Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 23, 2023

Critical relationship: Supply chain implications of US-UK Atlantic Declaration

The "Atlantic Declaration" between the US and UK includes provisions to negotiate a Critical Minerals Agreement. If ratified, it could give UK exporters of cobalt, graphite, lithium, manganese and nickel eligibility under the US Inflation Reduction Act (IRA) funding for electric vehicle components.

Good for the UK, challenging for others: New critical minerals deal

Talks between the UK Prime Minister Rishi Sunak and US President Joe Biden have yielded the "Atlantic Declaration," which provides an action plan for economic development between the two countries. While indicative of a continued "special relationship" between the two countries, it does not presage a free trade agreement.

Importantly, the two sides committed to negotiating a Critical Minerals Agreement, which may give UK sources of cobalt, graphite, lithium, manganese and nickel access to US IRA financing.

Increased access to US markets is an important boon for the UK as its exporters look for routes to replace sales in the EU lost during Brexit. The UK government will be negotiating a deal at the same time as the EU, generating some competition for preferential access, especially if limits are put on the quantity of exports that can be eligible for IRA funding.

Increased access for UK suppliers provides a further challenge for firms setting up mining and processing capacity in the US for critical minerals. Free trade agreements with Australia, Canada, Japan and Mexico already provide significant sources of competition, as outlined in " Before the battery and magnet: IRA and mineral supply chains."

Lithium booms, mainland China listens: Small, but growing exports

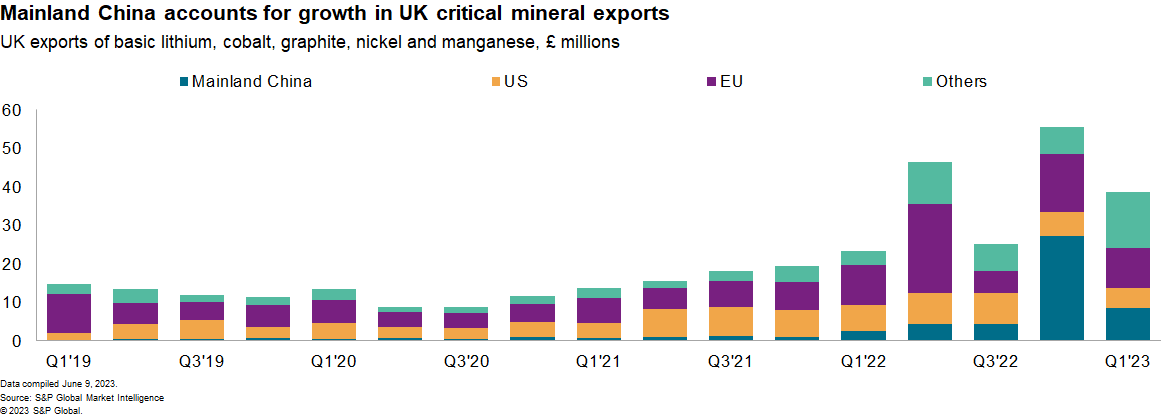

UK exports of the basic products linked to the five minerals were worth 166 million pounds ($209 million) in the 12 months to March 31, 2023, according to S&P Global Market Intelligence data.

Mainland China accounted for 27% of shipments in the 12 months to March 31, 2023, while the US represented just 17%. Exports to mainland China have climbed by 681% year over year during the past 12 months, while those to the US fell by 3%.

The expansion of purchases by buyers in mainland China may have been one consideration for the US in offering a deal to the UK, though the UK only accounted for 2% of US imports of five minerals covered by the deal in 2022.

The leading exports from the UK to all destinations in the 12 months to March 31, 2023, were lithium hydroxides and carbonates worth £112 million of shipments, while cobalt oxides were worth £32 million.

A deal's not enough: UK cost and risk considerations

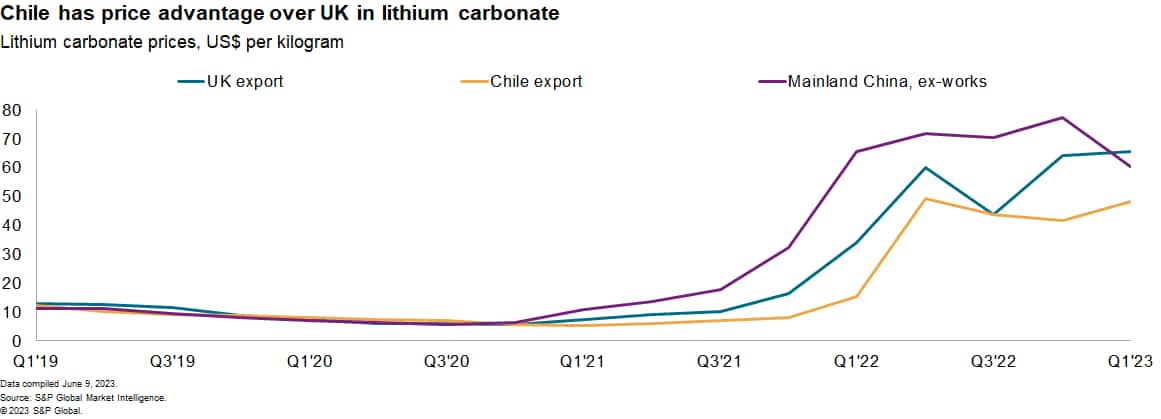

While UK exporters of lithium products may get some benefit from access to IRA-related funding, they nonetheless face a competitive challenge from the largest exporters in Chile.

The average achieved price for UK lithium carbonate exports in first quarter 2023 was $66 per kilogram. That was 36% higher than exports from Chile and 9% above the mainland China ex-works price, Market Intelligence data shows.

Exporters from Chile to the US also have the advantage of already having a full trade deal with the US. As such, batteries that use Chilean lithium are already eligible for IRA.

The disadvantage for Chilean exporters is the recently launched government plans to take closer control of lithium reserves once current concessions come to an end.

While the UK's legal risks are lower than the other lithium-exporting countries, it has higher operational risks including infrastructure disruption and labor strikes than both Chile and Australia. That may prove to be a disadvantage when dealing with buyers who are looking for certainty in supplies.

Sign up for our Supply Chain Essentials newsletter

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcritical-relationship-supply-chain-implications-of-us-uk-talks.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcritical-relationship-supply-chain-implications-of-us-uk-talks.html&text=Critical+relationship%3a+Supply+chain+implications+of+US-UK+Atlantic+Declaration+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcritical-relationship-supply-chain-implications-of-us-uk-talks.html","enabled":true},{"name":"email","url":"?subject=Critical relationship: Supply chain implications of US-UK Atlantic Declaration | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcritical-relationship-supply-chain-implications-of-us-uk-talks.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Critical+relationship%3a+Supply+chain+implications+of+US-UK+Atlantic+Declaration+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcritical-relationship-supply-chain-implications-of-us-uk-talks.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}