Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jul 31, 2023

US Weekly Economic Commentary: Headed for a soft landing?

Key releases last weak teased the prospect of continued strong growth, tight labor markets, and easing inflation. Can the elusive soft landing be achieved?

Several indicators came in as good or better than expected and leaned toward supporting strong growth ahead. Second-quarter GDP growth came in above our and consensus expectations, with a mix more favorable to stronger growth in the third quarter than we had been expecting. The profile of the monthly data on personal consumption expenditures (PCE) through June suggested even more momentum heading into the third quarter. Consumer Confidence from the Conference Board in June was up strongly for the second consecutive month to the highest level in 2 years. Two closely watched measures of existing home prices continued solid recoveries in June after a soft patch.

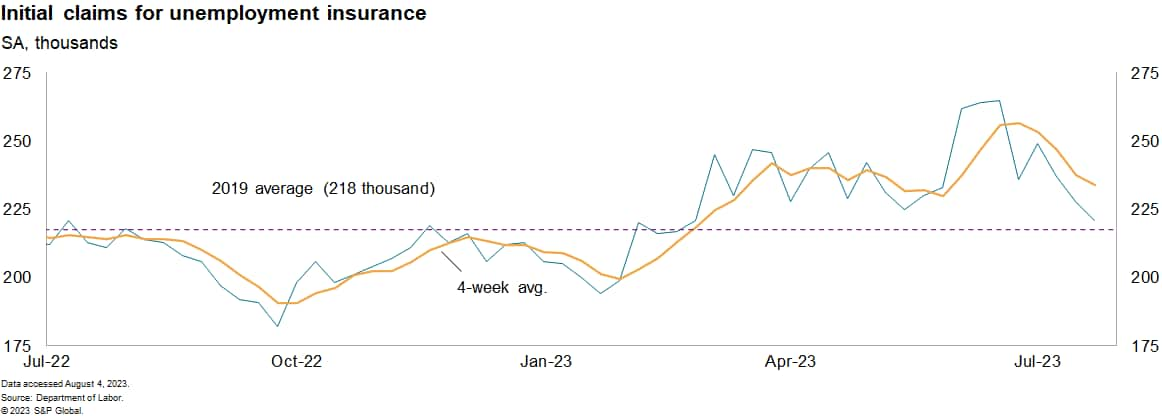

The recent trends in initial and continuing claims for unemployment insurance continue to point to a very tight labor market, a view supported by the report that the Employment Cost Index for private industry workers rose 4.1% (annualized) in the three months through June. While this does represent an easing in the growth of labor costs, it is inconsistent over the medium term with the Fed's 2% inflation target. Wage growth, broadly measured, must slow to around 3½% to allow unit labor cost growth to settle around 2%.

The degree of labor market tightness suggests it may be difficult to achieve further declines in wage growth soon enough to satisfy policymakers at the Fed. Pressure remains to restore real wages eroded during the last couple years of high inflation. As a result, it is likely that continued margin squeezes will encourage businesses to try to push through price increases, and where demand doesn't support it, turn to trimming costs. That complicates the Fed's job of keeping inflation moving down while trying to maintain a strong labor market.

That leaves us continuing to expect one more 25 basis point Fed rate hike. We have it penciled in for November, but given the firmness of economic growth, employment, and wages, a September hike cannot be ruled out.

Missed last week's commentary? Find it here

This week's economic releases:

- Construction (Aug. 1): We estimate nominal construction spending rose 0.2% in June. This would continue what has been a firming trend in recent months that has largely reflected rising spending on private nonresidential structures and, more recently, an upturn in private residential construction spending.

- Light vehicle sales (Aug. 2): We estimate light vehicles sold at a 16.1 million-unit annual rate in July. This would leave them close to recent averages and supportive of the view that firming inventories at automotive dealerships are continuing to prop up sales.

- Manufacturers' shipments, inventories and orders (Aug. 3): We estimate no change in inventories in June.

- Productivity and costs (Aug. 3): We estimate productivity rose at a 2.7% annual rate in the second quarter, while unit labor costs rose at a 2.5% annual rate.

- Employment report (Aug. 4): It will take a further deceleration of wages to support 2% price inflation over the medium term.

Learn more about our economic data and insights

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-weekly-economic-commentary-headed-for-a-soft-landing.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-weekly-economic-commentary-headed-for-a-soft-landing.html&text=US+Weekly+Economic+Commentary%3a+Headed+for+a+soft+landing%3f+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-weekly-economic-commentary-headed-for-a-soft-landing.html","enabled":true},{"name":"email","url":"?subject=US Weekly Economic Commentary: Headed for a soft landing? | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-weekly-economic-commentary-headed-for-a-soft-landing.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+Weekly+Economic+Commentary%3a+Headed+for+a+soft+landing%3f+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-weekly-economic-commentary-headed-for-a-soft-landing.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}