Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 28, 2022

Protests over price increases in Indonesia to continue, with low risks to businesses

Students and labor unions are planning periodic rallies through October against the Indonesian government's decision on Sept. 3 to increase the prices of subsidized petrol and diesel by 30.7% and 32.0%, respectively.

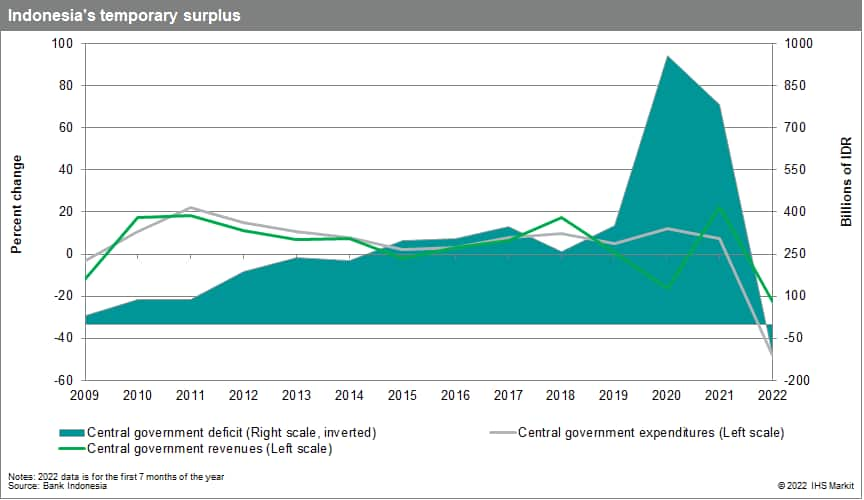

The government's decision to reduce fuel subsidies was prompted by a law requiring the fiscal deficit to be under 3% of GDP in 2023. Based on monthly data through July, the budget this year was running a small surplus thanks to strong commodities-driven revenues. The government expects the benefits from high commodity prices to decline in late 2022 and into 2023 as prices of commodities have recently retreated significantly (most notably, palm oil).

Indonesia's government would also like to shift budget spending back to more long-run initiatives to boost economic growth rather than subsidies.

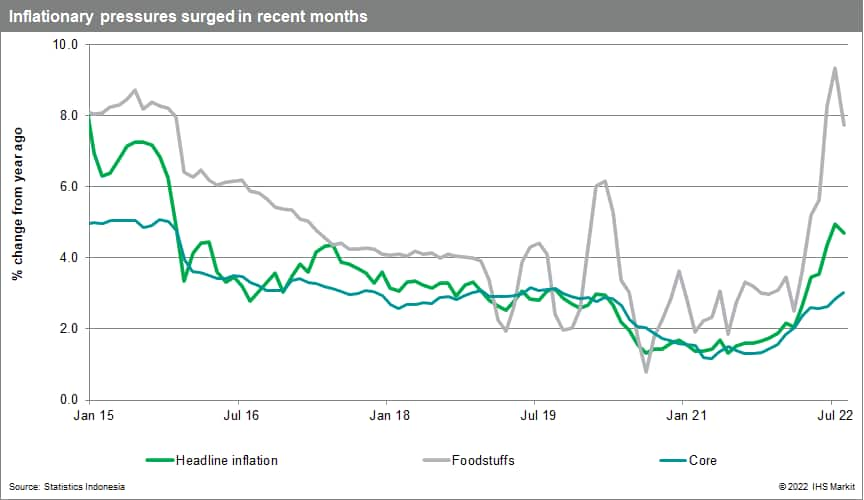

Inflation will worsen following the fuel price increase, providing momentum for anti-government protests. Inflation edged down slightly in August given small declines in food prices. Following the government's announcement of the fuel price adjustments, we expect inflation to peak at 7% year on year in September before slowly declining below 6% year on year in early 2023 and 4% year on year by September 2023.

Student protests

Rising living costs will provide the initial impetus for students to protest, and these are likely to go on for the next several months until price changes moderate.

The magnitude and locations of the protests are likely to remain similar to previous student demonstrations: a few hundred to a few thousand students in Jakarta, mainly at locations such as the parliament complex, the Horse Statue roundabout near the presidential palace, and the Hotel Indonesia roundabout.

Outside Jakarta, students have protested at regional legislatures or government buildings. Some of the protests in Jakarta and other cities have led to altercations with the police and the burning of tires. Protesters have not targeted office blocks, shopping malls, or other commercial property and have shown no intention of doing so.

Labor protests

Labor protests have been driven mainly by one major union coalition that has regularly organized anti-government protests: the Indonesian Labor Union Confederation (known by its Indonesian acronym as KSPI). As with the student protests, members of the KSPI and other smaller unions have held protests at government buildings, parliament, and regional legislatures rather than industrial parks or factories. Beyond scuffles with security forces, these protests are generally peaceful and are unlikely to result in violence causing significant property damage.

The KSPI and other unions are demanding that the government reverse the fuel price rise and increase the minimum wage by 10-13%. They are also seeking the revocation of the Job Creation Law, which they view as disadvantageous to workers.

The protests are not supported by major political parties, indicating that they are unlikely to transform into wider discontent against the government.

President Joko "Jokowi" Widodo's government is supported by seven out of the nine parties in parliament, altogether controlling 82% of parliamentary seats. This largely eliminates the risk of government instability.

Indicators of changing risk environment

The risk environment could change if one or more of the following events occur:

- A major pro-government party criticizes the government over the high costs of fuel and other basic goods, indicating its likely intent to support protests.

The government signals that it is willing to revise a government regulation that sets out the annual minimum wage formula to allow higher wage increases in 2023, or shows its openness to tripartite negotiations with employer groups and labor unions, reverting to its previous method of deciding the annual minimum wage increase. Such actions would reduce the momentum for protests.

Sustained large-scale protests over several months or incidents of violent protests would increase the likelihood of the government reversing its price increase - a policy stance taken in response to extended or large-scale protests by previous administrations.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fprotests-over-price-increases-indonesia-low-risk.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fprotests-over-price-increases-indonesia-low-risk.html&text=Protests+over+price+increases+in+Indonesia+to+continue%2c+with+low+risks+to+businesses+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fprotests-over-price-increases-indonesia-low-risk.html","enabled":true},{"name":"email","url":"?subject=Protests over price increases in Indonesia to continue, with low risks to businesses | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fprotests-over-price-increases-indonesia-low-risk.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Protests+over+price+increases+in+Indonesia+to+continue%2c+with+low+risks+to+businesses+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fprotests-over-price-increases-indonesia-low-risk.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}