Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 22, 2023

Weekly Pricing Pulse: Commodity prices up as natural gas supply concerns reemerge

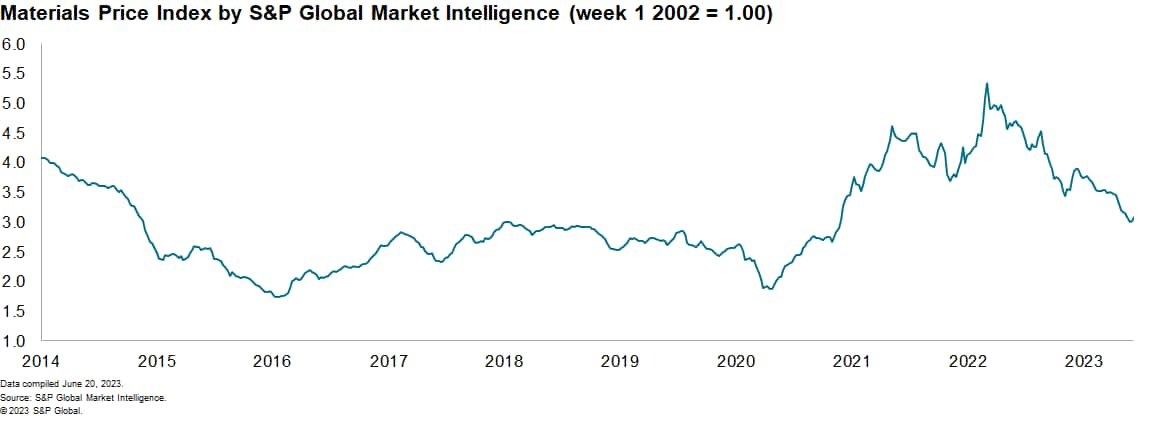

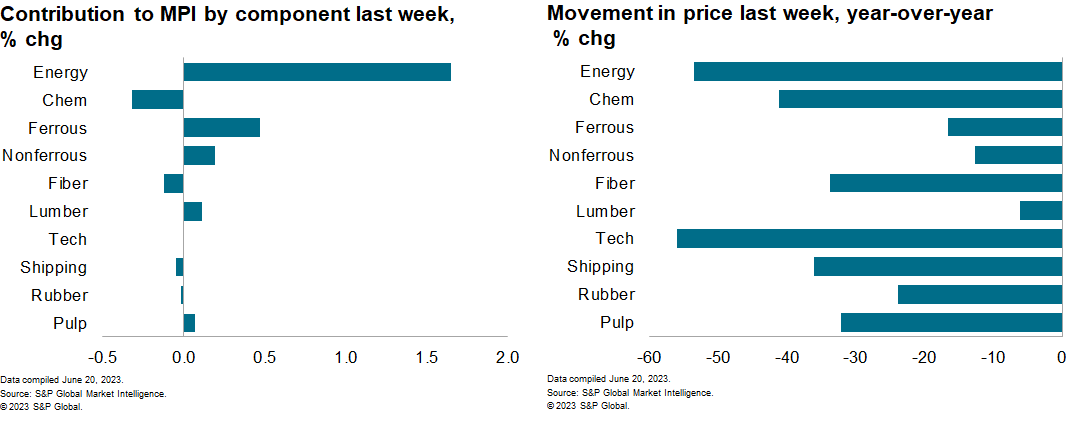

The Materials Price Index (MPI) by S&P Global Market Intelligence increased 2% last week, a second consecutive rise. The increase was mixed with exactly half of the ten subcomponents rising. Despite rising for the past two weeks the story so far in 2023 remains one of falling commodity prices with the MPI decreasing in 17 out of the last 23 weeks. The index also sits 34% below its year-ago level.

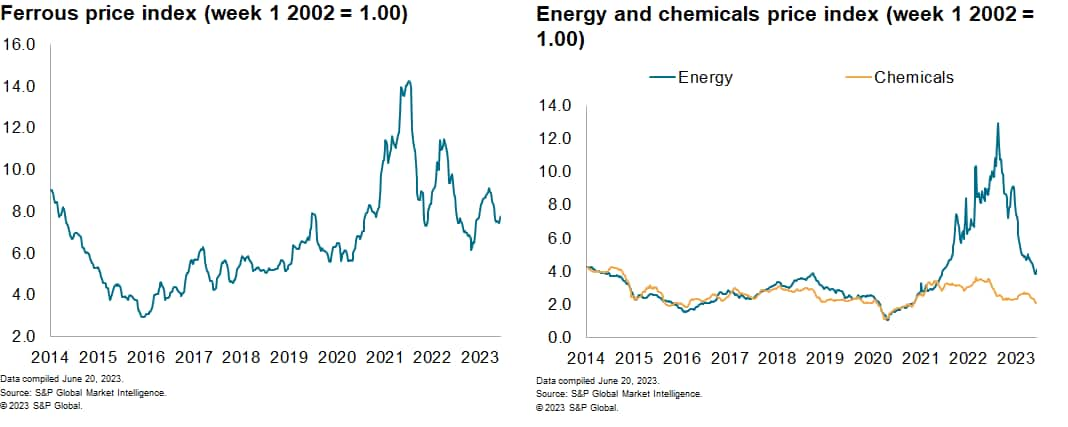

Upturns in energy and industrial metal prices were the main drivers of last week's rise in the MPI. The energy sub-index increased 9.1% the biggest rise in six months. Natural gas prices surged as speculation that the Netherlands would close its Gronigen gas field this year prompted nerves among market traders. In addition, several gas plants in Norway are undergoing maintenance which added to the gloomy mood in markets. These factors sent spot landed prices up to $12.17/MMBtu from $7.46/MMBtu the previous week. Despite this spike, fundamentals in the European gas market remain sound with storage levels above average for the time of the year. It does, however, show the volatility in global energy prices and the upside risk they pose to commodities overall. Elsewhere, industrial metal markets reacted positively to speculation that the mainland Chinese government will ramp up its stimulus efforts. Nickel prices soared to $23,138/tonne from $20,615/tonne the previous week as mainland Chinese industrial production and retail sales data both came in below market expectations.

Equity markets in the US had the strongest week since March with

the S&P 500 up 2.6%. This increase was in response to the

Federal Open Market Committee (FOMC) maintaining the target for the

federal funds rate at a range of 5% to 5.25%, following a

cumulative 5.0 percentage points over the 10 meetings since March

2022. Markets took this as a sign that the Federal Reserve has

shifted its stance on raising interest rates. However, S&P

Global Market Intelligence currently expect the FOMC to hike once

more by 25 basis points at the upcoming July meeting. The European

Central Bank also raised its deposit facility rate (DFR) last week

to 3.5%, its highest level since 2001. S&P Global Market

Intelligence expect an additional round of 25-bp rate hikes at the

next ECB policy meeting on July 27.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-up-natural-gas-supply.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-up-natural-gas-supply.html&text=Weekly+Pricing+Pulse%3a+Commodity+prices+up+as+natural+gas+supply+concerns+reemerge+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-up-natural-gas-supply.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Commodity prices up as natural gas supply concerns reemerge | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-up-natural-gas-supply.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Commodity+prices+up+as+natural+gas+supply+concerns+reemerge+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-up-natural-gas-supply.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}