Week Ahead Economic Preview: Week of 3 June 2024

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

ECB, BoC meetings, US payrolls and worldwide PMI data

Central bank meetings in the eurozone and Canada will be in the spotlight, while key data releases include US payrolls, mainland China's trade data and worldwide PMI updates across countries and sectors. GDP updates will also be anticipated in economies including the eurozone, Australia, Brazil and South Africa.

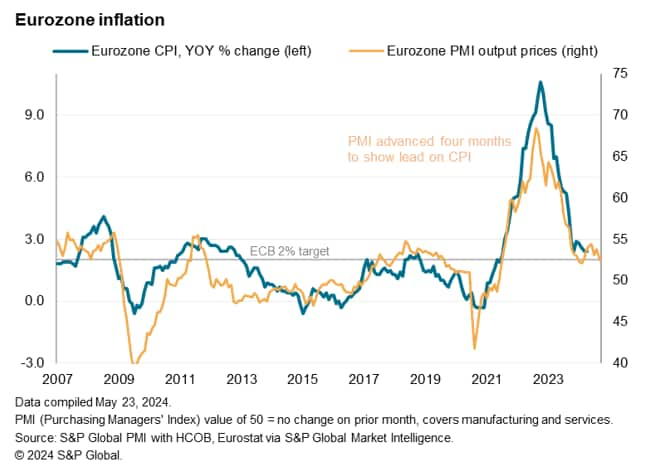

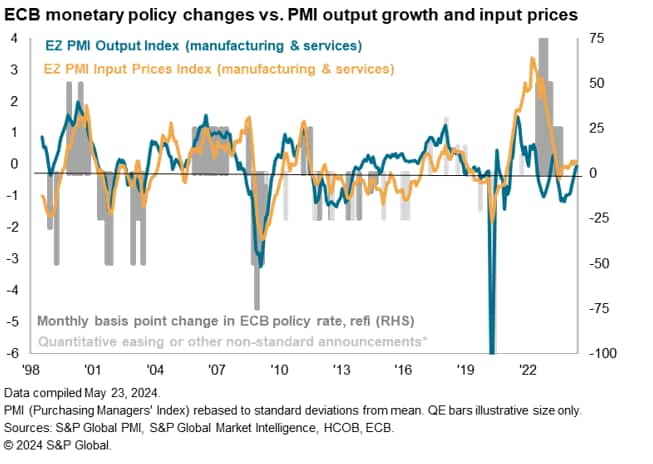

Rate cuts are expected in the eurozone and potentially Canada at the start of June as policymakers convene. While the European Central Bank (ECB) is well expected to lower rates, the focus shifts to their stance with respect to the path forward (see box). On the other hand, the Bank of Canada (BoC) moves into June with the market still relatively on the fence as to whether the monetary policy committee will lower rates, thereby signalling potential fluctuations for the CAD in the new week. PMI prices data, which preludes the trend for official CPI, indicated that inflationary pressures in Canada remain elevated by historical standards, thus adding to the uncertainties here.

Over in the US, May non-farm payrolls and wage growth statistics are anticipated, with the market eager for signs of slowing jobs growth and softening wage pressures. According to the latest May US flash PMI data, employment conditions were relatively subdued midway through the second quarter of the year. Given simmering concerns over delayed Fed cuts, any signs pointing to easing wage pressures will be positive for risk sentiment.

More broadly, we will also be seeing worldwide manufacturing and services PMI data after faster developed world growth was signalled by flash PMI data. With major developed central banks set to lower rates from June, inflation trends in other parts of the world will offer clues on which economies may follow suit. Additionally, given the positive sentiment surrounding the tech sector, detailed sector data from the US and more widely around the globe will offer insights into the actual growth and demand conditions going into the mid-year.

Over in APAC, besides PMI updates, May trade figures from mainland China will be a key release to watch. Australia's Q1 GDP will also be updated midweek with PMI indications having alluded to improvements in economic conditions, albeit services-led, in the first three months of 2024.

What will the ECB do… next?

With a recent Reuters poll indicating that the market has well priced in a rate cut in June by the ECB, the question moves on to what European central bankers may do next with mixed views on the number of rate cuts left for the rest of 2024 and how soon will the ECB move again.

While the latest HCOB Flash Eurozone PMI reinforced the easing inflation picture, which supports the lowering of interest rates, it also revealed that growth accelerated in May, which may induce added caution among some policymakers in committing to further cuts in the near-term. How the ECB will lean will be closely watched in the week.

Key diary events

Monday 3 Jun

New Zealand, Malaysia, Thailand Market Holiday

Worldwide Manufacturing PMIs, incl. global PMI* (May)

Indonesia Inflation (May)

Turkey Inflation (May)

United States ISM Manufacturing PMI (May)

Tuesday 4 Jun

ASEAN Manufacturing PMI* (May)

South Korea Inflation (May)

Switzerland Inflation (May)

Germany Unemployment Rate (May)

South Africa GDP (Q1)

Brazil GDP (Q1)

United States Factory Orders (Apr)

Wednesday 5 Jun

Worldwide Services, Composite PMIs, inc. global PMI* (May)

South Korea GDP (Q1, final)

Philippines Inflation (May)

Australia GDP (Q1)

Thailand Inflation (May)

France Industrial Production (Apr)

Brazil Industrial Production (Apr)

United States ADP Employment Change (May)

Canada BoC Interest Rate Decision

United States ISM Services PMI (May)

Thursday 6 Jun

South Korea, Sweden Market Holiday

Australia Trade (Apr)

Switzerland Unemployment Rate (May)

Germany Factory Orders (Apr)

Taiwan Inflation (May)

Eurozone Retail Sales (Apr)

Eurozone ECB Interest Rate Decision

Eurozone Construction PMI* (May)

United Kingdom Construction PMI* (May)

United States Balance of Trade (Apr)

United States Initial Jobless Claims

Global Sector PMI* (May)

Friday 7 Jun

China (Mainland) Trade (May)

India RBI Interest Rate Decision

Germany Trade and Industrial Production (Apr)

United Kingdom Halifax House Price Index* (May)

France Balance of Trade (Apr)

Eurozone Employment Change (Q1, final)

Eurozone GDP (Q1, 3rd est.)

Mexico Inflation (May)

Canada Trade (Apr)

Canada Unemployment Rate (May)

United States Non-farm Payrolls, Unemployment Rate, Average Hourly

Earnings (May)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

What to watch in the coming week

Worldwide manufacturing and services PMI releases

The first week of June brings worldwide manufacturing and services PMI updates on Monday and Wednesday respectively. Following encouraging news of accelerating 'G4' growth from flash PMI data, global PMI will be watched for whether business activity growth has further accelerated in May. Price trends will also be scrutinised with the first of major central banks set to lower rates from June.

Additionally, detailed sector data will also be due on Thursday for insights into where the key growth areas are and the expected trend with forward-looking sub-indicators.

Americas: US labour market report, ISM PMI, BoC meeting, Canada employment

May's US labour market report will be due at the end of the week with the consensus pointing to fewer job additions. Early flash PMI indications revealed a marginal reduction in workforce numbers, led by the service sector as manufacturing headcounts rose at the fastest pace in ten months. Meanwhile wage growth will be scrutinised for further insights into how inflation may trend. PMI price indications have suggested that price pressures edged higher in May.

The Bank of Canada convenes at the start of June amid growing expectations for a rate cut in the upcoming meeting. That said, inflationary pressures remain still elevated, which adds uncertainty over whether the BoC will make an imminent move.

EMEA: ECB meeting, Germany trade, Eurozone Q1 GDP

The European Central Bank convenes at the start of June with a 25-basis point cut well priced in by the market at present following hints of a mid-year rate cut as inflation eased. This falling inflation trend has been again confirmed by the most up-to-date May HCOB Flash Eurozone PMI update. Given the easing of price pressures, indications of further easing of rates will be sought with the upcoming meeting.

APAC:RBI meeting,China trade, Australia Q1 GDP, trade data,

Besides detailed PMI releases for the APAC region, the highlights in the week will be trade data due from mainland China, in addition to Australia's Q1 GDP print. Improvements in business activity growth from the closing quarter of 2024 were observed via the Judo Bank Australia PMI, with the latest flash PMI further showing growth extending into Q2 in Australia. This feeds into the forecast that we may see a better first quarter GDP reading. No changes to policy rates are meanwhile expected when the RBI convenes.

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.