Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 26, 2023

‘Super’ slow steaming makes a comeback as surplus capacity builds

The gaping imbalance between supply and demand is forcing ocean carriers to deploy a capacity-absorbing measure rarely seen since the dark days following the global financial crisis — super slow steaming.

The average sailing speed of container ships last month was 3.4% lower than in April 2019, according to Niels Rasmussen, chief shipping analyst at shipping association BIMCO.

"This has limited the supply that the fleet can deliver," Rasmussen said in a market update Thursday. "However, the total available fleet supply has still significantly outgrown Far East export volumes." He noted the global container fleet has grown 16.9% over the past four years to reach 26.2 million TEUs at the end of April.

Over the next two years, capacity will outstrip demand as huge amounts of new tonnage flood into service. Analysts predict global demand this year will grow 2% while supply will increase 4%; in 2024, capacity will rise 7% against 3% growth in demand.

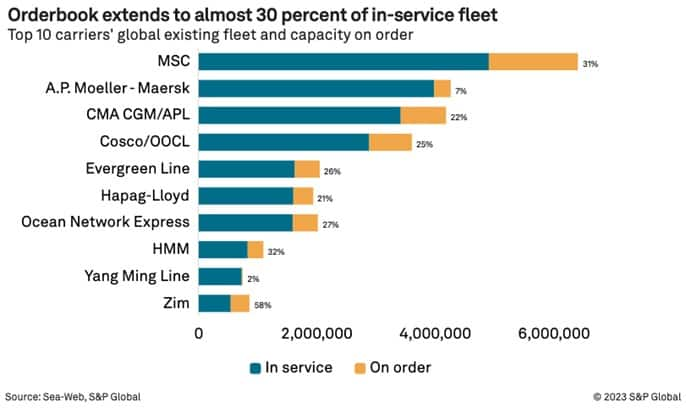

The current order book of about 7.3 million TEUs is already at 28% of the global fleet, with additional orders still being placed by carriers, many for megaships greater than 18,000 TEUs, according to Sea-web, a sister company of the Journal of Commerce within S&P Global.

"While not a novel idea, carriers are increasingly dipping into the playbook first used around the time of the global financial crisis: super slow steaming," Drewry noted in a recent Container Insight post. "More and more, we are seeing extra ships being added to existing services, extending round voyages, but crucially not the amount of effective capacity of the service."

The 2M Alliance of Maersk and Mediterranean Shipping Co. announced last week they will add two megaships to the AE6/Lion service from Asia to North Europe in early June. The upsizing of capacity is part of a program to reduce speed on all eight of the alliance's Asia-Europe loops to lower bunker costs and emissions, improve reliability and absorb extra "megamax" tonnage, according to Alphaliner.

Using 13 MSC-operated ships ranging from 19,400 to 24,300 TEUs in capacity, the round-trip service will be extended by two weeks to 13 weeks.

Steady supply-demand needle

Drewry noted that irrespective of the number of ships deployed, so long as the average capacity remained constant and the call frequency was maintained at seven days, there would be no change to the effective capacity.

"By extending the round voyage duration, either by slowing ships down or inserting new ports calls, or a combination of the two methods, carriers can find space for new ships without moving the supply-demand needle," the analyst pointed out.

Xavier Destriau, CFO of Zim Integrated Shipping Services, told the Journal of Commerce in an interview this week that the carrier was also taking measures to use up extra capacity. Zim suspended its China-U.S. West Coast service earlier this year and shifted the capacity to the South America-U.S. East Coast trade, while two 15,000-TEU ships have been added to an Asia-US East Coast string via the Panama Canal.

"We look at where we have additional tonnage and could add an extra vessel that is going to be well-suited to a trade and then look at extra slow steaming, but it is a matter of available tonnage and depends on the trade," Destriau said.

Rolf Habben Jansen, CEO of Hapag-Lloyd, estimated his vessels were sailing "about a knot slower" now than at this point last year, and his focus was on improving the utilization of his fleet.

"In some cases, we have decided to stop some services simply because cost-wise they did not make a lot of sense anymore, but there will be no major increase in the capacity deployed," he told analysts on a recent first-quarter earnings call.

Hapag-Lloyd has a dozen 23,500-TEU ships on order with delivery to start in June, as well as 10 13,000-TEU vessels that have already begun to sail into service. But Habben Jansen said the newbuildings will be used to upsize strings within THE Alliance.

Pulling capacity control levers

Carriers are using every tool at their disposal to absorb the surplus ships without destroying the utilization of the vessels and to prevent rates from collapsing entirely, including blank sailings, idling vessels and increasing scrapping levels. The measures are having an effect.

Rasmussen noted in the BIMCO update that despite overall supply-demand developments, ocean carriers appear to have become more efficient at matching capacity to cargo demand, and with a new-found freight rate discipline.

"No matter the underlying reason, we can conclude that despite a 70-80% fall in freight rates, and a worsening of the supply-demand balance, liner operators have so far been quite successful in keeping rates higher than pre-pandemic levels," he said.

Some of the main trades out of Asia have responded better to capacity management measures than others. On the eastbound trans-Pacific, some carriers have even backed off their blank sailings program in May, making fewer cuts and regularly turning weekly services into biweekly services.

Average spot rates from Asia to the U.S. East Coast are currently at $2,401 per FEU, 15% above the levels of May 2019, while rates on Asia-U.S. West Coast of $1,402/FEU are just 0.5% higher, according to rate benchmarking platform Xeneta.

On the Asia-Mediterranean trade, the average spot rate of $2,517/FEU is an incredible 70% higher than May 2019, while Asia-North Europe rates are up 6% at $1,451/FEU.

Subscribe now or sign up for a free trial to the Journal of Commerce and gain access to breaking industry news, in-depth analysis, and actionable data for container shipping and international supply chain professionals.

Subscribe to our monthly Insights Newsletter

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsuper-slow-steaming-makes-a-comeback-as-surplus-capacity-build.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsuper-slow-steaming-makes-a-comeback-as-surplus-capacity-build.html&text=%e2%80%98Super%e2%80%99+slow+steaming+makes+a+comeback+as+surplus+capacity+builds++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsuper-slow-steaming-makes-a-comeback-as-surplus-capacity-build.html","enabled":true},{"name":"email","url":"?subject=‘Super’ slow steaming makes a comeback as surplus capacity builds | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsuper-slow-steaming-makes-a-comeback-as-surplus-capacity-build.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=%e2%80%98Super%e2%80%99+slow+steaming+makes+a+comeback+as+surplus+capacity+builds++%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsuper-slow-steaming-makes-a-comeback-as-surplus-capacity-build.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}