Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Aug 04, 2021

Record-breaking events

Research Signals - July 2021

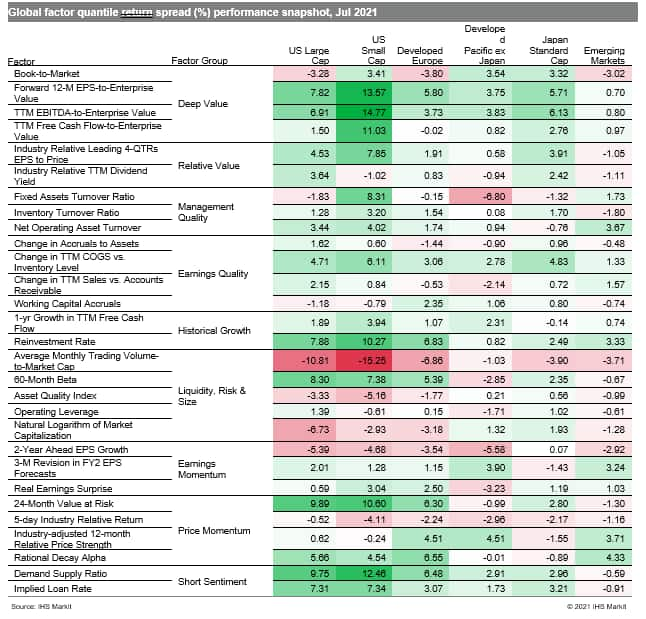

In a month of exciting and record-breaking competition during the Tokyo Olympics, several chart-topping events affected global markets and a broad representation of factors competed for the monthly performance lead across regions (Table 1). US and European equity markets continued to post all-time highs, though stocks struggled in Asia as rising coronavirus cases, including daily counts in the Japanese capital which topped earlier records, fueled concerns on the strength of the global economic recovery. While the J.P.Morgan Global Manufacturing PMI maintained a solid pace of expansion, with gold, silver and bronze medals awarded to the Netherlands, Germany and Austria and the US just shy of making the podium, record supply chain constraints drove up input prices and hindered growth.

- US: A high level of risk aversion was evident in the market, as confirmed by outperformance of signals such as 24-Month Value at Risk and 60-Month Beta

- Developed Europe: High quality firms were positively rewarded, as gauged by measures including Change in TTM COGS vs Inventory Level and Net Operating Asset Turnover

- Developed Pacific: Deep Value factors outperformed in the region, particularly in Japan where TTM EBITDA-to-Enterprise Value took top honors

- Emerging markets: Price Momentum measures remained positive indicators, as confirmed by outperformance of Rational Decay Alpha and Industry-adjusted 12-month Relative Price Strength

Table 1

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frecordbreaking-events.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frecordbreaking-events.html&text=Record-breaking+events+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frecordbreaking-events.html","enabled":true},{"name":"email","url":"?subject=Record-breaking events | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frecordbreaking-events.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Record-breaking+events+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frecordbreaking-events.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}