Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Mar 10, 2022

Russia-Ukraine war and inflation

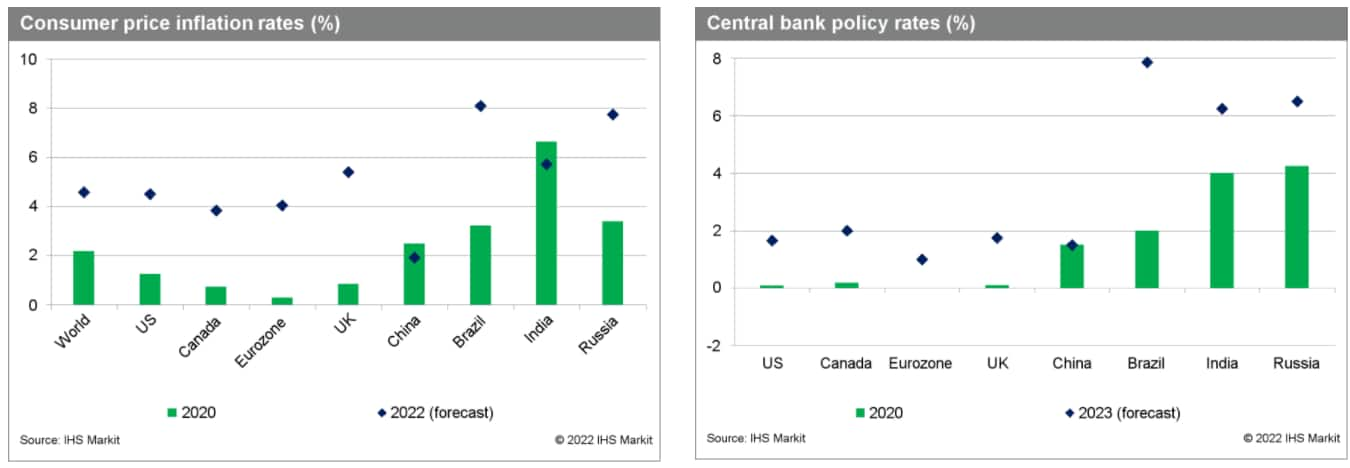

The soaring of global inflation rates is reflecting various factors including elevated commodity prices, supply bottlenecks, rising transportation costs, rebounding demand, and COVID-19-related base effects. The rising prices of energy and other goods have been the principal drivers of the unusually rapid increases in consumer price inflation rates, and in the short term further upward pressure from both areas is expected, aggravated by the impact of the Russia-Ukraine conflict.

Headline inflation rates should moderate from later in 2022 as supply bottlenecks ease, pent-up demand wanes, and energy-related base effects lean down. Nevertheless, a prolonged conflict and persistent spillovers on energy, food, and goods prices is a significant upside risk to the extension of global inflation.

Longer-term prospects for underlying global inflation rates will be determined by a range of influences including the evolution of spare capacity, inflation expectations, and potential "second-round" effects: i.e., the potential for current elevated inflation rates to feed through into higher wage and unit labor cost growth. The longer headline inflation rates remain elevated, the greater the risk of "second-round" effects and higher underlying inflation rates becoming entrenched.

Central bank tightening is already well under way in many emerging markets, reflecting multiple factors including the comparatively high sensitivity of their consumer price inflation rates to commodity prices, less well-anchored inflation expectations, exchange-rate vulnerabilities, and exceptionally low starting points for policy rates in real and nominal terms.

Developed economies are also on a tightening track, with persistently higher-than-expected inflation rates prompting the larger, globally relevant central banks to embark on a faster withdrawal of monetary policy stimulus.

Uncertainty related to the Russia-Ukraine conflict and its economic and financial implications could lead to a more cautious approach to policy tightening despite exceptionally elevated inflation rates in the short term.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frussia-ukraine-war-inflation.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frussia-ukraine-war-inflation.html&text=Russia-Ukraine+war+and+inflation+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frussia-ukraine-war-inflation.html","enabled":true},{"name":"email","url":"?subject=Russia-Ukraine war and inflation | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frussia-ukraine-war-inflation.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Russia-Ukraine+war+and+inflation+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frussia-ukraine-war-inflation.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}