Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 25, 2023

Ocean trade emerges from pandemic haze to face new realities

It is a familiar moment in container shipping markets, but deceptively so. The reappearance of overcapacity and general rate increases (GRIs) after years of hiatus seemingly harkens back to earlier — perhaps simpler — times.

But any comparison with markets past has its limitations given new factors in the mix today, such as the ability of carriers to withdraw significant capacity in the face of reduced demand and an energy transition beginning to meaningfully assert itself.

Industry members with long memories could be forgiven, upon seeing the recent barrage of GRI attempts, for thinking they were back in the 2010s, when carriers regularly deployed this tool in artificial and usually unsuccessful attempts to overcome weak underlying fundamentals.

Viewed through the lens of the industry's prior status quo, the current order book — with capacity equal to about 30% of the existing global container ship fleet — would by definition translate into overcapacity and a buyer's market that would linger possibly for years, depressing carrier profits until ordering slows and demand growth eventually absorbs the excess tonnage.

But these are not the 2010s, and not just because the market is still recovering from the shock of the COVID-19 pandemic. Although the order book is the highest it has been in many years and demand remains subdued, the ground is shifting in new and unfamiliar ways.

Decarbonization has been on the industry's radar for years but has yet to have a tangible effect on supply and demand in container shipping. That is changing now. Vessel scrapping is expected to greatly accelerate in response to stricter limits on greenhouse gas emissions, with replacement tonnage increasingly dominated by dual-fuel ships. Of the new capacity ordered this year as of February, 62% is tonnage capable of running on green methanol as well as conventional bunker fuel, up from 0% in the first half of 2020.

"Many older ships are expected to be recycled earlier than normal due to the ever-tighter limits on greenhouse gas emissions," BIMCO analyst Niels Rasmussen said in a May market update. BIMCO believes more than 15,000 vessels will be demolished over the next decade, more than double the amount in the previous 10 years.

That changes the calculus on capacity, according to some carriers.

"The order book is not such a concern, as much of this is about fleet modernization and technology enhancement, primarily due to future sustainability factors," Jeremy Nixon, CEO of container carrier Ocean Network Express, told the Journal of Commerce. "As the International Maritime Organization's mandatory EEDI and CII regulations start to bite later in 2023 and 2024, I would not be surprised to see a marked increase in scrapping, and a greater emphasis on schedule reliability based on lower steaming speeds."

'Continued rationality' needed from carriers

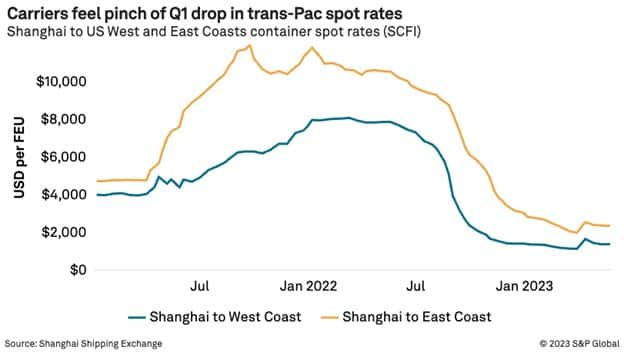

The possibility that accelerated scrapping may mitigate the impact of an outsized order book is not in itself a salvation; the collapse in spot rates since mid-2022 shows how fast-moving market forces quickly outpaced carriers' ability to effectively manage capacity, leaving lines playing catch up as they woke up to how quickly the pandemic-induced market was dissolving.

Carriers are pinning their hopes on a second-half rebound in volumes, but there are serious doubts that an uptick — which is also expected to resemble pre-pandemic seasonal swings — will lead to any significant tightness in capacity.

"We continue to believe in a recovery of volumes, but given the industry order book, the supply side risk that we flagged last time remains," Maersk CEO Vincent Clerc told analysts during a May 6 earnings call, noting that slow steaming "is something we're implementing across the network right now."

Capacity management through alliances is another relatively new phenomenon, predating the pandemic by only a handful of years, and is continuing as a factor that makes comparisons with earlier days more difficult. According to Clerc, aggressive capacity management by the three major alliances enabled carriers to put the brakes on the freefall in rates seen over the second half of 2022.

"This stabilization of rates that you see taking place here in the first quarter, it could not be possible if it was only Maersk that was behaving in a rational way," Clerc said. "We've seen significant blanking activities across all alliances."

In the end, it will be a combination of increased scrapping and capacity discipline by carriers that will be the keys to navigating the market this year and into 2024.

"You will see a gradual increase in scrapping, which will also have some type of positive impact," Clerc said. "That being said, you add this all up, it still requires a fair amount of discipline and a continued rationality."

Subscribe now or sign up for a free trial to the Journal of Commerce and gain access to breaking industry news, in-depth analysis, and actionable data for container shipping and international supply chain professionals.

Subscribe to our monthly Insights Newsletter

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2focean-trade-emerges-from-pandemic-haze-to-face-new-realities-.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2focean-trade-emerges-from-pandemic-haze-to-face-new-realities-.html&text=Ocean+trade+emerges+from+pandemic+haze+to+face+new+realities++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2focean-trade-emerges-from-pandemic-haze-to-face-new-realities-.html","enabled":true},{"name":"email","url":"?subject=Ocean trade emerges from pandemic haze to face new realities | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2focean-trade-emerges-from-pandemic-haze-to-face-new-realities-.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Ocean+trade+emerges+from+pandemic+haze+to+face+new+realities++%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2focean-trade-emerges-from-pandemic-haze-to-face-new-realities-.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}