Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 28, 2022

UK tax-cut plan induces short-term pain in debt market, inflation fight

Chancellor of the Exchequer (finance minister) Kwasi Kwarteng has delivered the biggest tax reduction since 1972, which amounts to GBP45 billion, or 1.5%, of GDP.

UK Treasury must borrow an additional GBP72 billion between now and April 2023, or around 3% of nominal GDP. Such borrowing is getting more expensive as central bankers lift interest rates to tame the worst inflation in decades.

The tax cuts, which come on top of a government scheme to assist households and firms with soaring energy prices, will "turn the vicious cycle of stagnation into a virtuous cycle of growth," Kwarteng has said. The government's expectation is that a lower tax burden for corporations and the wealthiest will eventually trickle down into higher wages and rising living standards for the rest of the UK.

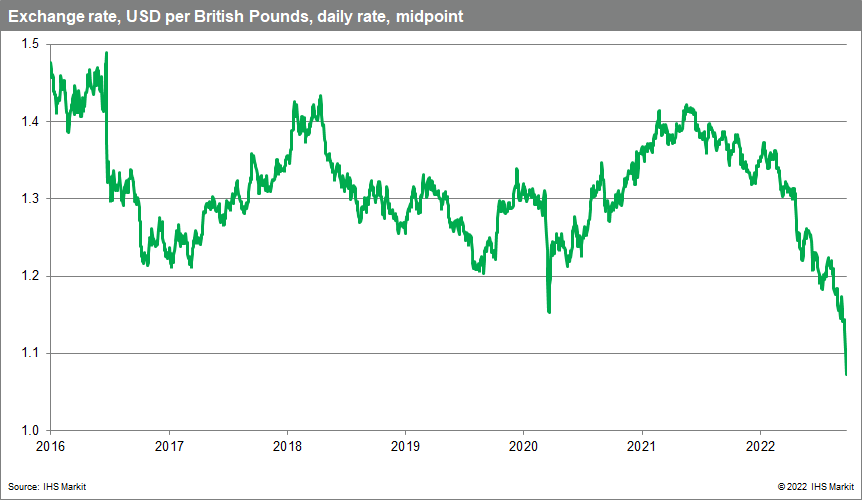

Investors responded to Kwarteng's tax-cut announcement by pummeling the pound and the U.K. bond market, which could have knock-on effects for interest rates, personal consumption, housing, and trade, which is facing significant checks and controls at the formerly frictionless border with the EU.

Our UK forecast is under a comprehensive review. We remain cautious about the UK's trend growth, which we continue to advocate to be around 1.4%. This signals a potential fiscal drag in the medium term. If the growth plan falls to deliver, the government will have to embrace a prolonged period of tax rises and spending cuts to restore fiscal discipline.

In pursuit of growth

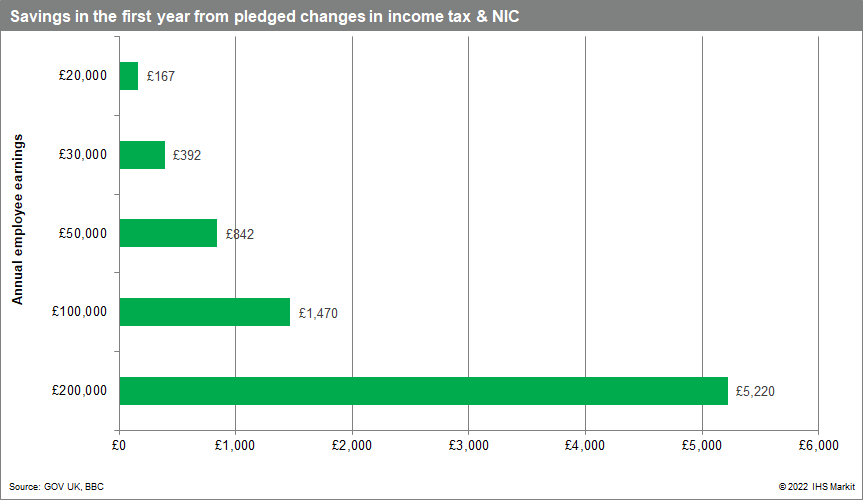

The proposed income tax and NI cuts will assist struggling households and provides support to our assessment that the anticipated recession is likely to end in early 2023. As the further strain comes off household budgets, it will probably result in them spending more on other goods and services.

We have some reservations. The chancellor has not asked its independent forecaster the Office for Budget Responsibility to produce new growth and borrowing forecasts to accompany the plan, which adds to investors' concerns. The proposed tax changes will only provide a limited boost to low-income earners, a missed opportunity given their higher-than-average propensity to consume. The freezing of tax thresholds for several years will hit middle-income earners.

A recent Office for National Statistics survey found that UK firms are not citing tax issues as their biggest concern, suggesting that tax incentives could struggle to accelerate the investment cycle. The latest business surveys suggest that the new rules and regulations that accompany the EU-UK Trade and Cooperation Agreement when exporting to the EU will remain a blight on UK firms in the medium term.

A bumpy road

We expect a bumpy road for the UK's sovereign borrowing costs and the sterling in the months ahead.

The pound fell to a record low of around USD1.08. The sterling has been under accumulating pressure since March, with markets increasingly concerned that eye-watering inflation will throw the UK into recession. Russia's invasion of Ukraine touched off a flight to quality, which favors the US dollar, leading to further pressure on the pound.

Kwarteng's announcement also triggered turmoil in the U.K. bond market. Ten-year borrowing costs reached their highest level since 2011.

The Bank of England (BoE) now faces a bigger task in its own fight against inflation. The central bank may need to send out a stronger signal that it is prepared to do whatever it takes to pull back inflation. This could include an emergency, or an unscheduled, rate hike.

Central bank pressures

We expect the BoE to stick to its scheduled meetings, particularly as it prepares to issue new growth and inflation forecasts in its early November meeting. We also expect a 50-basis-point hike in this November followed by 25-bp rises at the December 2022, February 2023, and March 2023 meetings, taking the Bank Rate to a peak of 3.5%.

The BoE is probably under pressure to deliver a larger hike in its scheduled meeting in November, pointing to a higher peak in early 2023.

Given the turbulence in the bond market, the central bank may face challenges to its plan to reduce the stock of UK government bond purchases, financed by the issuance of central bank reserves, by GBP80 billion (USD90 billion) over the next 12 months.

The U.K. Debt Management Office will have to work harder to place higher issuance in the hands of private investors following the tax cut announcement and will have to rely more on foreign investors. The extra borrowing will pile pressure on the UK's current-account deficit, which widened to a record GBP51.7 billion, or 8.3%, of GDP in the first quarter of 2022.

The inevitable rise in mortgage rates add to struggling UK household finances. Mortgages on variable rates account for around one in five of the 11.1 mortgages in the UK. In addition, they are 3.1 million mortgage holders whose fixed-rate periods expire in 2022-2023.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-taxcut-plan-induces-shortterm-pain-in-debt-market-inflation.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-taxcut-plan-induces-shortterm-pain-in-debt-market-inflation.html&text=UK+tax-cut+plan+induces+short-term+pain+in+debt+market%2c+inflation+fight+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-taxcut-plan-induces-shortterm-pain-in-debt-market-inflation.html","enabled":true},{"name":"email","url":"?subject=UK tax-cut plan induces short-term pain in debt market, inflation fight | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-taxcut-plan-induces-shortterm-pain-in-debt-market-inflation.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+tax-cut+plan+induces+short-term+pain+in+debt+market%2c+inflation+fight+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-taxcut-plan-induces-shortterm-pain-in-debt-market-inflation.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}