Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Feb 23, 2022

Weekly Pricing Pulse: Commodity prices dip after government intervention

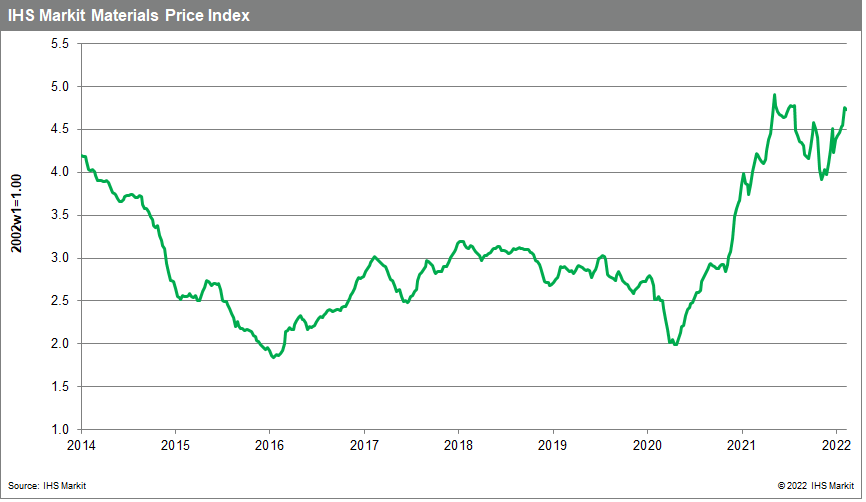

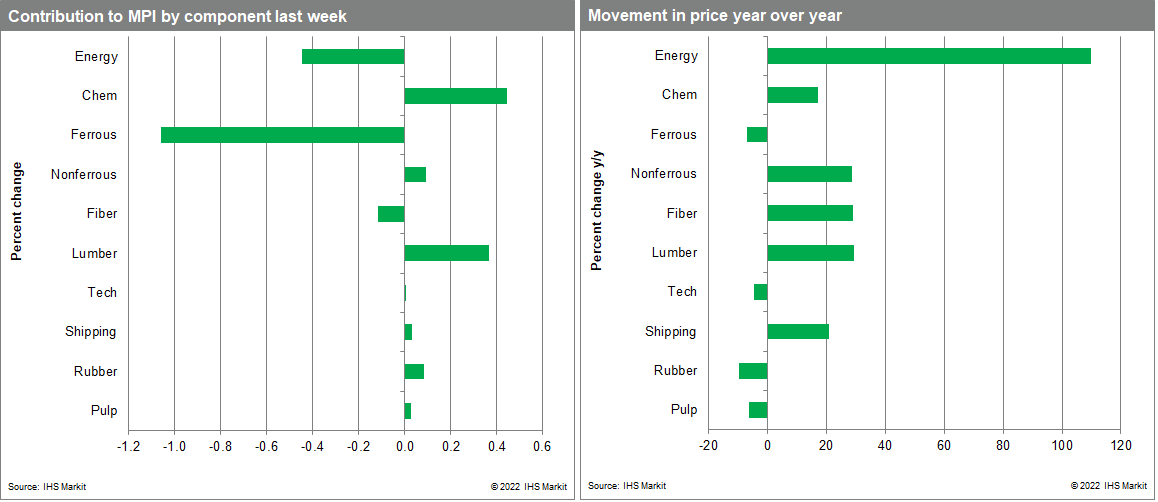

Our Materials Price Index (MPI) fell 0.6% last week, its first retreat this year. Price decreases were narrow, however, with only three out of ten sub-components in the index falling. Notwithstanding last week's decline, commodity prices are up 18.8% since the end of November, a rally that has now carried the MPI close to its May 2021 peak.

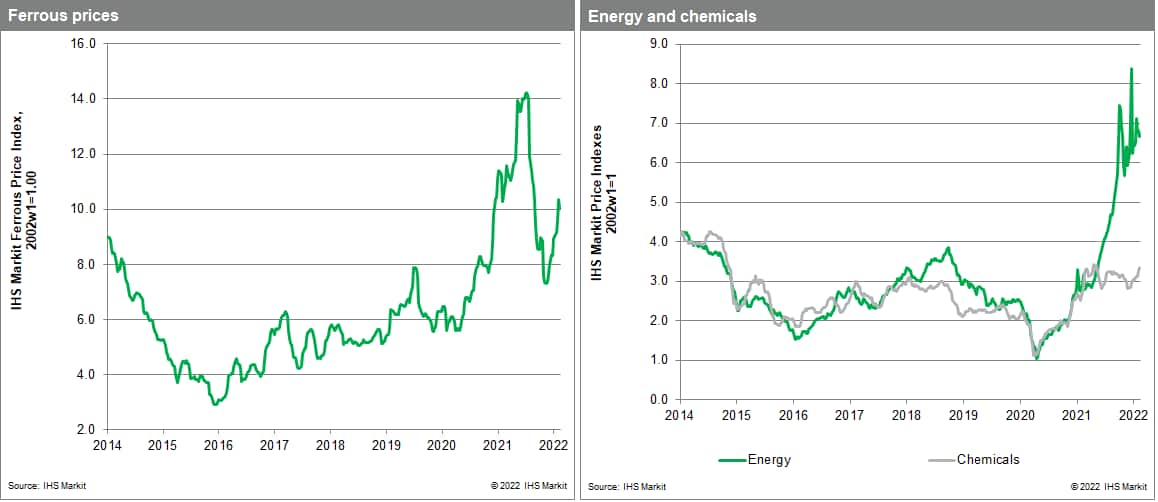

Falling iron ore and coal prices were the main reason for the MPI's overall decline last week. Our ferrous sub-index was down 3.1% as iron ore prices dipped to $141 per tonne after recently trading above $150. Prices dropped after the National Development and Reform Commission (NDRC) and State Administration of Market Regulation (SAMR) in mainland China requested traders release excess inventory. Authorities also carried out port checks and raised trading fees to curb market speculation. Chinese authorities also held discussions with China Shenhua Energy Co. and China Coal Energy Co, two of the largest state coal miners, to establish a price cap for coal. This shook coal markets and caused global coal prices to decline 4.4%. While these measures had the desired effect, recent history shows that these types of interventions have limited success. Similar moves in other markets also initially reduced prices which then slowly recovered as market fundamentals reasserted themselves.

While commodity markets took their lead from Chinese government interventions last week, geopolitical tensions loomed large. Russia and Ukraine are large exporters of many hard and soft commodities so any escalation in the current standoff remains the major upside risk to prices. With inflation in many countries already high, the danger of higher oil, natural gas, metal, and wheat prices because of intensifying tensions is clear. Moreover, the crisis in Eastern Europe comes against a backdrop of tightening monetary policy, another reason to expect heightened volatility in commodity markets as spring approaches.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-dip-after-intervention.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-dip-after-intervention.html&text=Weekly+Pricing+Pulse%3a+Commodity+prices+dip+after+government+intervention+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-dip-after-intervention.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Commodity prices dip after government intervention | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-dip-after-intervention.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Commodity+prices+dip+after+government+intervention+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-dip-after-intervention.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}