Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Mar 08, 2022

Regional and sectoral growth dynamics in Mexico

Mexico's economy has been struggling to grow, with real GDP in 2019 having decreased by 0.19%, before then dropping by 8.37% in 2020 owing to the impact of the coronavirus disease 2019 (COVID-19) pandemic. Although Mexico's economy did not grow in the second half of 2022, real GDP rebounded to 5.02% growth in the full year 2021. S&P Global anticipates growth at 1.87% in 2022. This trajectory is supported by strong growth in the United States favoring the expansion of some sectors in the short-term. However, when this rebound in growth is disaggregated by region and sector, the resulting opportunities for investors look more uneven.

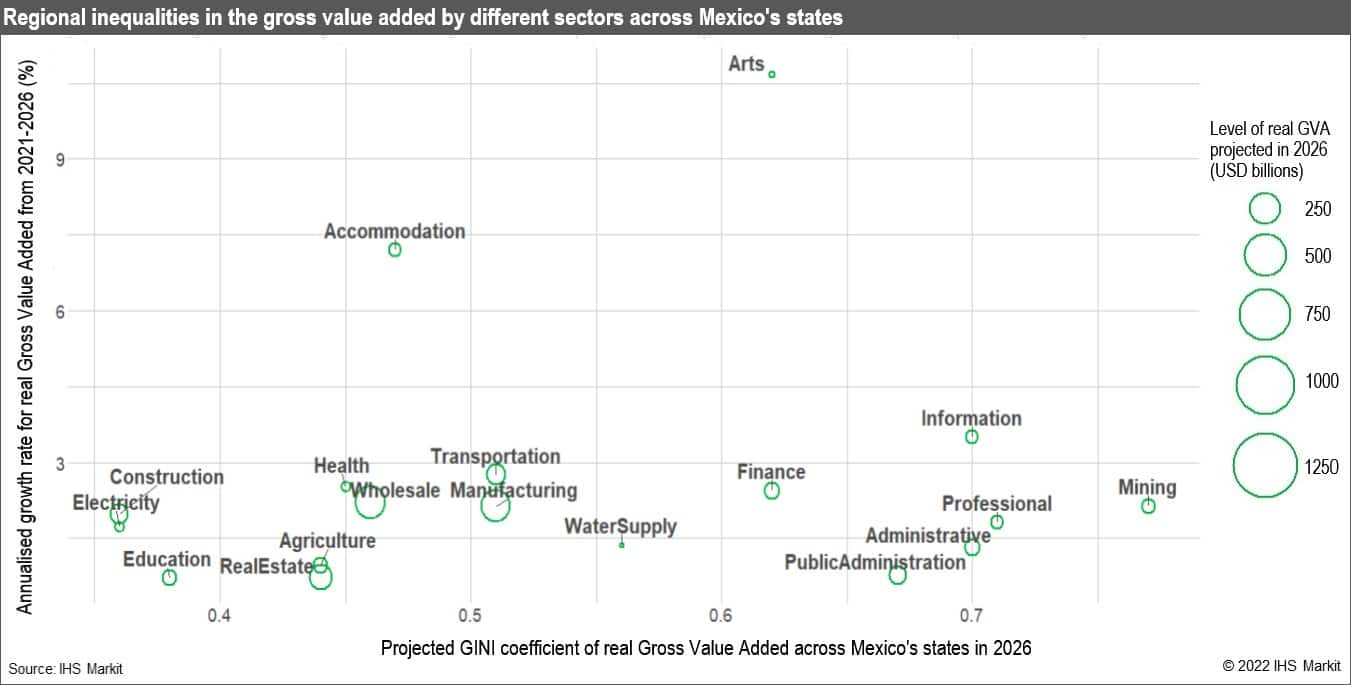

According to 2022 data from Regional Explorer, 12 of 32 states represented just under 70% of Mexico's total real GDP. Five of these twelve states (Jalisco, México, Veracruz, Chihuahua, and Guanajuato) have an important weight across primary, secondary, and tertiary economic activities in Mexico. The recovery in economic activity has also differed by sector. For instance, in the third-quarter of 2021, the services sector experienced an important contraction because of new regulations on labor subcontracting and weakness in the automotive industry stemming from the sustained shortage of semiconductors. At a regional level, in 2021 there was a weakening in the economic recovery of the South and Central states owing to a decline in commerce and tourism activities because of a higher rate of local COVID-19 cases.

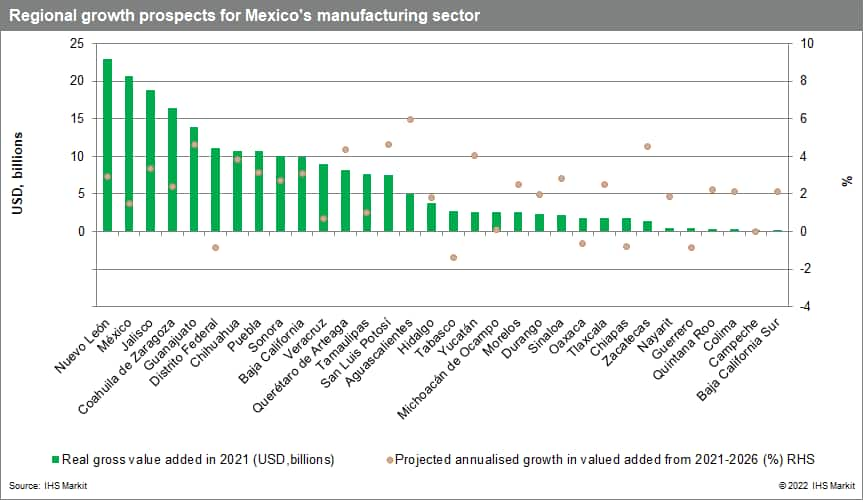

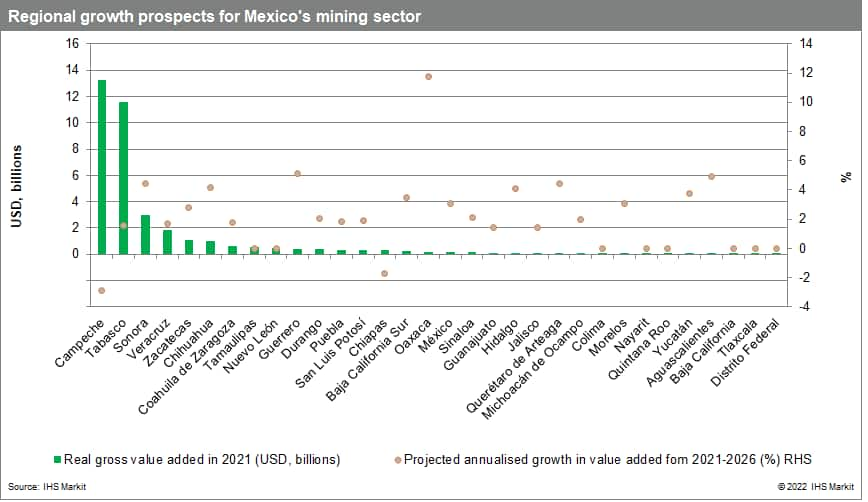

Although the mining sector recovery was still weak, the construction sector started to recover in the South region states owing to the advancement of government-backed infrastructure projects. In addition, in the Central states, the new regulation on labor subcontracting also could have had a negative impact as it is the Mexican region where this type of activity is the most concentrated. In the North-Central states, the manufacturing sector was negatively impacted mainly owing to the automotive industry, as well as lower agricultural production. Finally, the Northern states had a favorable economic recovery as the manufacturing, construction, and agricultural sectors performed favorably compared to the mining, commerce, and services sectors.

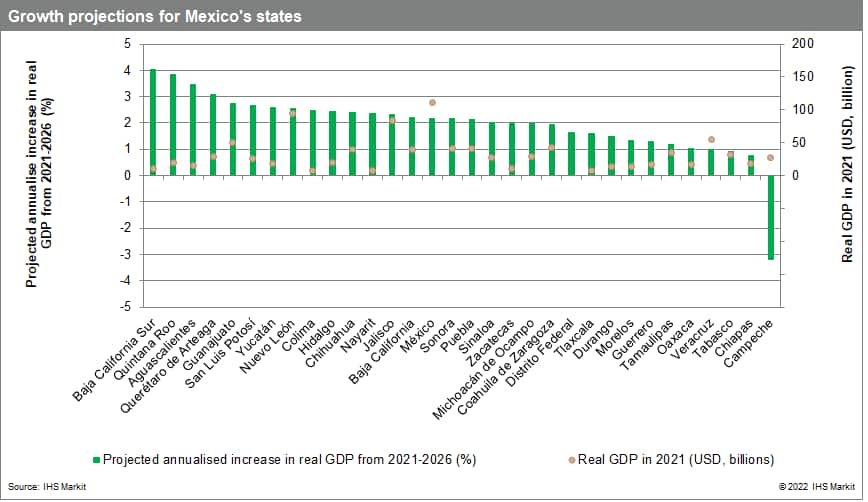

Looking forward, S&P Global expects several states grow quickly from a comparatively low base. For instance, Baja California Sur is projected to have the highest annualized real GDP growth rate (4.07%) during the period 2021-26. Helping drive future growth is the fact that since 2021 Baja California Sur has had access to natural gas through liquefied natural gas (LNG) deliveries in the new regasification terminal at the Port of Pichilingue. This has enabled additional power generation for the local grid and is a low-cost fuel for the industrial sector. The rate of projected growth is significant given that economic activity in Baja California Sur had already dropped 23.3% in 2020 largely owing to the restrictions imposed on tourism activity (one of the main economic activities in this state) to deter COVID-19 contagion. Despite an increase in tourism in Mexico during 2021, economic activity in this state only recovered to around 8.6% year-on-year, reaching just over the same economic level as in 2017. However, as restrictions related to COVID-19 ease, we are expecting a quick economic recovery.

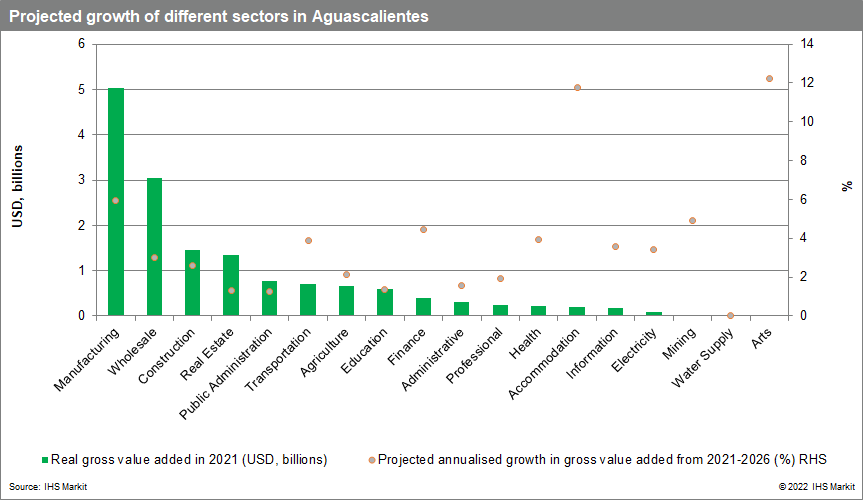

Another important economic region in Mexico is the Bajío region, where we expect three states from the region to grow at particularly robust rates. Aguascalientes, Querétaro, and Guanajuato are projected to have the highest real GDP growth in Bajío region in 2021-26, despite having an average 2021 GDP 3% below 2019 levels. In this region, the manufacturing sector drives 27% of total economic growth. We expect that in the short term that manufacturing activity will expand owing to strong growth in the US economy.

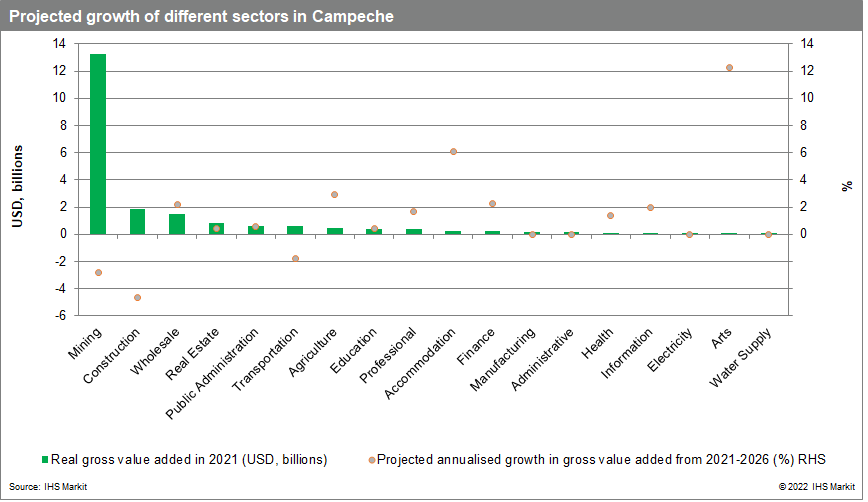

In the Peninsular region, Quintana Roo state will have the second highest annualized GDP growth rate in 2021-26 —nearly 4%— a substantial increase after pandemic-related impacts on the commercial and service sectors caused a year-over-year economic contraction of 24.2% in 2020. As pandemic-related restrictions ease, we expect a quick economic recovery for this state, mainly driven by tourism activity as more people resume travelling for leisure activities. However, we estimate that decreased mining activity in Campeche state will drive a yearly average economic GDP contraction of 3.21% from 2021-2026. Overall, a decrease in mining and construction in Campeche has reduced GDP average annual growth rate by 4.6% from 2013 to 2021.

Mexico's economy will continue to face downside risks to growth this year, notably: higher inflation will continue to erode the purchasing power of salaries; the central bank of Mexico (Banxico) will continue to tighten monetary policy; and business sentiment and investment will be further constrained owing to a constitutional amendment proposed by President Lopéz Obrador that will likely affect the energy sector. All this adds to already high security and operational risks in Mexico. At a regional level, we are expecting inflation, weakening of the rule of law, and domestic economic conditions to be the main downside risks for economic growth across Mexico's regions.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fregional-and-sectoral-growth-dynamics-in-mexico.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fregional-and-sectoral-growth-dynamics-in-mexico.html&text=Regional+and+sectoral+growth+dynamics+in+Mexico+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fregional-and-sectoral-growth-dynamics-in-mexico.html","enabled":true},{"name":"email","url":"?subject=Regional and sectoral growth dynamics in Mexico | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fregional-and-sectoral-growth-dynamics-in-mexico.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Regional+and+sectoral+growth+dynamics+in+Mexico+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fregional-and-sectoral-growth-dynamics-in-mexico.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}