Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Aug 05, 2021

Securities Finance July 2021

- July revenues declined by 4.7% YoY

- South Korea, Taiwan & Hong Kong SAR lead APAC upswing

- US equity special balances decline

- ADR borrow demand accelerates

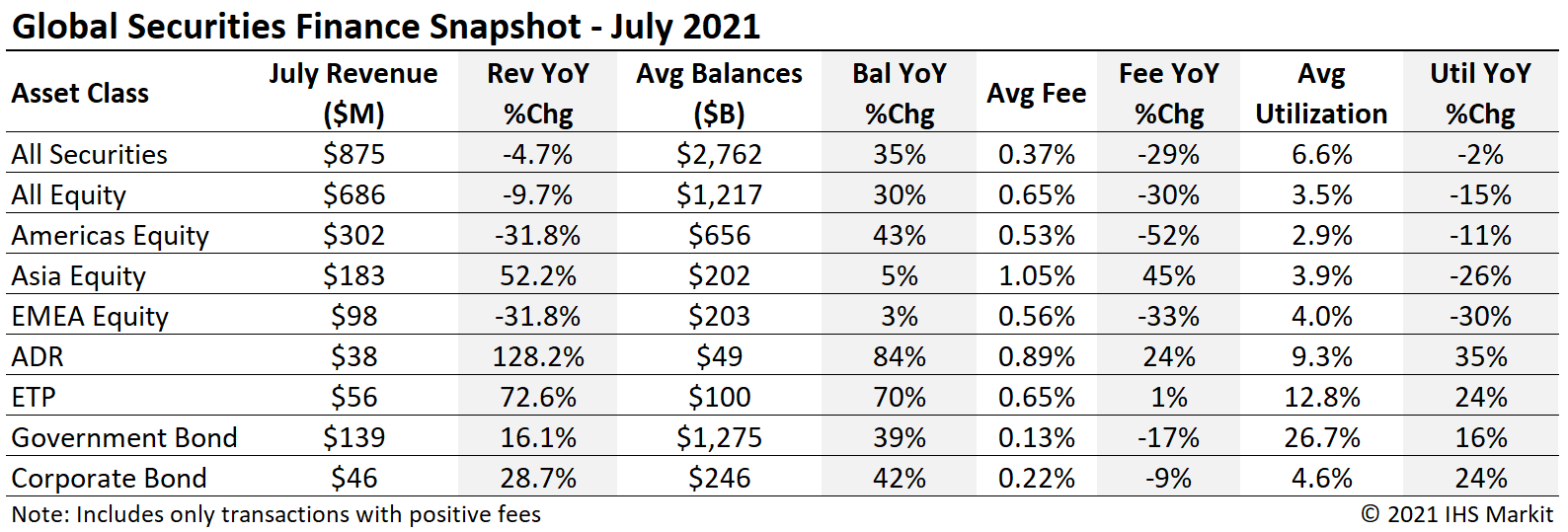

Global securities finance revenues totaled $875m in July, a 4.7% YoY decline. Global equity special balances increased by 17% YoY, due to increasing APAC special balances, though declined by 15% MoM compared with June. For the second consecutive month, ADRs and ETPs saw YoY increases in revenues, loan balances, fees and utilization in July. In this note we'll discuss the drivers of July revenue.

APAC Equity

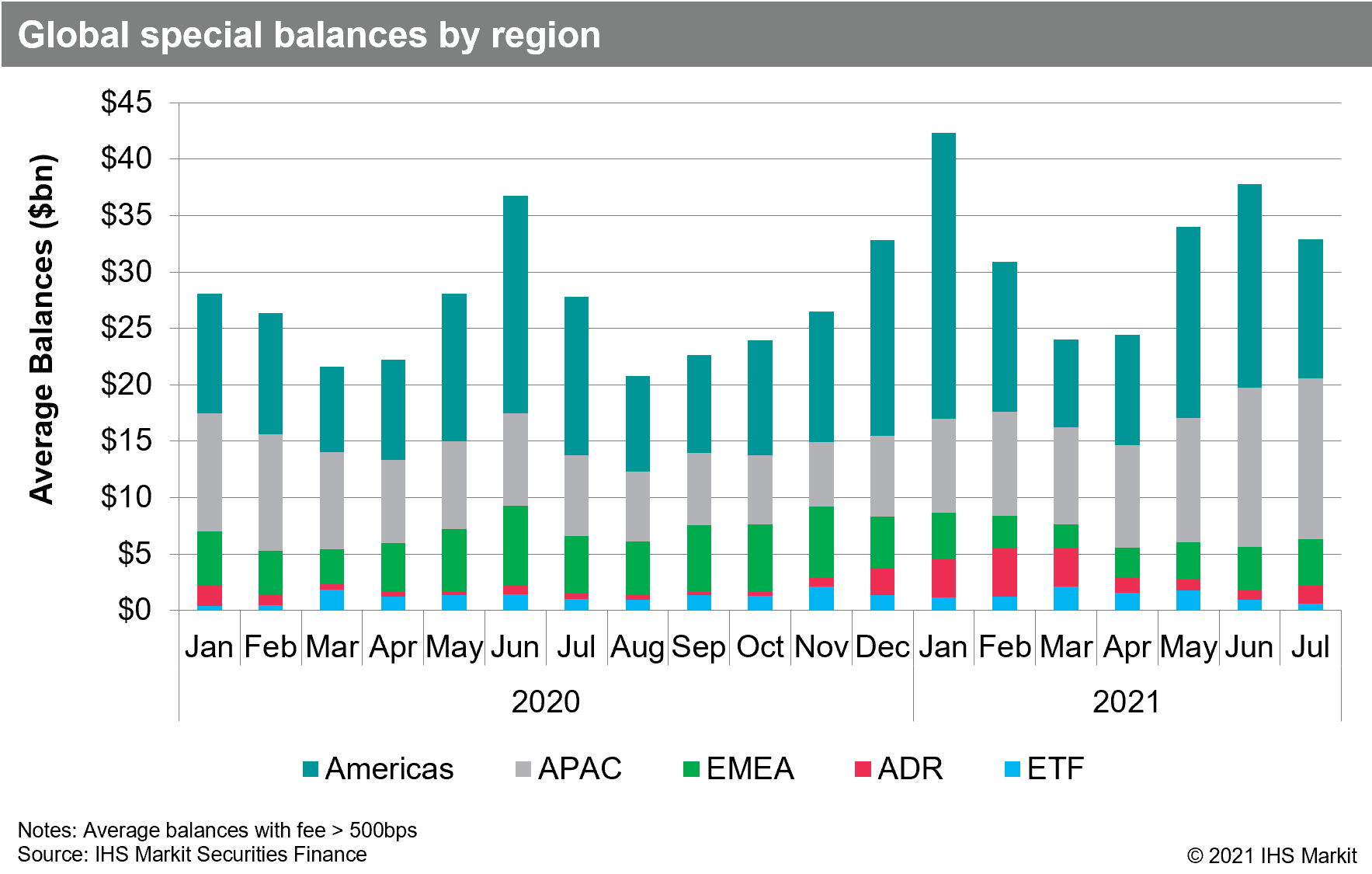

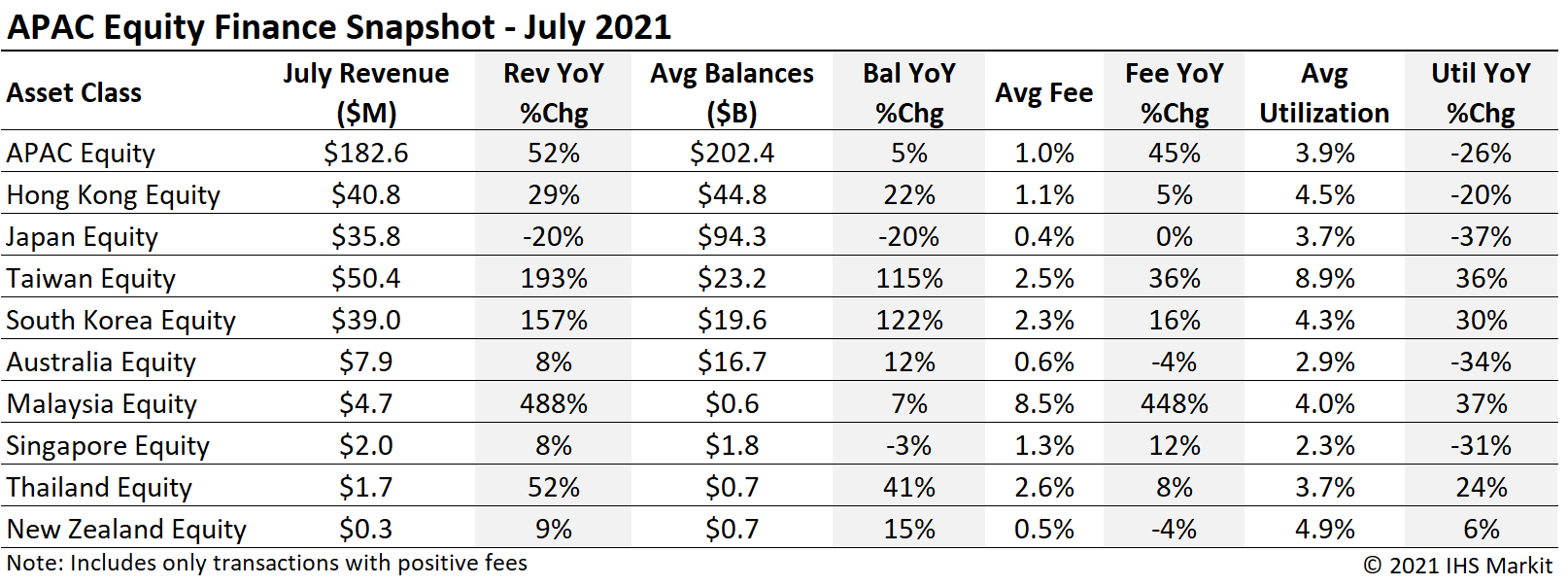

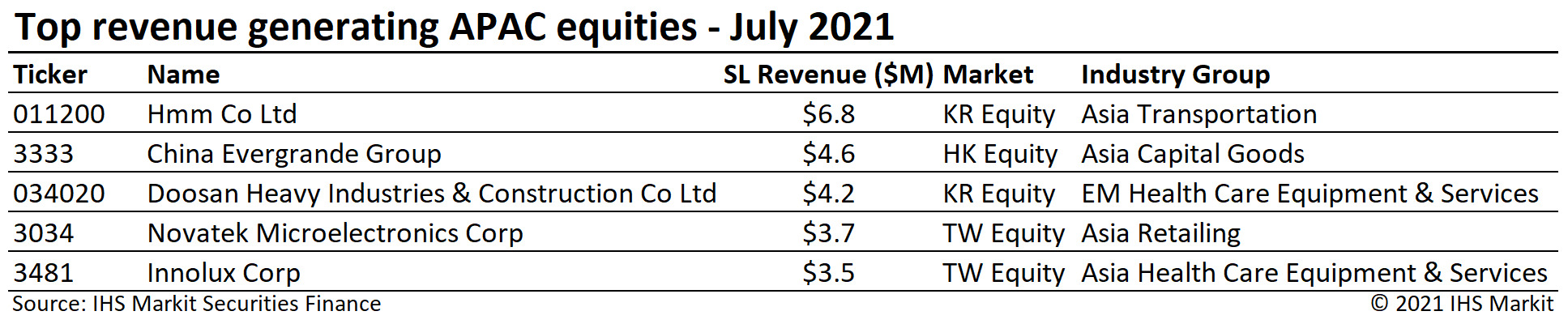

APAC equity finance revenues increased by 52% YoY in July, with $183m in revenue, the most for any month since March 2019. Asia equity special balances maintained the elevated level of $14bn observed in June, increasing by less than 1%, following May and June where specials balances increased by more than 20% MoM for both months. Special balances are defined in this note as balances with a fee greater than 500bps.

Americas Equity

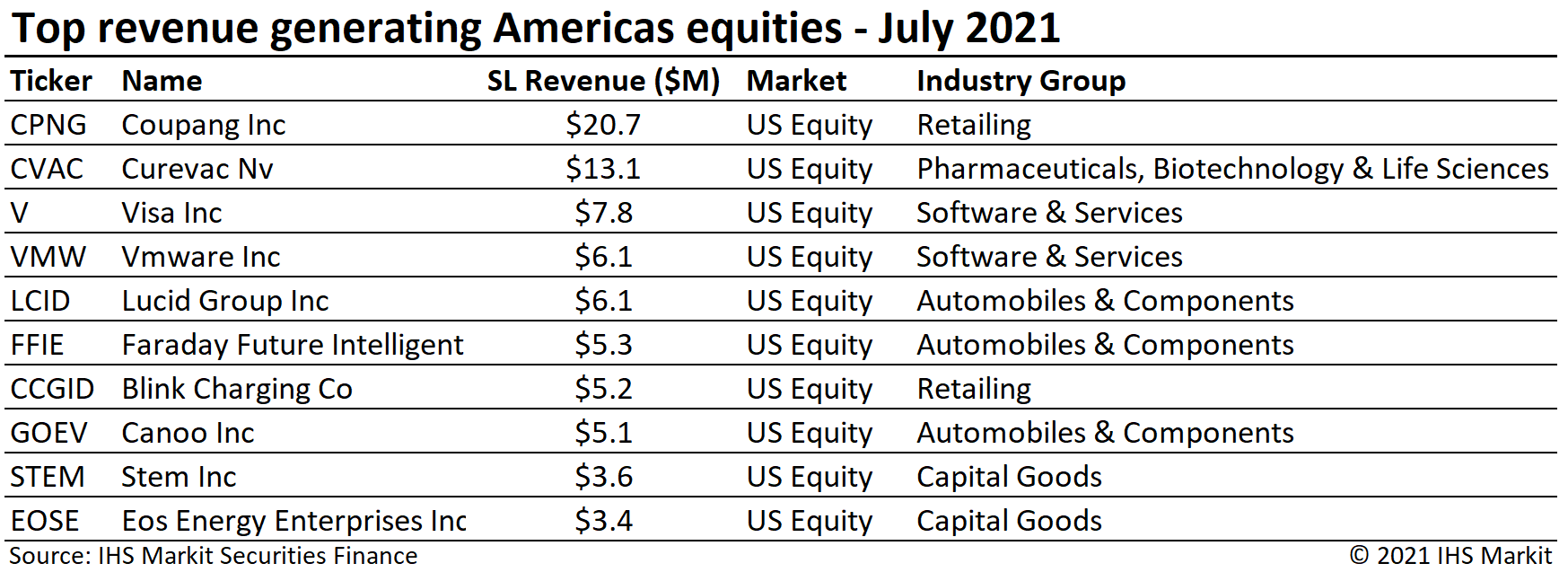

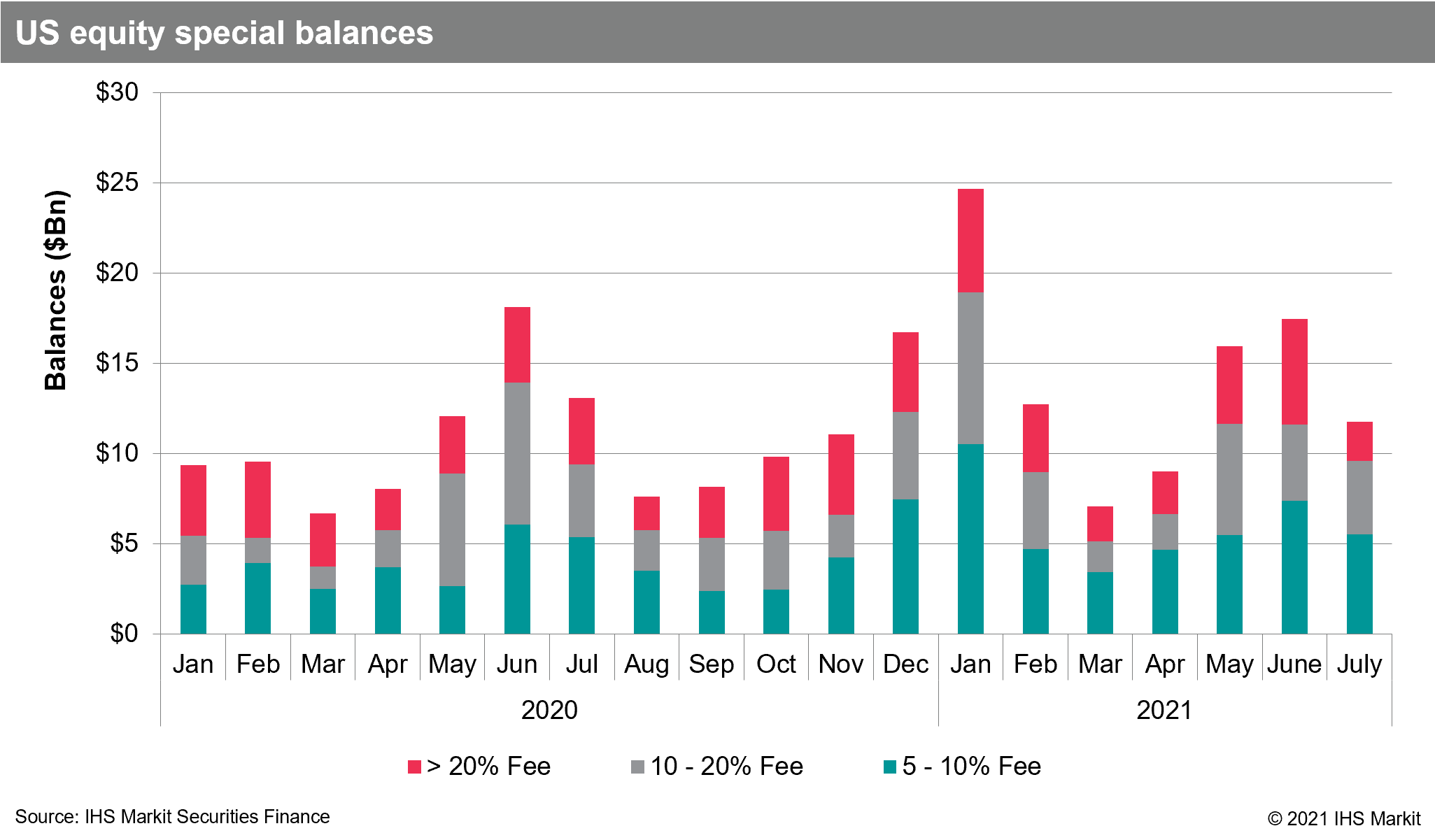

Americas equity revenues came in at $302m for July, a 32% YoY decline. The YoY revenue decline is the result of declining average fees, with loan balances increasing. Specials balances declined sharply in July relative to June, however at $12.3bn, remain 58% above the YTD low month in March.

The most revenue generating US equity was Coupang Inc, which delivered $20.7m in July, driven by a steady increase in share borrowing and average fees throughout July amid share price volatility. Curevac Nv generated the second most revenue, having become one of the hardest to borrow US equities during late-June and early-July after publishing disappointing test results for a COVID vaccine.

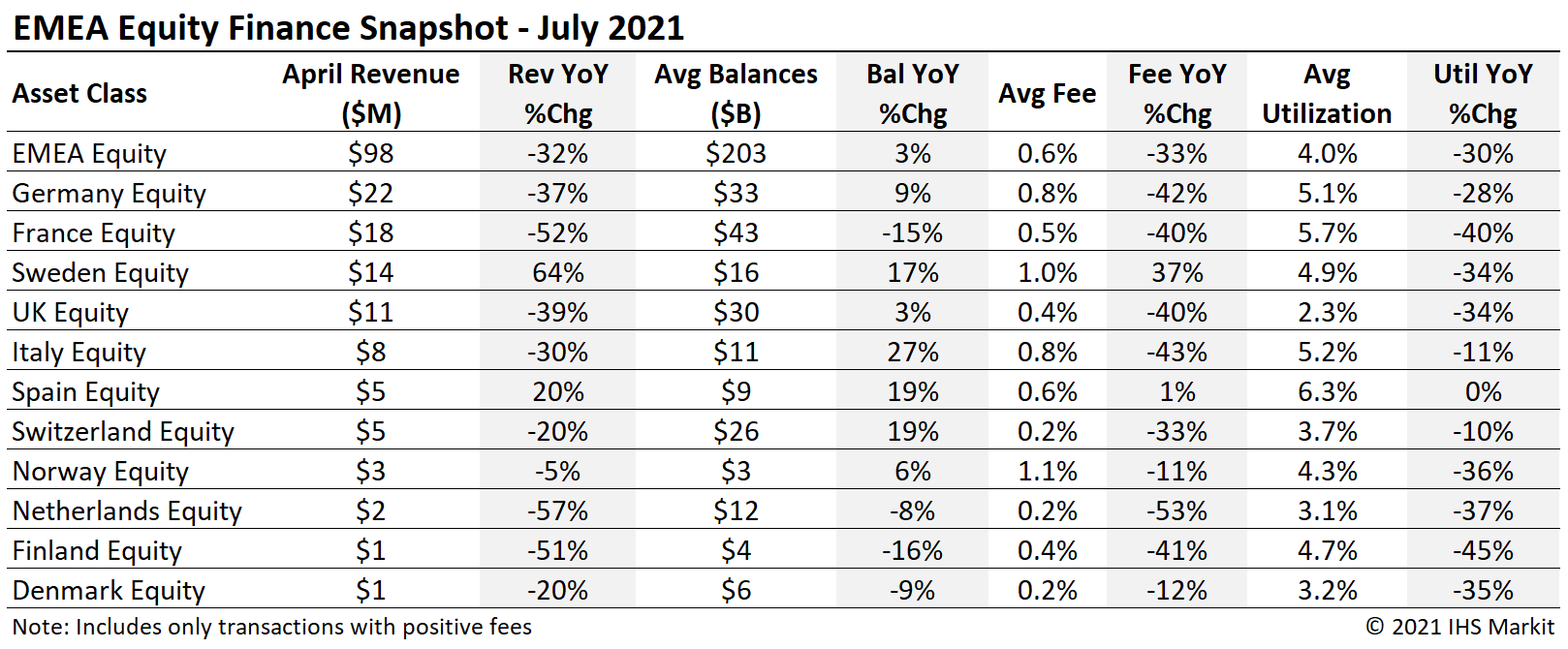

European Equity

European equity returns declined by 32% YoY for July, with $98m in monthly revenue. The YoY decrease was driven by decreasing fees, the result of a lack of specials revenue relative to July 2020. The YoY growth in Sweden's equity finance revenues was driven by the reinstatement of the AB Volvo dividend.

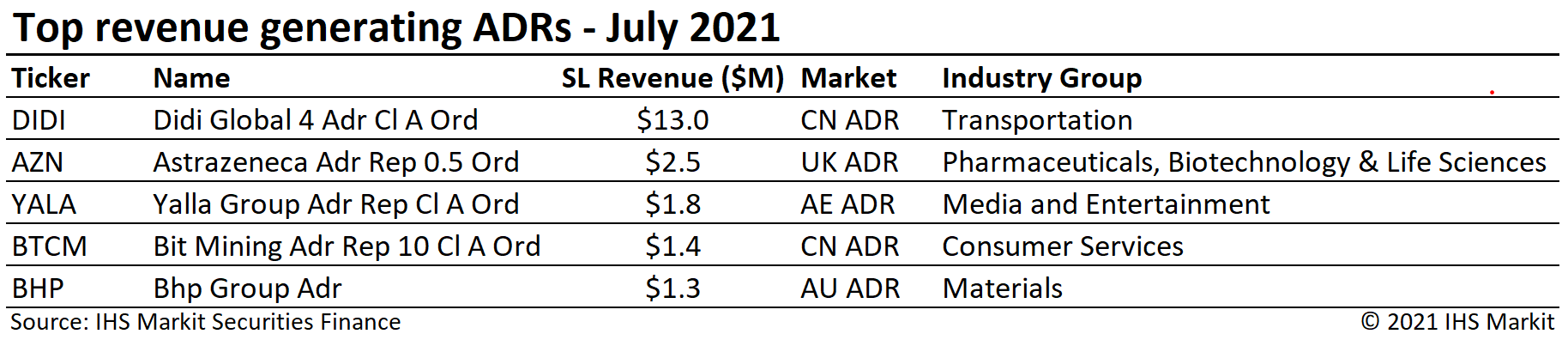

Depository Receipts

Revenues from lending American Depository Receipts (ADRs) increased 128% YoY in July, with $38m the highest monthly revenue since March when Futu Holdings generated more than 70% of ADR returns. Didi Global (DIDI) led ADR finance revenues in July with $13m, or 34% of July ADR revenue, resulting from substantial borrow demand following the firm's IPO. Led by Didi and Bit Mining Ltd, a Chinese bitcoin mining firm, Chinese ADR revenues reached $24.5m in July, a 200% YoY increase.

Exchange Traded Products

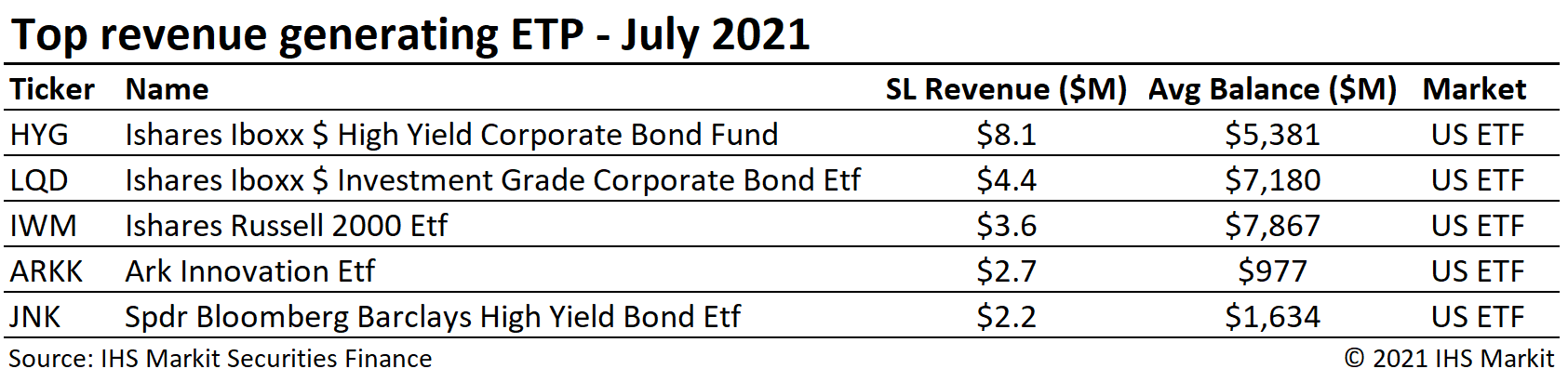

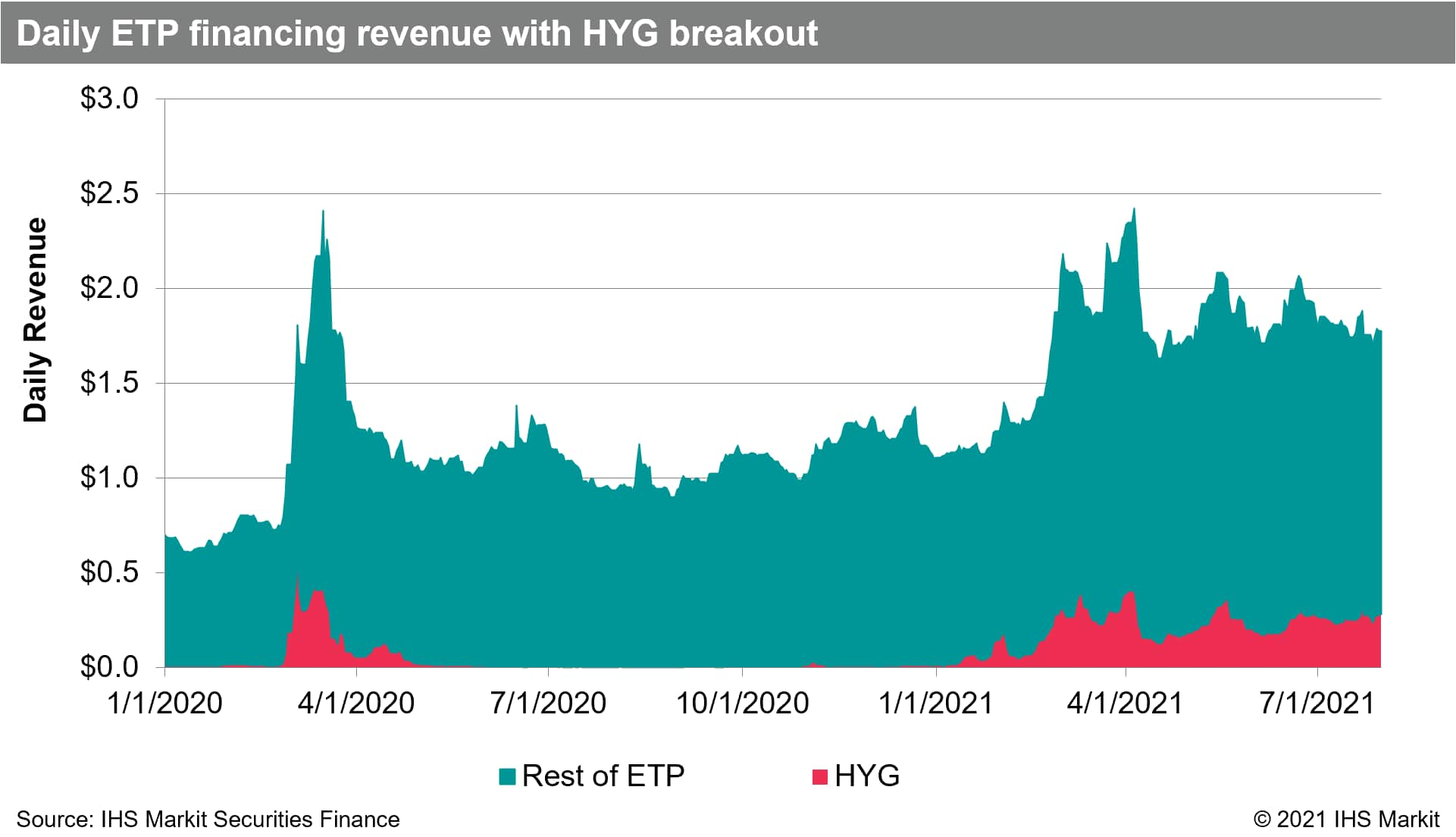

Global ETP revenues totaled $56m for July, a 72% YoY increase. Loan balances set new high monthly average balance of $99.8b, the third consecutive month to set a new record. Lendable asset values also set a new all-time monthly average high of $478bn. The iShares iBoxx $ High Yield Corporate Bond Fund (HYG) continues to be the most revenue generating exchange traded product, with $8m in July revenue, 14.5% of all ETP revenue. ETP specials balances continued to slide from the March YTD peak in March, with July having the lowest average special balances since February 2020; the decline in specials in July was partly driven by declining share prices for emerging market products.

Conclusion

Global securities finance revenues took a step back in July, declining by 4.7% YoY. A similar boom-bust trajectory for US equities observed in June and July 2021 as was observed in 2020, although the 2021 July drop-off was more severe. The decline in EMEA revenues was driven by both a lack of equity specials in 2021 and the delay of some dividend payouts in 2020 which boosted July revenues of that year. The uptrend in APAC revenues has been driven by emerging markets, with Taiwan and South Korea posting the most monthly revenue YTD in July. Borrow demand for ADRs and ETPs continue to boost global returns in what is likely to be a record setting year for revenues in both asset classes. The summer months are typically slow for capital markets activity, with August 2020 having the lowest global revenue for any month of 2020. July revenues underwhelmed mostly as a result of lower returns for US and EMEA equities. Whether August will repeat as the least revenue generating month of the year remains to be seen, however the uptrends in demand for APAC EM, ADRs and ETPs are supportive of growth and the presence of several recent IPOs as well as SPACs seeking business combinations will likely provide lucrative lending opportunities for the remainder of 2021.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-july-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-july-2021.html&text=Securities+Finance+July+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-july-2021.html","enabled":true},{"name":"email","url":"?subject=Securities Finance July 2021 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-july-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Securities+Finance+July+2021+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-july-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}