Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 06, 2021

Daily Global Market Summary - 6 May 2021

All major European equity markets closed higher for a second day, while US and APAC markets closed mixed. US government bonds were close to flat on the day and benchmark European government bonds closed mixed. European iTraxx closed slightly wider across IG and high yield, while CDX-NA indices were close to unchanged on the day. Gold, copper, and silver closed higher, while the US dollar, oil, and natural gas were lower. All eyes will be on tomorrow morning's US non-farm payroll report, as the consensus estimate is for a significant one million new jobs added in April.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

- Most major US equity indices closed higher except for the Russell 2000 closing flat; DJIA +0.9% (new record close), S&P 500 +0.8%, and Nasdaq +0.4%.

- 10yr US govt bonds closed -1bp/1.57% yield and 30yr bonds flat/2.24% yield.

- CDX-NAIG closed flat/51bps and CDX-NAHY +1bp/290bps.

- DXY US dollar index closed -0.4%/90.95.

- Copper closed +1.7%/$4.60 per pound, which is a new all time high close.

- Gold closed +1.8%/$1,816 per troy oz and silver +3.6%/$27.48 per troy oz.

- Crude oil closed -1.4%/$64.71 per barrel and natural gas closed -0.3%/$2.93 per mmbtu.

- US seasonally adjusted (SA) initial claims for unemployment

insurance fell by 92,000 to 498,000 in the week ended 1 May, its

lowest level since 14 March 2020. The previous week's level was

revised up by 37,000 to 590,000. With one-third of the total

population fully vaccinated and a falling tally of new daily

infections, states are accelerating their reopening plans, giving a

boost to the labor market. (IHS Markit Economist Akshat Goel)

- Seasonally adjusted continuing claims (in regular state programs), which lag initial claims by a week, rose by 37,000 to 3,690,000 in the week ended 24 April. The insured unemployment rate remained at 2.7%.

- In the week ended 17 April, continuing claims for Pandemic Emergency Unemployment Compensation (PEUC) fell by 221,592 to 4,972,507.

- There were 101,214 unadjusted initial claims for Pandemic Unemployment Assistance (PUA) in the week ended 1 May. In the week ended 17 April, continuing claims for PUA fell by 112,204 to 6,862,705.

- The Department of Labor provides the total number of claims for benefits under all its programs with a two-week lag. In the week ended 17 April, the unadjusted total fell by 404,509 to 16,157,024.

- US productivity (output per hour) rebounded in the first

quarter, more than reversing a sharp decline in the fourth quarter

that followed a surge over the prior two quarters related to

disruptions stemming from the pandemic. (IHS Markit Economists Ken

Matheny and Lawrence Nelson)

- Hours rose in the first quarter, while compensation per hour posted a robust increase. Unit labor costs edged lower in the first quarter.

- Relative to the fourth quarter of 2019, the last quarter not affected by the COVID-19 pandemic, productivity is up 3.9% (3.1% annualized).

- Over the same period, compensation per hour has jumped 8.1% (6.4% annualized) as employment in lower-wage sectors remains more severely impacted by the pandemic than employment in higher-wage sectors.

- Unit labor costs rose 4.0% (3.2% annualized) over the same period, but hours worked declined 4.3% (down 3.5% annualized).

- We expect growth in compensation per hour to moderate eventually as distortions related to the pandemic ease. We expect productivity growth to ease but remain generally healthy amid strong growth in output, with growth in unit labor costs likely to moderate.

- Employers announced 22,913 planned layoffs in April, according

to Challenger, Gray & Christmas—down 25% from March's

30,603. April's total was the lowest monthly reading since June

2000 and a whopping 96.6% lower than the 671,129 cuts announced in

April 2020, the highest monthly reading on record. (IHS Markit

Economist Juan

Turcios)

- April marked the 14th month to report job-cut announcements specifically because of COVID-19. So far this year employers have cited COVID-19 as a reason for 6,922 planned job cuts. Employers have cited other reasons including market conditions (47,847), demand downturn (39,108), closing (25,903), restructuring (21,157), and acquisition/merger (9,235) more frequently than COVID-19 as causes of job cut announcements this year.

- Job hiring plans are also down from the pandemic highs of last year. So far in 2021 employers have announced plans to add 392,578 jobs, down 68% from the 1,221,680 announced through the same time last year. The robust hiring announcements last year reflected a surge in hiring in grocers, delivery apps, food chains, and warehouses as employers dealt with a pandemic-driven increase in demand for online shopping.

- Aerospace/defense has announced 32,006 job cuts so far this year, the highest number of any industry. Job cut announcements have not been led by either the entertainment/leisure or transportation sectors in any month this year.

- Rounding out the five sectors that have announced the most job cuts this year are telecommunications (24,639), services (15,193), retail (12,541), and entertainment/leisure (11,149).

- DuPont reported first-quarter income from continuing operations

of $573 million, reversing a year-ago loss of $456 million. Net

sales were $4 billion, up 8% year on year (YOY). Strong earnings

performance in the electronics and industrial, and mobility and

materials segments more than offset slight earnings decline water

and protection. (IHS Markit Chemical Advisory)

- Electronics and industrial segment net sales for the first quarter were $1.3 billion, up 14% YOY. Segment operating EBITDA was $436 million, up 33% YOY. Semiconductor and smartphones drove top-line growth and strong volume growth and a gain on an asset divestiture drove earnings improvement. Segment volume was up 15% YOY.

- Water and protection segment revenue was up 1% YOY, to $1.3 billion. Segment operating EBITDA fell 1% to $355 million. Strong demand for water technologies and ongoing strength in residential construction was partially offset by weakness in aerospace. Segment volume was up 1% YOY.

- Mobility and materials segment sales were $1.2 billion, up 8% YOY. Segment operating EBITDA was $278 million, up 29% YOY. Automotive recovery drove double-digit growth for resins and strong demand for specialized pastes and adhesives. DuPont said demand was strong for engineered polymers, which include nylon and thermoplastic polyester, but global supply constraints for key raw materials resulted in low-single digit volume declines for that product line.

- General Motors (GM) has reported its financial results for the first quarter, including strong revenues and EBIT despite the ongoing challenges of the semiconductor shortage and coronavirus disease 2019 (COVID-19)-pandemic-related protocols. However, many metrics showed a large year-on-year (y/y) drop in the first quarter of 2020, as the impact of the COVID-19 pandemic started then, and in the first quarter of 2021, GM's income increased sharply y/y. GM's adjusted EBIT increased 253.4% y/y to USD4.4 billion. However, GM's net revenue declined 0.7% y/y to USD32.4 billion and wholesale deliveries declined 15% y/y. There are similarities between the situations in 2020 and 2021, as GM expects to see the worst of the semiconductor shortage in the second quarter of 2021 and an improvement in the second half, which is how the COVID-19 pandemic played out for GM's performance in 2020. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Uber reported a narrowed net loss of USD108 million in the first quarter of 2021, compared with USD2,936 million in the same period of 2020. The company's revenues shrank to USD2.90 billion in the first quarter, a decrease of 10.6% year on year (y/y). The fall in revenues was the result of a decline in the number of monthly active users across rides, bike shares, and food deliveries, to 98 million, down from 103 million a year earlier. Gross bookings, a number used to track customer demand, increased 23.8% y/y to USD19.54 billion. Uber's core business, ride hailing, posted a decline in its revenues of 65.4% y/y to USD853 million. Meanwhile, revenues at its food delivery business, Uber Eats, rose 230.4% y/y to USD1.74 billion in the first quarter. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- SAE International has collaborated with the International Organization for Standardization (ISO) to update levels of automation, in an attempt to better define and group the capabilities of autonomous technology. The six levels, established by SAE International in 2014, describe the capabilities of vehicle autonomy; levels vary from 0, which stands for no driving automation, to 5, which signifies full automation. The update involves improving clarity on the differences between Level 3 and Level 4, grouped under the J3016 automation requirements. It clarifies the role of fallback-enabled users, the potential for automatic fallback at Level 3, and the possibility for alerting in-vehicle users at Level 4. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- At its 5 May policy meeting, the Central Bank of Brazil (Banco

Central do Brasil: BCB) increased the policy rate from 2.75% to

3.5%, in response to high inflation that had reached 6.2% as of

mid-April. The BCB targets inflation at 3.75% +/- 1.5 percentage

points this year. (IHS Markit Economist Rafael

Amiel)

- The central bank raised the rate, by 75 basis points, on 17 March from an all-time low of 2.0% and had announced a similar increase for its May meeting, so the move comes as no surprise.

- Higher commodity prices and food prices continue to push inflation up, which has consistently increased since May 2020, when it amounted to a low of 1.8%. Despite higher agricultural output during 2020, food prices increased substantially because of disruption in the distribution channels.

- In recent months, increasing energy prices in international markets are also putting upward pressure on electricity tariffs and on the prices of gasoline (petrol), ethanol, and propane gas (distributed in cylinders) and transportation costs.

- Core inflation, which excludes items with high price volatility such as agricultural products and energy-related goods, amounted to 3.1% at the end of the 12-month period ending March 2021. Inflation in services is relatively low because of lockdowns and other restrictive measures imposed as a result of the COVID-19 virus pandemic.

Europe/Middle East/Africa

- All major European equity indices closed higher for a second consecutive day; UK +0.5%, France +0.3%, Germany +0.2%, Spain +0.2%, and Italy +0.1%.

- 10yr European govt bonds closed mixed; UK -3bps, Germany flat, France/Spain +1bp, and Italy +2bps.

- iTraxx-Europe closed +1bp/51bps and iTraxx-Xover +3bps/254bps.

- Britvic plc has bought plant-based drinks brand Plenish for an undisclosed sum. Plenish, founded in 2012, is one of the UK's fastest growing plant-based drinks brands. It produces a range of organic drinks including plant-based milks and cold-pressed juices. Plant-based drinks are among the fastest growing food segments, with companies including PepsiCo and Coca-Cola expanding into the sector in recent years. Plant-based milks, especially, are growing in popularity rapidly, with retail sales set to reach more than GBP500 million (USD) by 2024. Sales of non-soya plant-based milks have grown more than tenfold in the last 10 years. (IHS Markit Food and Agricultural Commodities' Neil Murray)

- The 3.6 GW Dogger Farm offshore wind farm, in the United Kingdom, has revealed that it will feature an unmanned 1.2 GW high-voltage direct current (HVDC) offshore substation. The first substation will be installed at the Dogger Bank A site in 2023, and will be the largest HVDC substation once installed, up from the current industry benchmark of 0.8 GW. The wind farm is located more than 130 kilometers from shore. Such platforms would typically have living quarters and other attendant features. However the development's joint-venture partners SSE Renewables, Equinor, and Eni, worked together with platform manufacturer Aibel to reduce up to 70 percent of the weight by designing an unmanned platform, thereby removing the need for living quarters, a helideck, and sewage systems. This will be the first unmanned offshore HVDC substation in the world. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- A northern European power generator is eyeing a roll out of hydrogen and electric vehicle (EV) charging stations to meet UK zero-emissions vehicle (ZEV) demand. Swedish utility Vattenfall, which already operates EV stations in continental Europe, agreed to explore supplying an EV charging and hydrogen filling station package for fleet owners alongside British electric truck manufacturer Tevva, according to a 23 April statement. Tevva is present in the UK electric truck market, three years ago providing package delivery and logistics giant UPS with hybrid electric and diesel vehicles to operate on electric power only while in urban areas, such as a planned clean air zone in Birmingham. It has rapidly moved on from a 2015 prototype phase under the wing of UK government research agency Innovate UK. Tevva's latest move anticipates a partial diesel vehicle ban in the next decade. The UK government in November announced it would ban certain gasoline and diesel van and car sales in 2030, bringing forward an earlier 2035 target. Hybrid cars that use these fuels can be sold until 2035. (IHS Markit Climate and Sustainability News' Cristina Brooks)

- The German passenger car market posted a 90% y/y increase in registrations in April to 229,650 units. This is of course the result of the very low April 2020 base comparison when the worst impact of the initial COVID-19 pandemic lockdown measures were being felt in the German market, in similar fashion to other Western European markets. However, a more accurate comparison is the 310,715 units the market recorded in April 2019. (IHS AutoIntelligence's Tim Urquhart)

- Technip Energies has announced the launch of BlueH2 by T.ENTM,

its full suite of deeply-decarbonized and affordable solutions for

hydrogen production. This new technology offers several advantages,

such as (IHS Markit Upstream Costs and Technology's William

Cunningham):

- Up to a 99% reduction in the carbon footprint compared to the traditional hydrogen process—from ~10 down to 0.1 kilogram CO2 per kilogram H2, while maintaining flexibility to be tailored to each individual application.

- Maximum hydrogen yield, minimum energy demand (fuel + power), and highly-efficient carbon avoidance and carbon capture utilization and storage (CCUS) techniques, to arrive at the lowest cost of (blue) hydrogen "LCOH".

- Comprised of proven, company-developed and owned technologies and equipment, available to customers today.

- Optional integration of highly efficient, low-carbon cogeneration of power.

- Leading wind farm developer Orsted has stated in its quarterly financial reporting conference call that it has set aside a provisional sum of up to USD484 million (EUR403 million) for repairs to cable protection systems (CPS) and array cables for up to 10 of its wind farms. The company revealed that the movement of the CPS across the scour protection rocks placed around the foundations at the seabed caused the abrasion of the CPS and in some cases the eventual failure of the cables being protected. As a remediation measure, Orsted will, in the first phase in 2021, stabilize the existing undamaged CPS by adding another layer of rock protection. In the second phase, damaged inter-array cables will be replaced or repaired in 2022 and 2023. As the installation method that led to the CPS and cable failure had been in use for several years, and was adopted industry-wide at the time of construction, Orsted estimates that up to 10 of its offshore wind farms could be affected. The incident was first discovered during an inspection campaign at the Race Bank offshore wind farm in the United Kingdom. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- At its session on 5 May, Poland's Monetary Policy Council (MPC)

kept the policy interest rate stable at a historic low of 0.1%,

where it has stood since May 2020. Rates were held steady despite a

jump in consumer price inflation to a 13-month high of 4.3% year on

year (y/y) in April. (IHS Markit Economist Sharon

Fisher)

- Inflation was driven by soaring fuel costs, while food prices rose at the fastest pace in five months. According to the NBP, the rising cost of operating a business during the pandemic (including higher transport costs and supply-chain disruptions) has also added to inflation, threatening to keep price growth above the 1.5-3.5% target band during the coming months.

- Inflation increased in April despite a stronger zloty, which rose by 0.7% month on month (m/m), to an average of PLN4.57/EUR1.00. In a y/y comparison, the zloty was down by 0.5%, the smallest drop since February 2020.

- Egypt's Prime Minister Mostafa Madbouly announced on 28 April a

new round of reform plans, the National Structural Reform Programme

(NSRP), from the fiscal year that begins in July 2021. (IHS Markit

Economists Yasmine Ghozzi and Jack

Kennedy)

- The headline goal of the program was to achieve annual economic growth of 6-7% over the next three years.

- The three-year program of structural reforms builds on the 2016 International Monetary Fund (IMF)-backed monetary and fiscal measures and focuses on three sectors - manufacturing, agriculture, and telecommunications and information technology - as well as support for the growth of the private sector. The new wave of reforms is not expected to add any additional burdens on citizens.

- In May 2020, Egypt submitted a request to the IMF to obtain a loan worth USD5.2 billion, under the stand-by agreement (SBA) program to back its structural reform program as COVID-19 exerted pressure on Egypt's finances. So far, Egypt has received two tranches of the loan, worth USD3.6 billion, and it is expected to get the third tranche in June 2021 after completing the final review of the loan program, which will be conducted by the IMF in May.

- IHS Markit considers it unlikely that at current levels the Egyptian government will achieve the stated goal of 6-7% annual economic growth over the next three years.

- IHS Markit assesses that the key stated driver of economic growth for the program, the Egyptian private sector, will face hurdles in light of heavy state involvement.

Asia-Pacific

- APAC equity markets closed mixed; Japan +1.8%, South Korea +1.0%, Hong Kong +0.8%, India +0.6%, Mainland China -0.2%, and Australia -0.5%.

- Chinese wholesale pork prices have fallen for 13 straight weeks and now stand at the lowest level since August 2019. Average prices in the final week of April fell to CNY30.84 per kg (USD4.77/kg) - down by a further 2% w/w, according to data from the Chinese Commerce Ministry. Prices have now fallen by 36% since the middle of January as a result of increased supplies and lower demand. Figures from the Chinese Agriculture Ministry show that live pig prices fell to CNY23.64 per kilogram in the third week of April, down 3.5% m/m and 30.6% y/y. The fall in partly down to a seasonal drop in demand but has also been linked to a rise in the number of animals being sent to market by farmers who fear a resurgence of African Swine Fever. (IHS Markit Food and Agricultural Commodities' Max Green)

- Siemens Gamesa has signed a new preferred supplier agreement (PSA) for the Hai Long 2B and 3 projects in Taiwan. The PSA covers the supply and servicing of Siemen Gamesa's flagship SG 14-222 DD offshore wind turbines for the combined project capacity of 744 MW. A previous agreement was signed in 2019 with consortium partners, Canadian independent power producer Northland Power Inc. and Taiwan-based developer Yushan Energy, for the 300 MW Hai Long 2A for the same wind turbines. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- Tesla is developing a platform that will allow its customers in China to access the data generated by their cars, according to Reuters. The company aims to introduce the data platform this year. The announcement comes after an angry Tesla customer complained about the malfunctioning of brakes and raised a protest at the Shanghai Motor Show 2021. The automaker is said to have now provided the data related to the brake incident to the customer, complying with the local authorities' order. Making the data accessible is likely to help Tesla regain consumer confidence about the quality and performance of its vehicles. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Nissan has announced in a press release that it has sold its entire 1.54% stake in Daimler AG, equivalent to 16.4 million shares. The automaker sold the shares through an accelerated bookbuild offering at a price of EUR69.85 (USD83.80) per share, translating to gross proceeds of approximately EUR1.149 billion. The proceeds from the sale will be used to further strengthen the automaker's business competitiveness, including investments to promote electrification. (IHS Markit AutoIntelligence's Isha Sharma)

- Reserve Bank of India (RBI) governor Shaktikanta Das made an

unscheduled speech on 5 May 2021 in which he announced a number of

schemes to support the banking sector and bank customers. (IHS

Markit Banking Risk's Deepa

Kumar, Angus

Lam, and

Hanna Luchnikava-Schorsch)

- The RBI has reclassified COVID-19-virus-related industries (such as vaccine manufacturers and oxygen and ventilator suppliers) as well as lending to micro-finance institutions for the purpose of on-lending to individuals as priority sectors. It has also introduced a liquidity facility of INR500 billion (USD6.8 billion) with a tenor of three years until March 2022 to boost bank lending to these areas.

- MSME borrowers with gross loans of INR250 million will be eligible to apply for loan restructuring by September 2021 (and implement the restructuring by the end of 2021), provided that the MSMEs have not used the facilities before. At the same time, borrowers who have already exercised the loan restructuring right will be eligible to extend the loan repayment period to the same maximum two years.

- The RBI's ability to use conventional monetary policy tools may be more limited in the current crisis compared with 2020. Between February and June 2020, the RBI cut its policy repurchase rate three times by a cumulative 115 basis points and has since maintained the accommodative policy stance, thanks in part to the space created by lower inflation. However, inflation has started rising quickly in 2021, responding to the surge in global commodity prices.

- Our assessment of the loan restructuring scheme remains the same - it is likely to simply delay the bad loan problem in the medium term by hiding the amount of bad loans.

- The Competition Commission of India (CCI) has ordered an anti-trust investigation into allegations that Tata Motors has abused its market position to supply commercial vehicles (CVs) to some of its dealers, reports Reuters. According to the allegations, which have been filed by former dealers of the company, Tata Motors dictated the terms and conditions relating to the quantity as well as the type of vehicles the dealers should stock, as well as working together with affiliate firms while advancing credit. (IHS Markit AutoIntelligence's Tarun Thakur)

- The Indonesian economy contracted by 0.74% year on year (y/y)

in the first quarter, an improvement from the previous quarter's

contraction, supported by ramped-up government spending, a stronger

recovery in fixed investment, and healthy exports. Further

significant economic recovery will be dependent on private

consumption. However, if consumer inflation and labor market data

are any indication, households are not yet ready to carry the

economy. (IHS Markit Economist Bree

Neff)

- Earlier this week, the government announced that PEN spending through 30 April 2021 reached 22.3% of its IDR699.4-trillion (USD48.4 billion) 2021 budget, with spending on corporate support programs, business incentives, and social assistance programs accounting for much of the spending.

- Fixed investment activity also beat expectations during the first quarter, with real (inflation-adjusted) spending on machinery and equipment and transportation both returning to year-on-year (y/y) growth.

- Building activity remained subdued, contracting 0.7% y/y as costly and labor-intensive construction projects likely faced delays.

- Private consumption spending on food and beverages weakened further, contracting 2.3% y/y in the first quarter of 2021, down from a 1.4% y/y decrease in the fourth quarter of 2020.

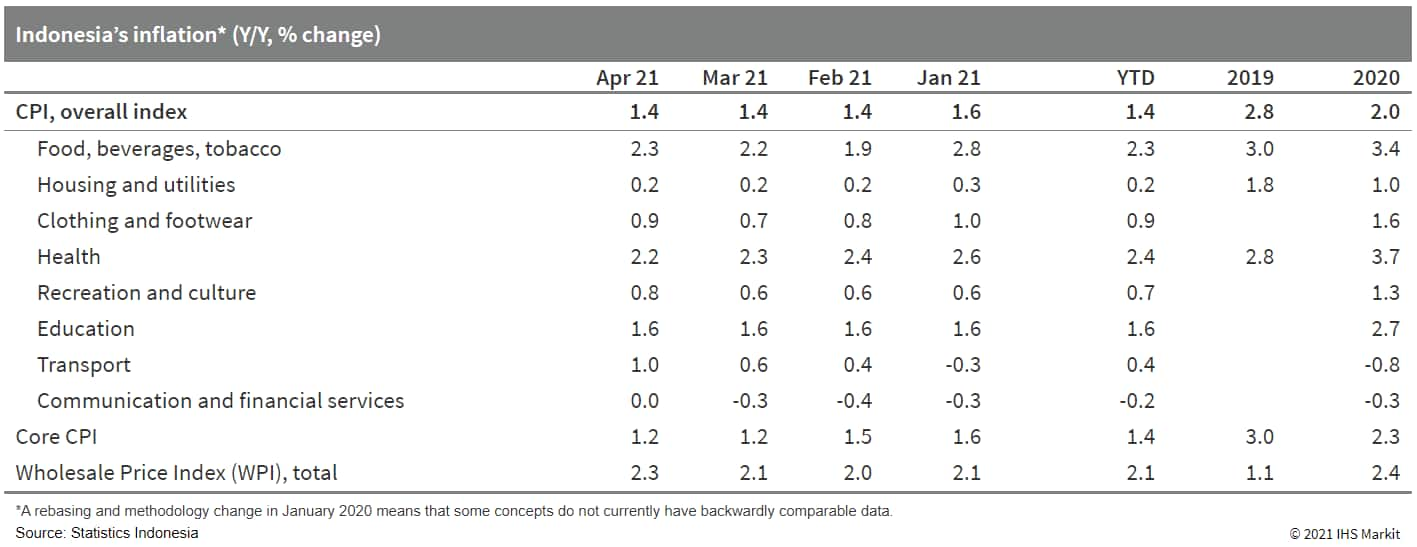

- Headline consumer price inflation remained steady at 1.4% y/y

for a third consecutive month in April, according to Statistics

Indonesia.

- New Zealand's seasonally adjusted unemployment rate was 4.7% for the March (first) quarter of 2021, according to Statistics New Zealand (SNZ), dropping 0.2 percentage point quarter on quarter (q/q) and continuing to fall from the peak recorded during the September 2020 quarter. However, the unemployment rate is still 0.4 percentage point higher than it was during the same period last year, and remains above any pre-pandemic level seen since the June quarter of 2017. (IHS Markit Economist Andrew Vogel)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-6-may-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-6-may-2021.html&text=Daily+Global+Market+Summary+-+6+May+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-6-may-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 6 May 2021 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-6-may-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+6+May+2021+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-6-may-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}