Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Feb 10, 2022

Weekly Pricing Pulse: Commodity prices increase for fifth week in a row

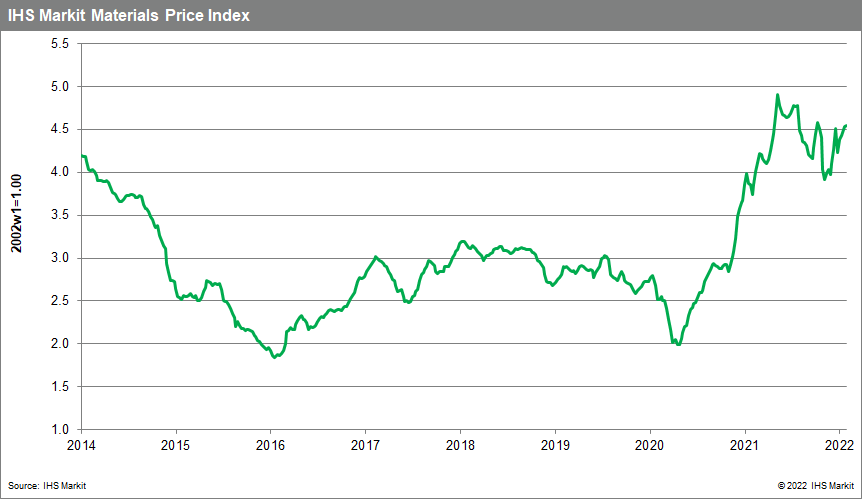

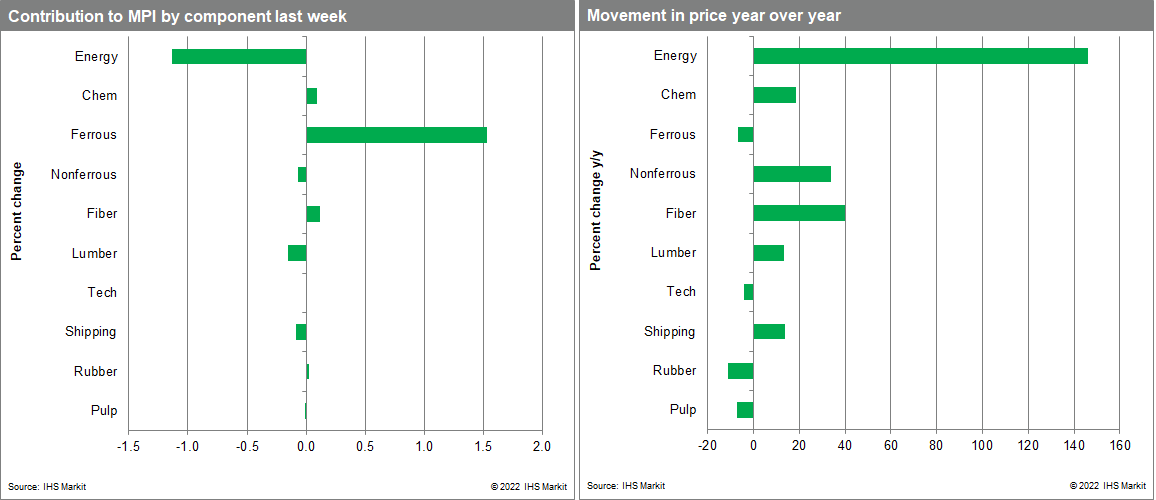

Our Materials Price Index (MPI) rose 0.3% last week, continuing its recent strength. Price increases were not universal, however, with only half of the MPI's ten sub-components rising. That said, commodity prices have now risen for five consecutive weeks and are up 14% since the end of November. Despite the recent price growth, the MPI remains 7.4% below its May 2021 peak.

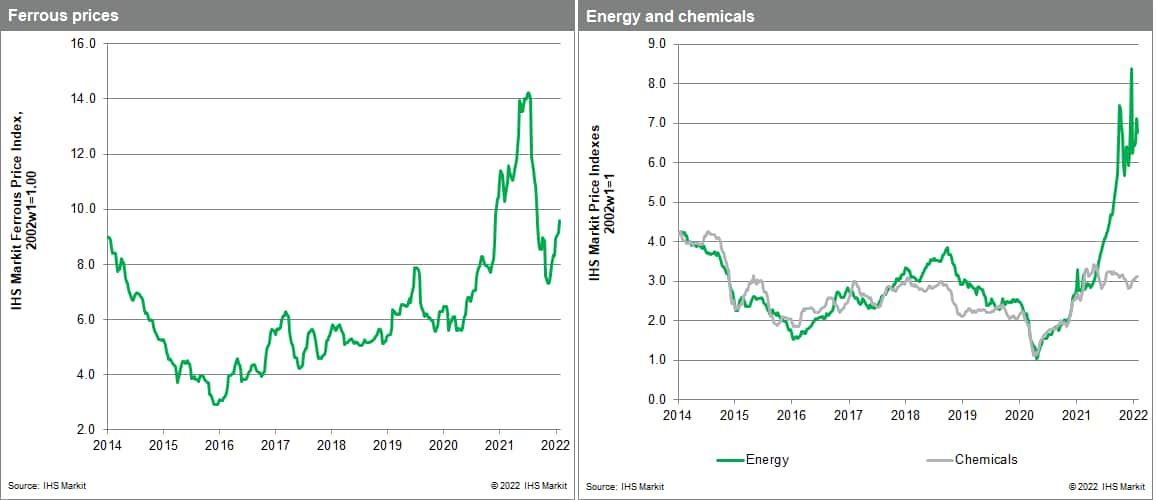

Iron ore was the main reason for last week's increase. Our ferrous sub-index was up 4.8% as iron ore prices reached $145 per tonne amid improved demand sentiment. Iron ore import figures into mainland China continue to show strong growth, which is boosting hopes that steel markets there will prove to be better than previously expected. Last week the discovery of several new COVID-19 cases in Western Australia, a key export market, also created supply concern and sparked additional buying adding upward momentum to prices. Energy markets remain volatile with our sub-index declining 5% last week. Asian and European natural gas prices dropped 12.2% and 9.7%, respectively, as supply from Russia into Europe increased. Near-term winter weather forecasts also indicate milder than average temperatures, which caused some additional softness in prices. The precarious nature of European supply, however, means further price volatility is likely before the end of winter.

While commodity prices increased last week, trading was quiet in markets due to the Lunar New Year holiday and opening of the Olympics in mainland China. Buyers were largely absent in Asia, with much of mainland China's manufacturing sector on holiday. Volatility will likely resume after the Lunar New Year holiday since geopolitical tensions around Russia and Ukraine will continue to shake not just energy markets, but a range of raw materials given the importance of both countries as large exporters of many hard and soft commodities. However, with weather models indicating milder weather in February, energy prices may provide some welcome relief to buyers.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-increase-fifth-week.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-increase-fifth-week.html&text=Weekly+Pricing+Pulse%3a+Commodity+prices+increase+for+fifth+week+in+a+row+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-increase-fifth-week.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Commodity prices increase for fifth week in a row | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-increase-fifth-week.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Commodity+prices+increase+for+fifth+week+in+a+row+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-increase-fifth-week.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}