Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

May 05, 2021

Variants rise in factor style performance

Research Signals - April 2021

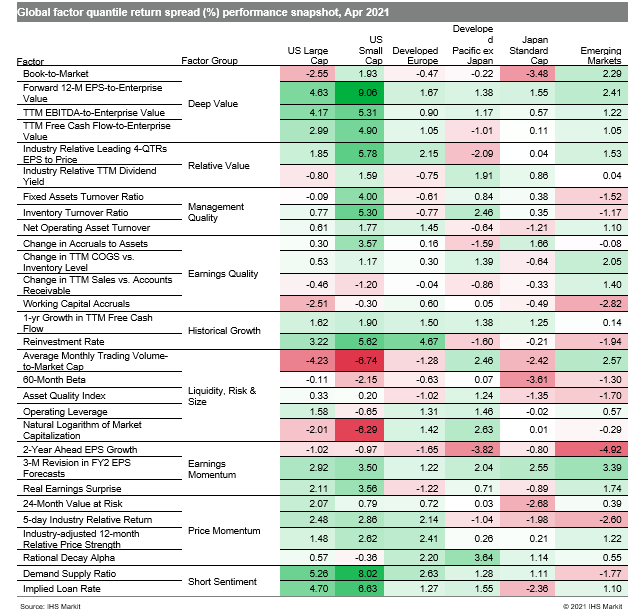

Global stocks continue to press forward, with several countries reaching new record highs. Equity markets are supported by an improved economic outlook including that captured by an accelerated upturn in manufacturing activity at the quickest pace in over a decade, according to the J.P.Morgan Global Manufacturing PMI. However, cost inflationary pressures also remain strong and inconsistencies are seen regionally in combating coronavirus cases and its variants, raising some concerns about the fragility of the recovery. As such, variations in factor style performance across regions were also observed in April (Table 1).

- US: Traders took cues from the securities lending market, as Demand Supply Ratio ascended to the top spot in factor performance among large caps

- Developed Europe: Investors favored high quality firms and those with positive earnings revisions, as gauged respectively by Net Operating Asset Turnover and 3-M Revision in FY2 EPS Forecasts

- Developed Pacific: Price Momentum measures such as Rational Decay Alpha outperformed in Japan, displacing value's four-month string as a leading style

- Emerging markets: 3-M Revision in FY2 EPS Forecasts was a positive signal, while 2-Year Ahead EPS Growth underperformed

Table 1

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvariants-rise-in-factor-style-performance.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvariants-rise-in-factor-style-performance.html&text=Variants+rise+in+factor+style+performance+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvariants-rise-in-factor-style-performance.html","enabled":true},{"name":"email","url":"?subject=Variants rise in factor style performance | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvariants-rise-in-factor-style-performance.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Variants+rise+in+factor+style+performance+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvariants-rise-in-factor-style-performance.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}