Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 17, 2021

Week Ahead Economic Preview: Week of 21 June 2021

The following is an extract from IHS Markit's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

Flash PMIs will be released in the coming week for the US, UK, eurozone, Japan and Australia. The surveys will offer a first look for worldwide economic conditions in June, and will be followed by central bank meetings in the UK, Philippines and Thailand. Some key economic releases, such as the final US GDP and PCE data, plus June eurozone consumer confidence, are also lined up.

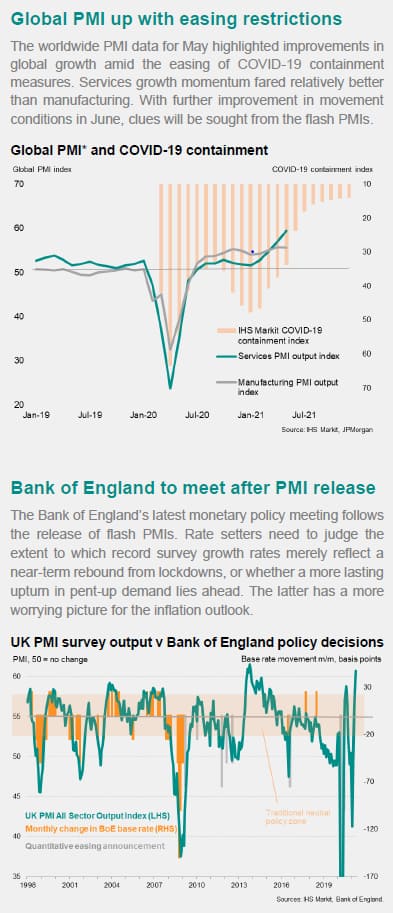

Divergences in performance were a key theme shining through in the May global PMI data releases, with record US and UK growth and a reviving eurozone contrasting with a renewed downturn in Japan. This was no surprise, given the wave of COVID-19 cases seen in various APAC countries while the US and Europe enjoyed an easing of containment measures.

We'll be looking to see if this divergence has widened, and also whether demand is switching from goods to services as economies open up. Supply constraints will also be closely scrutinised, both in terms of whether companies are reporting further labour and raw material shortages, which have shown signs of curbing output and driving prices higher.

Commodity prices have been in firm focus in June. While certain raw materials such as copper saw prices ease following reports of China's scrutiny, crude oil prices have touched fresh multi-year highs, adding to concerns on factory gate inflation. For the likes of the US especially, what the flash PMIs have to say about economic conditions and the uncertain inflation story, which the Fed just alluded to, will be key.

Contact us

PMI commentary: Chris Williamson, Jingyi Pan

Europe commentary: Ken Wattret

APAC commentary: Rajiv Biswas

© 2021, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-21-june-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-21-june-2021.html&text=Week+Ahead+Economic+Preview%3a+Week+of+21+June+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-21-june-2021.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 21 June 2021 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-21-june-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+21+June+2021+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-21-june-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}