Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 01, 2019

UK manufacturing buoyed by pre-Brexit stockpiling but outlook darkens

- PMI falls to 52.0 despite record pre-Brexit boost to inventories

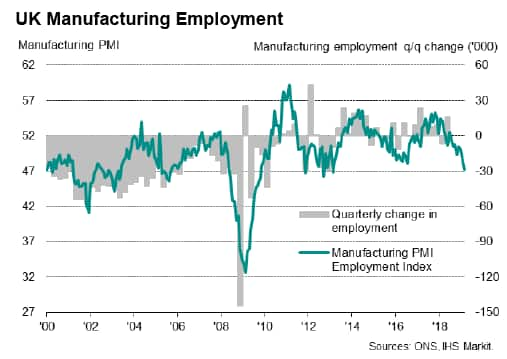

- Order inflows stall and employment falls at fastest rate for six years

- Business optimism hits survey-record low

Growth of manufacturing activity edged lower in February despite being buoyed by factories and their customers building inventories ahead of the UK's exit from the EU. The underlying weakness of demand and increased gloom about the year ahead, linked principally to Brexit, meanwhile prompted factories to cut headcounts at the fastest rate for six years.

Brexit stockpiling provides temporary lift to output

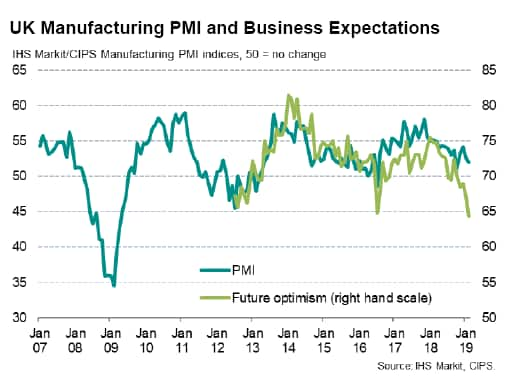

The headline IHS Markit/CIPS UK Manufacturing PMI dropped from 52.6 in January to 52.0 in February. With the exception of last October, the latest reading was the lowest since July 2016.

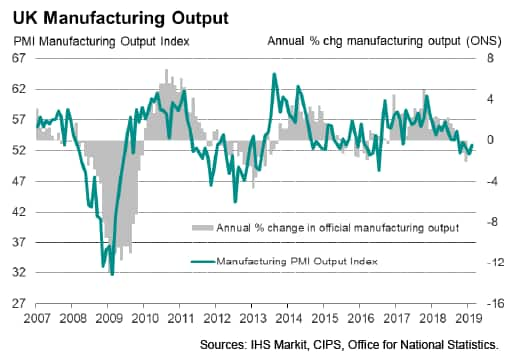

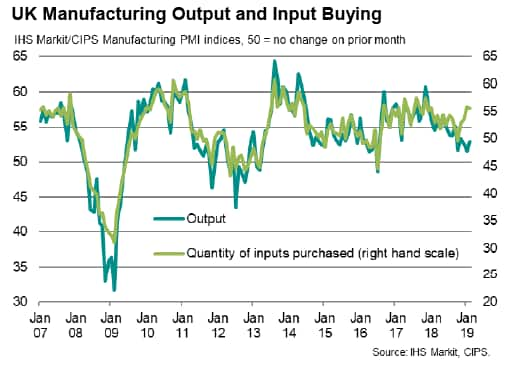

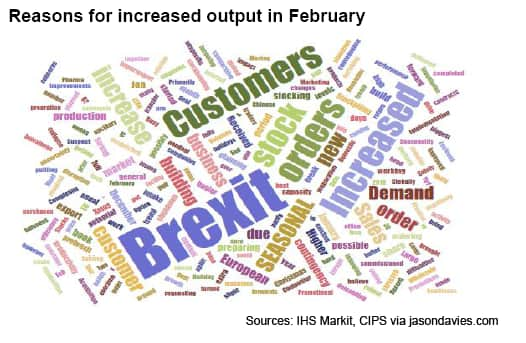

While the survey's gauge of factory output registered the first acceleration of growth since November, the improvement could be traced at least in part to Brexit-related activity ahead of the UK's scheduled departure from the EU on 29th March. In particular, just over one in three companies giving a reason for increased production indicated that output was raised in preparation for potential supply disruptions in the event of a 'no-deal' Brexit.

Gloomier outlook

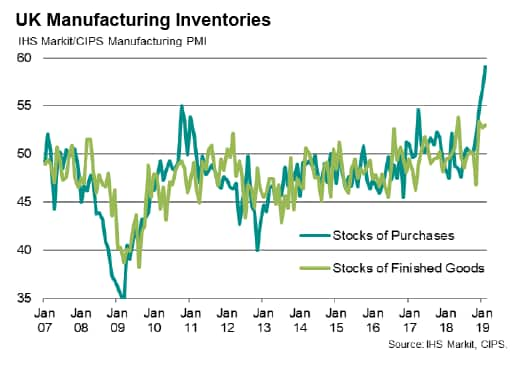

Pre-Brexit stock building was also evident in the largest increase in manufacturers' stocks of inputs ever recorded in the survey's 27-year history, surpassing January's prior record.

Forward-looking indicators provided scant hope for any reversal of the weakening trend in coming months. New orders barely rose, registering one of the weakest expansions seen over the past six years. Only last October and July 2016 saw worse order book readings.

New export orders fell for the fifth time in the past seven months, with the rate of decline accelerating slightly though remaining only modest.

Brexit and slower global demand were cited as the key causes of falling exports. Pre-Brexit buying was again evident, however, providing some support to export orders.

Moreover, with over one in four companies reporting higher volumes of new orders linking the rise in part to pre-Brexit stockpiling by customers, both output and new orders growth could cool after Brexit when the inventory build moves into reverse, adding to gloomier signs for the near-term outlook.

Business expectations about production in the year ahead meanwhile slipped to the lowest since data on future sentiment were first available in mid-2012. 'Brexit' was by far the most commonly cited cause for concern regarding the outlook.

However, perhaps the loudest warning signal about the plight of manufacturing came from the survey's employment gauge. Amid a backdrop of heightened Brexit uncertainty, falling backlogs of work and subdued global demand, companies cut their headcounts at the steepest rate for six years in February.

Large firms lead stockpiling

Stockpiling was far more evident among larger firms, with smaller companies boosting their input inventories only modestly by comparison and even cutting their stocks of finished goods.

By sector, stockpiling of inputs was again most commonly reported in the food & drink, clothing, chemical & plastics, electrical & electronics and mechanical engineering sectors.

In terms of stocks of finished goods, by far the largest rise in inventories was recorded at food & drink producers.

Chris Williamson, Chief Business Economist, IHS

Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

© 2019, IHS Markit Inc. All rights reserved. Reproduction in

whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-manufacturing-buoyed-by-stockpiling-but-outlook-darkens.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-manufacturing-buoyed-by-stockpiling-but-outlook-darkens.html&text=UK+manufacturing+buoyed+by+pre-Brexit+stockpiling+but+outlook+darkens+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-manufacturing-buoyed-by-stockpiling-but-outlook-darkens.html","enabled":true},{"name":"email","url":"?subject=UK manufacturing buoyed by pre-Brexit stockpiling but outlook darkens | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-manufacturing-buoyed-by-stockpiling-but-outlook-darkens.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+manufacturing+buoyed+by+pre-Brexit+stockpiling+but+outlook+darkens+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-manufacturing-buoyed-by-stockpiling-but-outlook-darkens.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}