Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 20, 2022

Weekly Pricing Pulse: Commodity sell-off accelerates

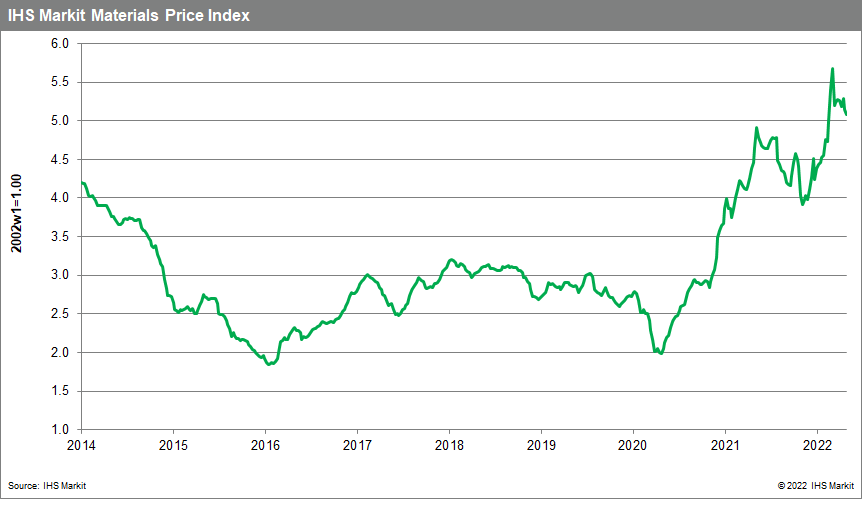

Our Materials Price Index (MPI) fell 4.3% last week, with all but one of the index's ten sub-components declining. Markets are growing increasingly anxious about global growth prospects due to widening COVID-19 lockdowns in China (mainland) and aggressive monetary tightening. This sparked the third consecutive weekly decline in the MPI with commodity prices as measured in the index now collectively 14.3% lower than the all-time high established in early March.

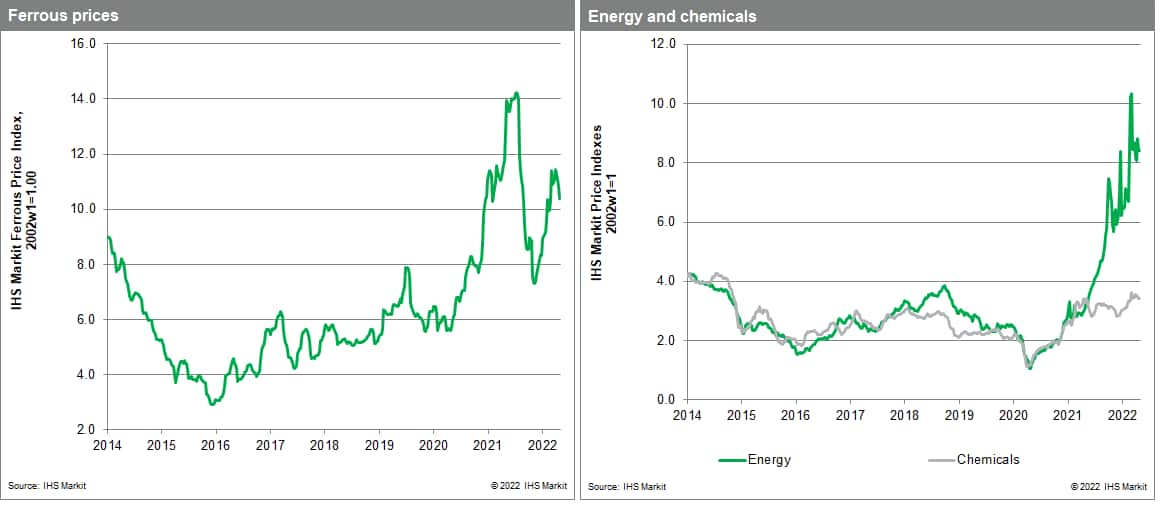

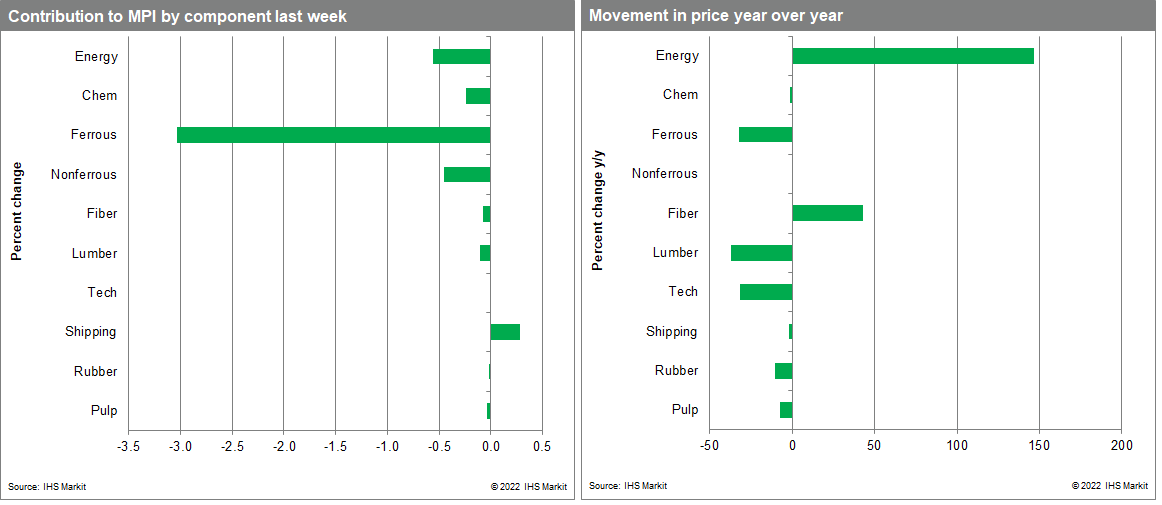

A broad sell off on commodity markets saw everything from energy to lumber prices fall last week. However, the dip was notably sharp across industrial metals with our steel making raw material sub-index showing significant weakness. The ferrous index was down 9.6%, the biggest weekly drop since November 2021 and its fifth consecutive decline. Iron ore prices eased to $132/metric ton having been above $150/metric ton the previous week while steel scrap prices fell 13%. Markets were reacting to rising COVID-19 cases in mainland China and ongoing lockdowns in several major cities. In addition, construction demand was hit after heavy rain in the south of the country temporarily halted activity. Nonferrous metals declined 5.9% as every traded metal from copper to zinc experienced falling prices. Copper prices dropped to an eight-month low of $9,000/metric ton and zinc prices dipped below $3,500/metric for the first time this year. The metal sell off was sparked by the same weaker fundamentals tied to mainland China that impacted iron ore. The MPI's energy sub-index declined 2.3% last week due to falling global natural gas prices. Henry Hub spot prices dropped to $6.80/MMBtu from $8.40/MMBtu due to improving temperatures and higher recorded storage levels.

Equity markets had another poor week with the FTSE All-World index down for the sixth week in a row, the longest stretch since 2008. Global stock markets are nearing bear market territory with commodity price declines only adding to gloomy sentiment last week. The only good news is that the combination of slower growth, tighter financial markets and an eventual easing of supply bottlenecks will lead to a further retreat in commodity prices over the next year. The caution in this sanguine view of commodity markets is that unwinding the cost pressures built up over the past two years in supply chains will take some time. Inflation is peaking now; however, its decline may prove painfully slow.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-selloff-accelerates.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-selloff-accelerates.html&text=Weekly+Pricing+Pulse%3a+Commodity+sell-off+accelerates+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-selloff-accelerates.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Commodity sell-off accelerates | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-selloff-accelerates.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Commodity+sell-off+accelerates+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-selloff-accelerates.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}