Week Ahead Economic Preview: Week of 13 May 2024

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

US CPI, UK labour report and China activity data in focus

A busy economic calendar is anticipated with the highlight being US CPI data, though key economic activity data out of the US and mainland China, UK labour market statistics and Japan's first quarter are all set to be eagerly assessed by the markets. Additionally, US investor sentiment will be assessed with the release of the results from the May S&P Global Investment Manager survey.

An inflation updated in the form of CPI data out of the US will be the most heavily anticipated economic release of the week, as the attention remains centred on the Fed's FOMC and its wide-reaching influence on global interest rates. Early PMI data releases have hinted at US inflation slightly easing into the start of the second quarter of 2024 which, alongside recent indications of a slowdown in US hiring and wage growth, have helped to boost market sentiment. That said, official confirmation of the inflation trend via the CPI will still be key in bolstering confidence for the lowering of interest rates. Other US economic updates, including US retail sales and industrial production data, will also be assessed through the week for insights into economic growth momentum in April and therefore provide new Q2 nowcasting inputs.

Meanwhile, whether the old adage of "sell in May and go away" continues to sway markets will be reviewed with the S&P Global Investment Manager Index (IMI). Whether confidence levels in the US equity market have improved post the positive Q1 earnings showings so far will be keenly tracked.

Labour market updates in the UK will also be important steers to UK rates after the Bank of England held rates steady at its latest monetary policy meeting but raised prospects of a summer rate cut. However, any such move would be 'evidence based', ensuring the coming week's labour market and inflation data will be hotly awaited.

In APAC, mainland China's retail sales and industrial production figures will be in focus, with Caixin PMI surveys having revealed improvements in the Chinese economy at the start of Q2. Japan's Q1 GDP will also be updated. This comes after the au Jibun Bank Japan PMI showed a sustained expansion of the Japanese economy in Q1 and further acceleration in growth momentum at the start of Q2.Diverging service sector cost growth

The Bank of England was the latest central bank to make a statement on monetary policy last week and, in a continuation to the trend seen in recent months among the major central banks, it stressed that any upcoming policy decisions remained 'evidence based', or data dependent. Key to this data dependency is the future path of service sector inflation.

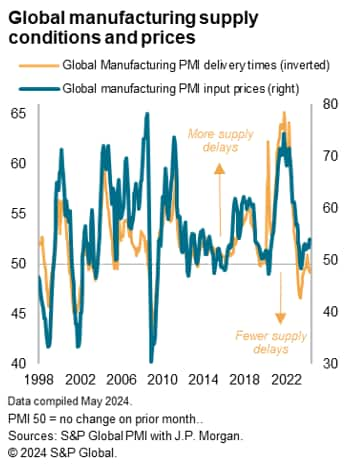

While oil prices pose a threat, central banks are more influenced by 'core' inflation excluding energy. In this respect, a recent improvement in global supplier delivery times bodes well for core goods price inflation to not present any hurdles to rate cuts in Europe and the US over the coming months.

For the service sector, the picture is more varied. Service sector prices tend to be principally driven by wage costs, and the tightness of the labour markets in the US and Europe have led to strong wage growth that has in turn kept service sector inflation high in April according to the PMI surveys. To gauge just how elevated these service sector price gauges are by historical standard, we compare current levels with their pre-pandemic ten-year averages. These comparisons show the US PMI's service sector inflation index - a diffusion index which varies around the no change level of 50 - is running 1.3 points higher than its pre-pandemic average. However, this rises to 6.1 and 5.0 points in the eurozone and UK respectively. In Spain, the figure rises to 10.4 points.

These data therefore suggest that the European central banks have a greater problem with sticky service sector inflation than the Fed.

Key diary events

Monday 13 May

Australia NAB Business Confidence (Apr)

India Inflation (Apr)

Germany Current Account (Mar)

Germany HCOB Export Conditions Index* (Apr)

Canada Building Permits (Mar)

Brazil Business Confidence (May)

GEP Global Supply Chain Volatility Index* (May)

Tuesday 14 May

Japan PPI (Apr)

Germany Inflation (Apr, final)

United Kingdom Labour Market Report (Mar)

India WPI (Apr)

Eurozone ZEW Economic Sentiment Index (May)

Germany ZEW Economic Sentiment Index (May)

United States PPI (Apr)

S&P Global Investment Manager Index* (May)

Wednesday 15 May

Hong Kong SAR, South Korea Market Holiday

Australia Wage Price Index (Q1)

China (Mainland) 1-Year MLF Announcement

Thailand GDP (Q1)

Indonesia Trade (Apr)

France Inflation (Apr, final)

Eurozone Employment Change (Q1)

Eurozone GDP (Q1, 2nd est.)

Eurozone Industrial Production (Mar)

United States CPI (Apr)

United States Retail Sales (Apr)

United States Business Inventories (Apr)

Thursday 16 May

Japan GDP (Q1, prelim)

Australia Employment (Apr)

Philippines BSP Interest Rate Decision

Italy Inflation (Apr, final)

United States Building Permits (Apr, prelim)

United States Housing Starts (Apr)

United States Industrial Production (Apr)

Friday 17 May

Norway Market Holiday

South Korea Unemployment (Apr)

Singapore Non-oil Domestic Exports (Apr)

China (Mainland) House Price Index (Apr)

China (Mainland) Industrial Production, Retail Sales, Fixed Asset

Investment, FDI (Apr)

Malaysia GDP (Q1)

Japan Industrial Production (Mar, final)

France Unemployment (Q1)

Hong Kong SAR GDP (Q1, final)

Eurozone Inflation (Apr, final)

Canada New Housing Price Index (Apr)

United States CB Leading Index (Apr)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

What to watch in the coming week

Americas: US inflation, retail sales, industrial production, building permits data

The highlight of the week will be US inflation figures midweek with the focus on the trend for CPI after a higher-than-expected March CPI dampened rate cut hopes ahead of the May Fed meeting. Latest S&P Global US PMI data indicated that inflation eased in April after rising over March and the official confirmation will be awaited with the CPI data.

Additionally, US activity data such as retail sales and industrial production numbers are anticipated through the week. Early insights from PMI data showed US manufacturing production growth decelerated amidst lower new business. That said, retail sales may well reflect the improvements in consumer sectors that were observed in the US sector PMI data.

EMEA: UK labour data, Eurozone inflation, German ZEW index

The UK releases updated labour market data with the consensus pointing to an unchanged level of unemployment rate in March, in line with the PMI signal of steady employment conditions. More recent KPMG and REC UK Report on Jobs meanwhile revealed that permanent placements fell in April, albeit with faster pay growth aligned in part to the new minimum wage.

Additionally, final April inflation data will be due from the eurozone alongside industrial production numbers.

APAC: China activity data, Japan GDP and India inflation

A busy economic calendar in APAC culminates in a series of activity data due from mainland China on Friday. This includes retail sales and industrial production figures. According to the latest Caixin PMI data, mainland China's manufacturing output and services new business both expanded at the fastest rates since May 2023, hinting at improvements in official economic indicators.

Separately, GDP data will be due from Japan and various other Asian economies in the week. According to market expectations, the Japanese economy is set to show steady growth in the first quarter, with the latest au Jibun Bank Japan PMI further alluding to an acceleration in growth pace at the start of the second quarter of 2024.

S&P Global IMI survey and GEP supply chain volatility

The May S&P Global Investment Manager Index provides a unique lens to US investors' sentiment, sector preferences and key drivers for equities, due Tuesday.

The GEP Global Supply Chain Volatility Index will also provide detailed insights into global supply conditions in April.

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.