Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Feb 10, 2021

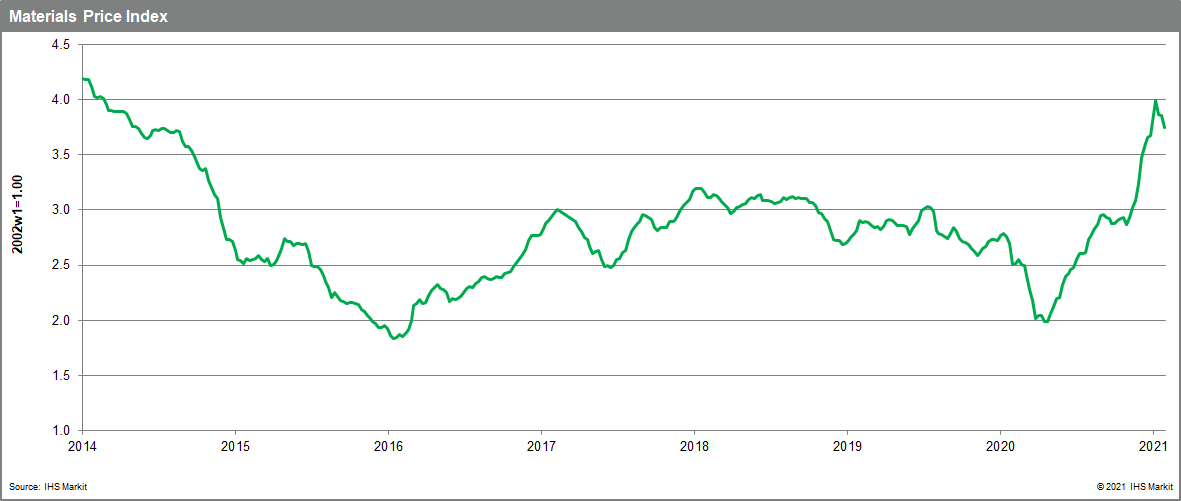

Weekly Pricing Pulse: Commodity prices drop for third week in a row

Our Materials Price Index (MPI) fell 2.8% last week, its third consecutive weekly drop. Despite the successive declines, the MPI remains at its highest point since May 2014 and still stands 48% higher than early February 2020.

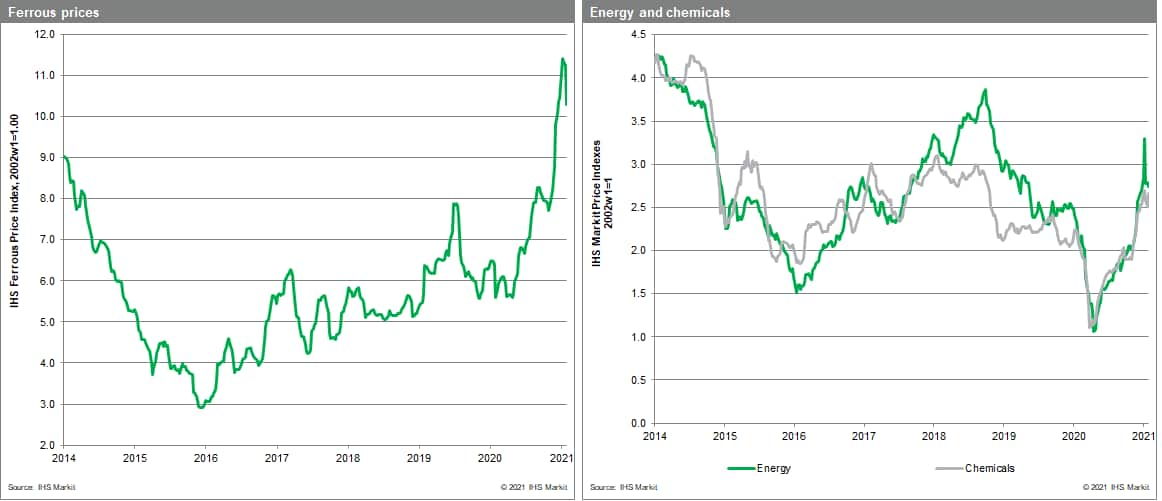

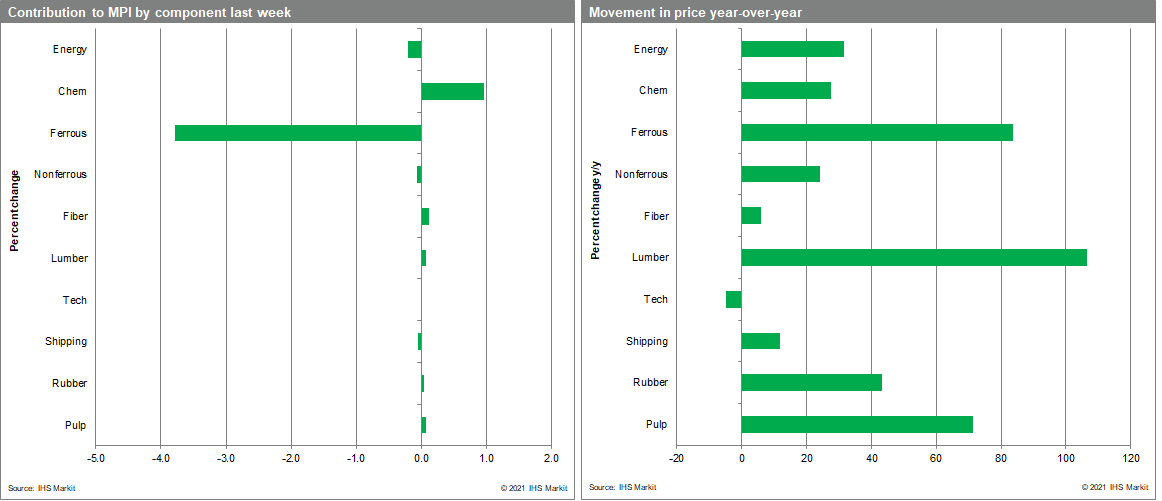

A large downward move in our steel making raw materials index was the principal cause of last week's price drop. Indeed, more components of the index rose than fell. Our steel index was down 8.4% after a significant iron ore sell off in the first half of the week drove prices down to $148/metric ton, the lowest point since mid-December. Lower demand from mainland China due to the upcoming Lunar New Year holiday was the main reason for the decline. An improving supply picture added to iron ore's weakness as major producer Vale is expected to increase production in the near term. Our energy sub-index continued its recent downward move, falling 1.7%, as natural gas prices retreated from historic highs. Coal prices also fell as Asian demand dropped due to the Lunar New Year effect. In contrast, oil prices increased last week as the supply reductions implemented by the OPEC+ producers in January began to have an impact on the overall market balance. Our DRAMS index increased 3.2% as ongoing microchip shortages pushed prices higher. The index has increased for the past ten weeks and, with General Motors announcing the temporary closure of three global production sites because of the shortage, price pressure will persist in the near term.

Equity markets, in contrast to commodities, had their best week since November. Despite weaker than expected US non-farm payroll data, markets focused on strong earnings reports and the brighter prospects for global economies from the COVID-19 vaccine rollouts. The weakness in commodity markets is tied to the run up to the Lunar New Year holiday in mainland China. Buyers were largely absent in Asia, with much of mainland China's manufacturing sector on holiday. Whether this softness continues beyond the Lunar New Year holiday will depend on the supply-side of markets and specifically on clear signs that vendor performance is improving, something that is not yet apparent in the data for backlogs or delivery times. Prospects for a third large stimulus package in the US also now loom in front of markets. Increases in the MPI over the past eight months guarantee a rise in goods price inflation through the second quarter. The question for markets is what impact will the fresh stimulus have on spending? If added spending is directed toward goods with bottlenecks in supply-chains still unresolved, pricing pressures will worsen. On the other hand, should consumption shift back toward services as the pandemic recedes at the same time that supply disruptions are tackled, markets may be able to accommodate the stimulus induced increase in demand without experiencing a worrisome increase in goods price inflation.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-drop-for-third-week.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-drop-for-third-week.html&text=Weekly+Pricing+Pulse%3a+Commodity+prices+drop+for+third+week+in+a+row+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-drop-for-third-week.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Commodity prices drop for third week in a row | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-drop-for-third-week.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Commodity+prices+drop+for+third+week+in+a+row+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-drop-for-third-week.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}