Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Feb 08, 2022

Banking risk monthly outlook: February 2022

- Further cut of reserve requirement ratio in mainland China to boost loan disbursements

- Extension of Bangladesh's loan-classification relaxation on asset-quality reporting

- Capital injections for Turkey's state-owned banks likely on the horizon

- Details on the sale of Citigroup's Citibanamex

- Completion of Central Bank of Lebanon (Banque du Liban: BDL) audit

- Rising interest rates in Sub-Saharan Africa likely to affect asset quality

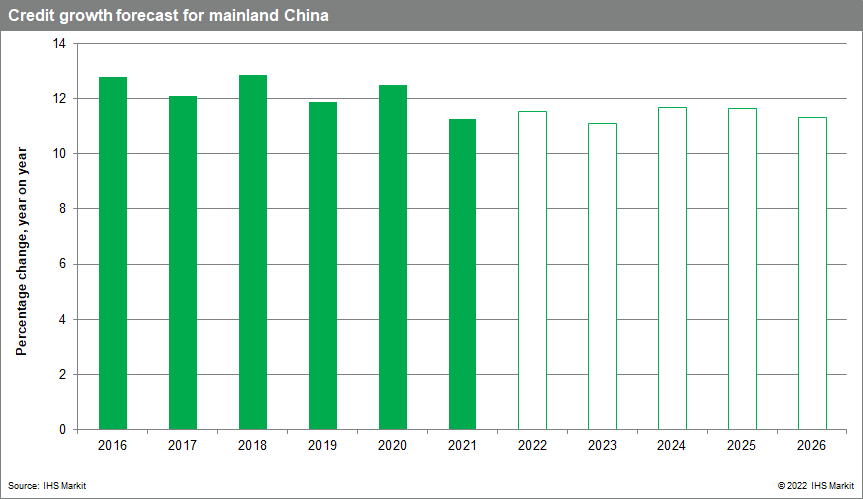

Further cut of reserve requirement ratio in mainland China will likely boost loan disbursements broadly.

After the central bank cut both the short-term and the medium-term loan prime rates in recent weeks, IHS Markit experts judge it likely that considering the reserve requirement ratio (RRR) is still at around 8.4% after it was reduced in December 2021, there is room for a further cut in the first quarter. Overall, we expect credit growth in mainland China to be around 11.6% in 2022.

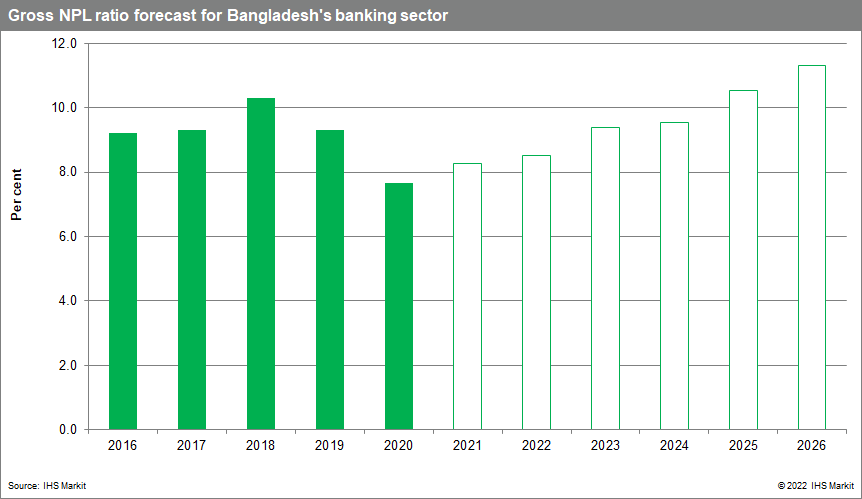

The impact from the extension of Bangladesh's loan-classification relaxation on asset-quality reporting.

At the end of 2021, Bangladesh authorities had shown willingness to relax the minimum loan-repayment requirement for a loan to be classified as normal; this policy will likely continue into 2022. Although the regulators may show resilience and a strong stance towards better loan classification, in the beginning, IHS Markit experts expect these will once again relax. We expect the non-performing loan (NPL) ratio to remain around 8.3% for 2022.

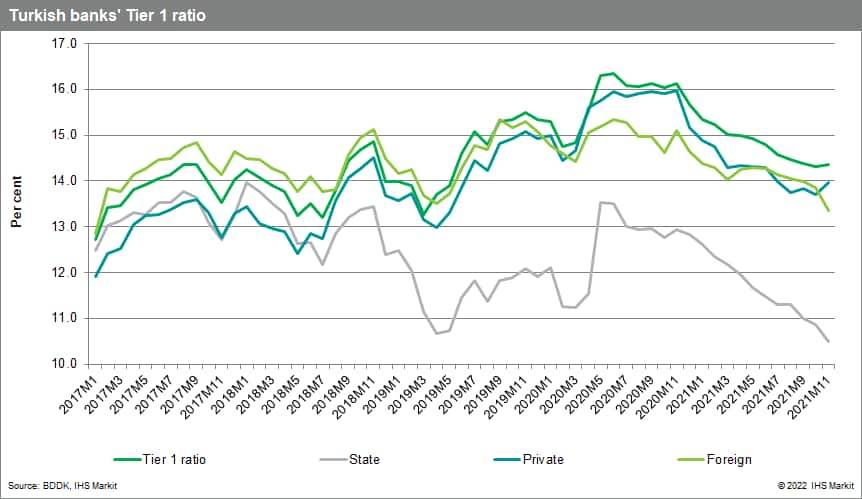

Capital injections for Turkey's state-owned banks likely on the horizon.

Turkey's sovereign wealth fund (Türkiye Varlık Fonu Yönetimi: Turkey Wealth Fund, or TWF) is likely to inject capital into the country's three state-owned banks in the first quarter to maintain expansion capital and boost capital buffers that have been eroded by rapid lending and higher risk-weighted assets. Not yet announced officially, the TWF is rumored to be considering a TRY51.5-billion (USD3.8-billion) capital infusion into state-owned banks including Ziraat Bank (TRY22.5 billion), Halkbank (TRY13.5 billion), and Vakifbank (TRY13.5 billion), which we expect to occur before the end of the first quarter. Although still above local requirements (Tier 1 minimum of 8.5% including capital conservation buffer), state-owned banks have the lowest cushion when compared with private and foreign-owned banks. In light of low profitability, we expect credit growth to be curtailed if state-owned banks do not receive capital injections soon.

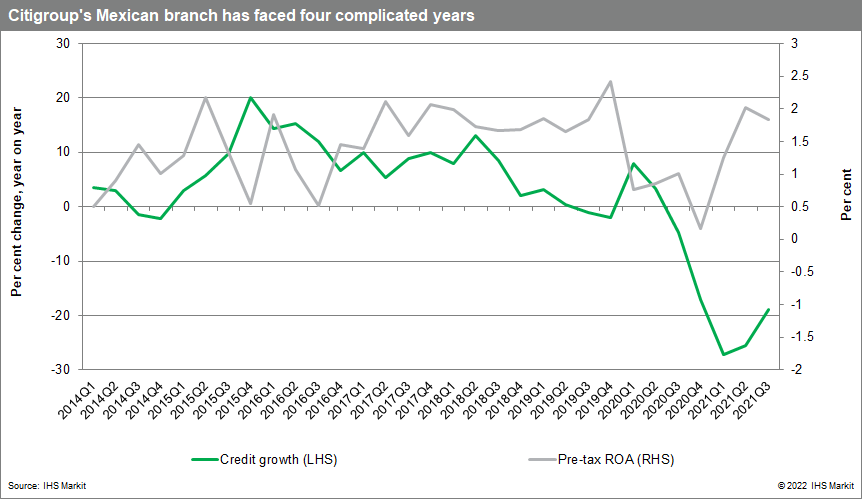

Developments relating to the sale of Citibanamex in Mexico.

Citigroup announced on 12 January that it will be selling most of the portfolio and assets of its branch in Mexico, remaining as a small-sized corporate banking institution. The decision follows four complicated years at the branch, with relatively low profitability and significantly low credit growth. Over the course of February - and then later through the year - we expect that further details will be provided about the sale process and some of the potential buyers, which could shape the banking sector going forward.

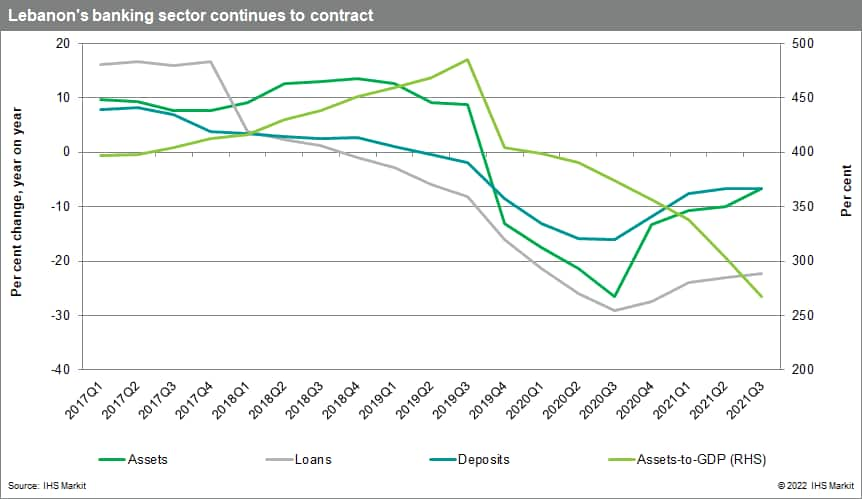

Completion of Central Bank of Lebanon (Banque du Liban: BDL) audit would begin estimating the scale of financial sector recapitalization needs.

In October 2021, Lebanon contracted with a third-party auditor to estimate the size of the BDL's debt burden and potential losses. Originally contracted for completion within 12 weeks, the audit by Alvarez and Marsal could be completed in February, having reportedly been delayed because of a lack of BDL responsiveness to data requests. Quantifying the scale of BDL losses is a critical first step in Lebanon restarting stalled talks with the International Monetary Fund (IMF) seen as needed to restructure the banking sector. IHS Markit experts previously noted that sovereign debt holdings (10% of total assets) and deposits at the BDL (60% of total assets) make up most of the banking sector's assets. Based on recent government payments, we estimate that a de facto reduction of 50% on local currency-denominated debt and 92% on foreign currency-denominated debt has already occurred - a likely indication of what could be considered sustainable going forward.

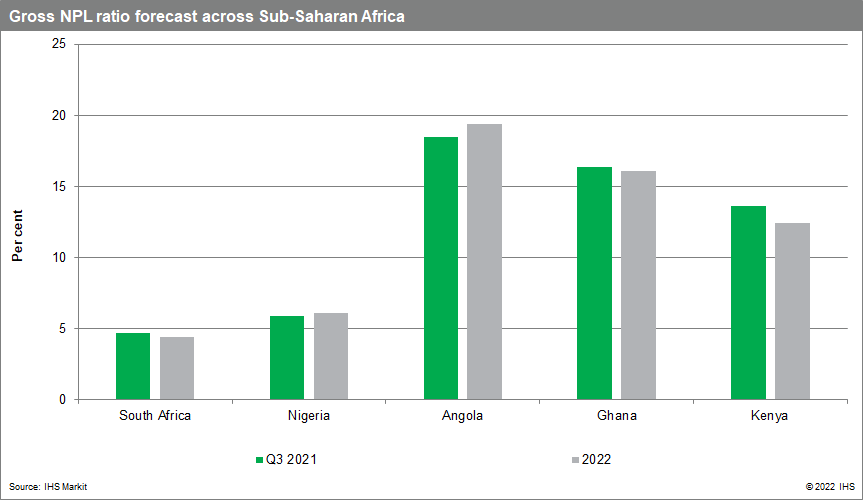

Rising interest rates in Sub-Saharan Africa likely to affect banks' asset quality.

At the onset of the pandemic, most countries in Sub-Saharan Africa adopted an accommodative monetary policy to support their economies. However, because of significant inflation risks, IHS Markit experts forecast risk to interest rates in some of Sub-Saharan Africa's largest economies, namely Angola, Ghana, Kenya, Nigeria, and South Africa, to be towards the upside for 2022. We forecast an average NPL ratio of 11.7% for these five countries for 2022 and significant interest rates hikes, at a time when these countries are already battling with asset-quality challenges (particularly Angola, Ghana, and Kenya) because of legacy problem loans and ongoing stresses related to the pandemic. In addition, further interest-rate hikes will push banks to lend more to the sovereign, which in the case of Sub-Saharan Africa is already at a notable level.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanking-risk-monthly-outlook-february-2022.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanking-risk-monthly-outlook-february-2022.html&text=Banking+risk+monthly+outlook%3a+February+2022+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanking-risk-monthly-outlook-february-2022.html","enabled":true},{"name":"email","url":"?subject=Banking risk monthly outlook: February 2022 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanking-risk-monthly-outlook-february-2022.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Banking+risk+monthly+outlook%3a+February+2022+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanking-risk-monthly-outlook-february-2022.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}