Flash PMI data signals steep acceleration of US growth midway through second quarter

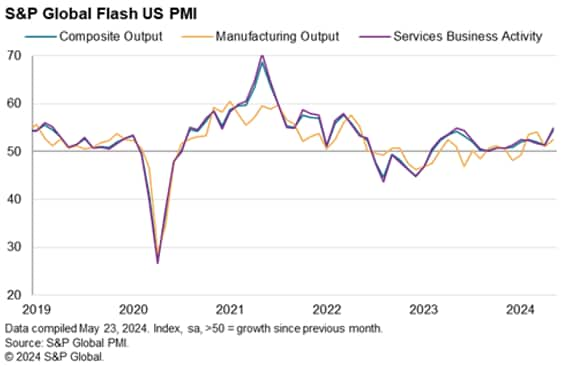

The US economic upturn accelerated again in May after two months of slower growth, with the early PMI data signaling the fastest expansion for just over two years. The data put the US economy back on course for another solid GDP gain in the second quarter.

Not only has output risen in response to renewed order book growth, but business confidence has lifted higher to signal brighter prospects for the year ahead. However, companies remain cautious with respect to the economic outlook amid uncertainty over the future path of inflation and interest rates, and continue to cite worries over geopolitical instabilities and the presidential election.

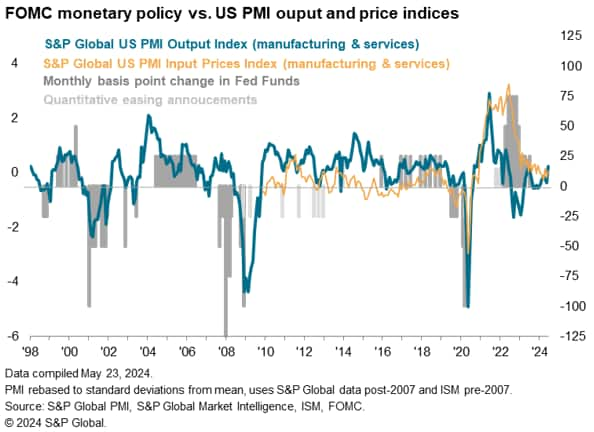

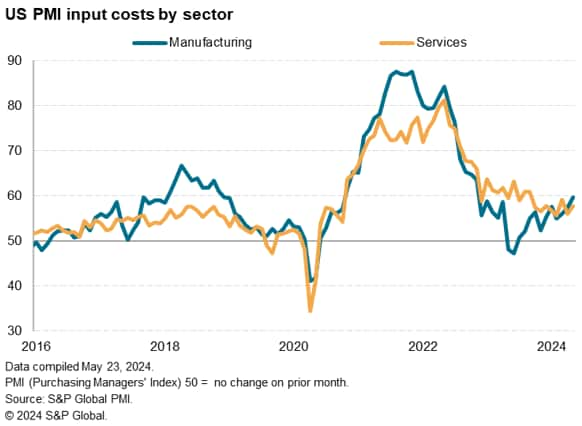

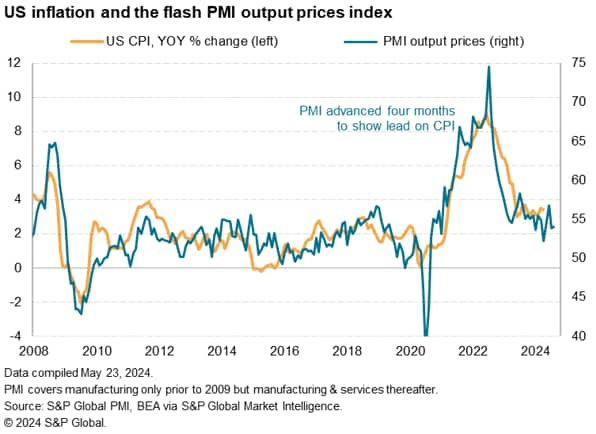

Selling price inflation has meanwhile ticked higher and continues to signal modestly above-target inflation. What's interesting is that the main inflationary impetus is now coming from manufacturing rather than services, meaning rates of inflation for costs and selling prices are now somewhat elevated by pre-pandemic standards in both sectors to suggest that the final mile down to the Fed's 2% target still seems elusive.

Growth accelerates in May

US business activity growth accelerated sharply to its fastest for just over two years in May, according to provisional PMI survey data from S&P Global, signaling an improved economic performance midway through the second quarter. The service sector led the upturn, reporting the largest output rise for a year, but manufacturing also showed stronger growth.

The headline S&P Global Flash US PMI Composite Output Index rose sharply from 51.3 in April to 54.4 in May, its highest since April 2022. The 3.1 index point rise (the largest gain for 15 months) signals a marked acceleration of growth midway through the second quarter. Output has now risen continually for 16 consecutive months, with May's acceleration contrasting with the slowdown seen in March and April.

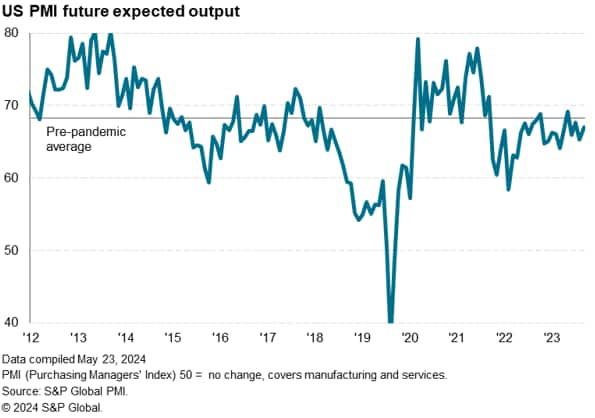

Optimism constrained by uncertainty

Optimism about output in the year ahead lifted higher in both manufacturing and services in response to brighter business prospects, the latter in turn often linked to expansion plans, new products and increased marketing. Customers were also reported to have likewise become more optimistic.

However, although future output expectations improved from April's five-month low, levels of confidence remained below long-run averages in both sectors. Companies continued to report uncertainty about the economic outlook given the possibility of higher-for-longer interest rates, upcoming elections, and wider geopolitical uncertainties.

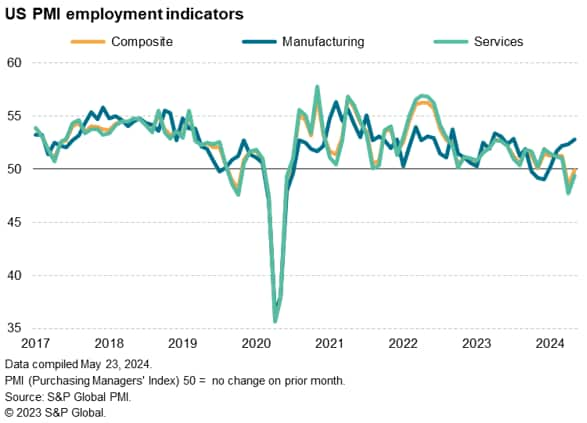

Employment trends diverge

Employment fell for a second successive month in May, contrasting with the continual hiring trend seen over the prior 45 months. The overall reduction in workforce numbers was only very marginal, however, and less than witnessed in April, as an upturn in manufacturing payrolls was accompanied by a slower rate of job shedding in services.

While factory jobs grew at the fastest rate for ten months in May, buoyed by rising order books and improved business prospects, services employment has now fallen for two successive months, albeit in part due to staff shortages.

Prices rise as inflation focus moves back to manufacturing

Input prices continued to rise sharply in May, with the rate of inflation accelerating to register the second-largest monthly increase seen over the past eight months. Manufacturers reported an especially steep increase, suffering the largest cost rise for one-and-a-half years amid reports of higher supplier prices for a wide variety of inputs, including metals, chemicals, plastics, and timber-based products, as well as higher energy and labor costs.

Service sector costs also rose at an increased rate, reflecting higher staffing costs in particular. However, the past two months have seen manufacturing input costs rise at a faster rate than service sector costs, contrasting with the trend of services leading price growth in the prior months since mid-2022.

Companies again sought to pass higher costs onto customers in the form of higher selling prices, the rate of increase of which accelerated slightly compared to April. However, although still elevated by pre-pandemic standards, the rate of inflation across both goods and services remained below the average recorded over the past year.

The PMI's selling price index provides a useful insight into inflation trends in the coming months, tending to act with a lead on consumer price data. The current reading of the index, at 54.1, is only modestly above the pre-pandemic average of 52.3 - a period in which CPI inflation average 1.8%. A simple statistical comparison suggests the May index value of 54.1 is roughly indicative of CPI annual inflation of 2.6%.

Access the full press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.