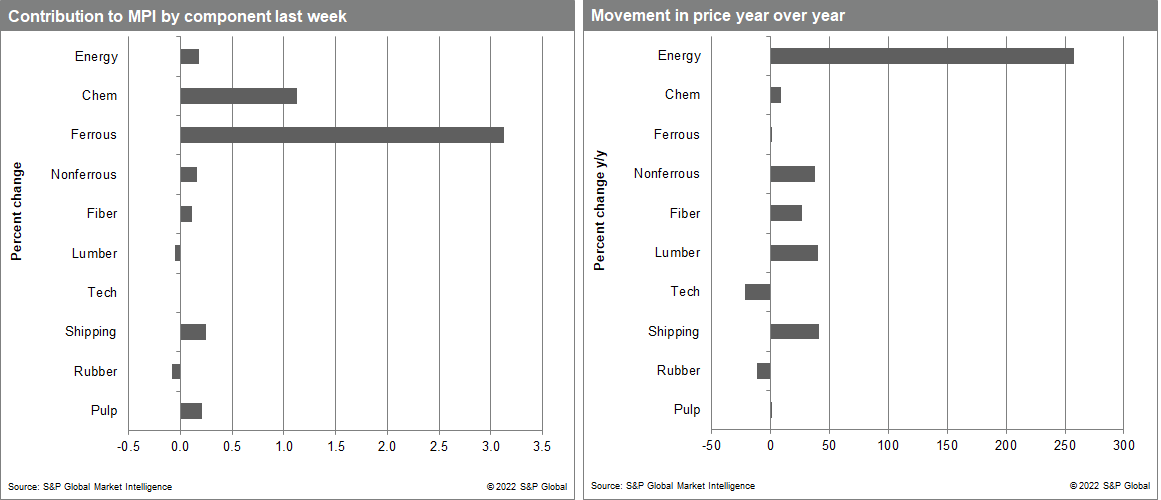

Our Materials Price Index (MPI) jumped another 5% last week, following the record breaking 8.1% increase the week before. Price increases were once again broad with seven out of ten sub-components in the index rising. After last week's increase, commodity prices now sit 11.7% above the previous all-time high set in April 2011.

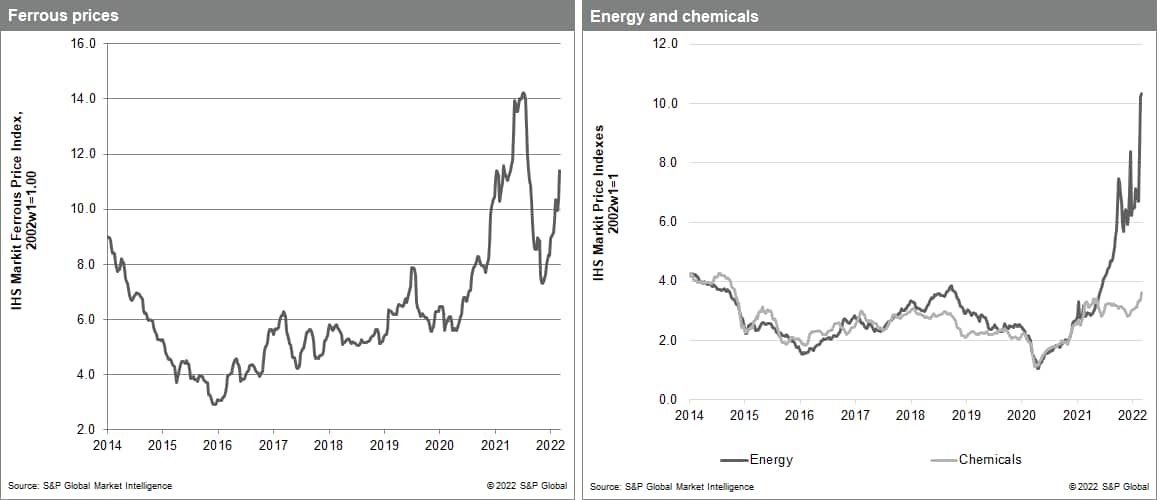

Brent Crude oil reached $129 per barrel for the first time since 2008 last week adding further upward pressure to commodity prices. It was industrials metals, however, that grabbed center attention. Prices soared amid trading volatility and concerns over future supply from Russia. The ferrous sub-index jumped 10%, with both scrap steel and iron ore posting large price gains. Turkish scrap steel prices, a global benchmark, reached a record $650/tonne, an $82 increase on the previous week. Turkey relies heavily on Russian scrap imports as feed for its EAF steel mills and is now scrambling to find alternatives, hence the strong price increases last week. The nonferrous metal sub-index increased 2% with unprecedented turbulence in the nickel market leading to the suspension of trading in the nickel contract on the London Metal Exchange (LME). A large short position held by Tsingshan Stainless Steel exceeding in size available inventory on the LME was the root cause of the turmoil in the market. Margin calls triggered by a rising nickel price could not be fully met because of the size of the position and low available inventory. The short squeeze therefore unmoored prices from the physical market, prompting the exchange to intervene.

With inflation already high, the broad jump in commodity prices last week only adds additional upward pressure on global prices while at the same time lowering projected economic growth - an unwelcome combination. Thus far there has been little actual supply disruption from the conflict in Ukraine, though traders and financial institutions are avoiding Russian exports, effectively isolating the country from global markets. The only good news is that markets did seem to calm slightly at week's end. Prices will be interesting to watch over the next fourteen days. While prices are certain to remain high, even a slight retreat will suggest that markets regard the current situation as a temporary disruption rather than indicative of long-term supply reduction.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-everything-rally-rattles-markets.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-everything-rally-rattles-markets.html&text=Weekly+Pricing+Pulse%3a+%e2%80%9cEverything%e2%80%9d+rally+as+Russia-Ukraine+conflict+rattles+commodity+markets+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-everything-rally-rattles-markets.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: “Everything” rally as Russia-Ukraine conflict rattles commodity markets | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-everything-rally-rattles-markets.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+%e2%80%9cEverything%e2%80%9d+rally+as+Russia-Ukraine+conflict+rattles+commodity+markets+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-everything-rally-rattles-markets.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}