Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Mar 09, 2023

Weekly Pricing Pulse: Marginal gain for commodities amid subdued trading

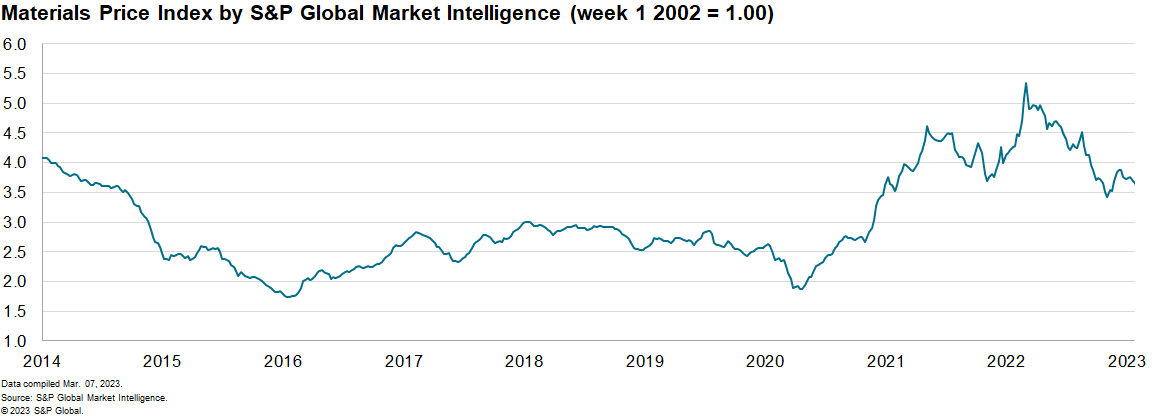

The Material Price Index (MPI) by S&P Global Market Intelligence increased 0.1% last week, its first rise since mid-January. The increase was mixed with only six of the ten subcomponents climbing. The MPI still sits 30% lower year on year (y/y). Prices, however, remain far higher (40%) than the pre-pandemic levels of the fourth quarter 2019.

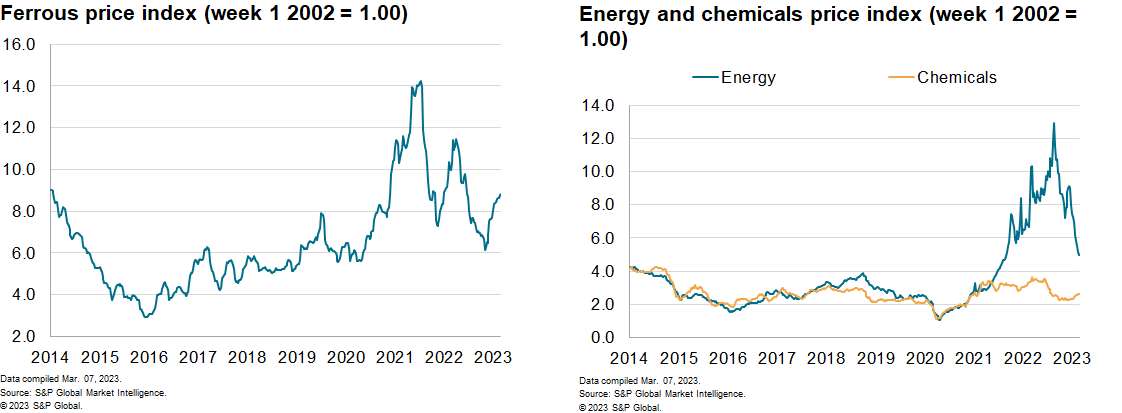

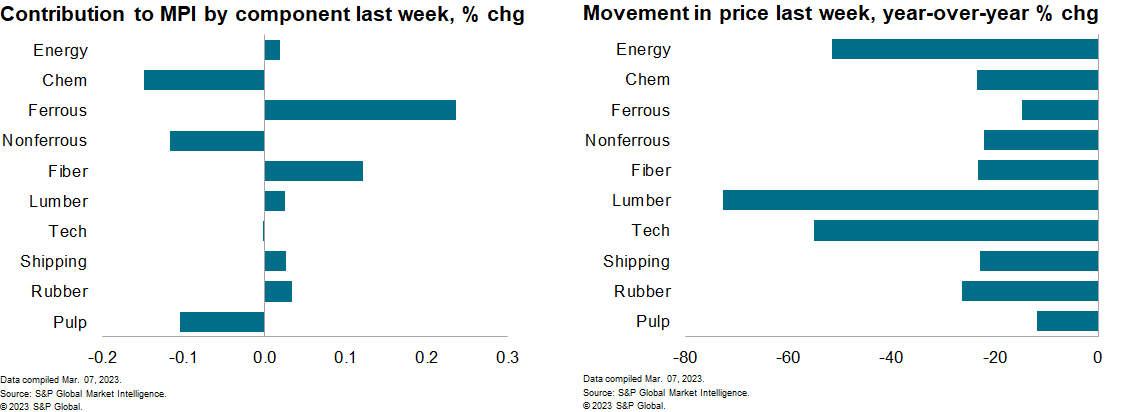

A rebound in oil prices was the single largest upward move across commodity markets last week. Brent crude oil, the international benchmark, climbed to $85/barrel having been as low as $80/barrel the previous week. Traders were optimistic on Chinese growth ahead of the opening of the Chinese parliament (on 5 March.) Markets were pricing in the announcement of a series of supportive economic policies that would boost oil demand. The Chinese government announced a growth target of 5% for 2023 providing room for structural reforms and high-quality, long-term growth. This may impact oil prices during the trading week. Nonferrous metals were the biggest decliner last week with the sub-index down 1.2%. Tin prices on the London Metal Exchange dipped to $24,000/tonne, from $26,800/tonne the previous week. The resolution of a dispute over export licenses for Indonesian traders and the return of a Peruvian mine after production outages boosted supply and placed downward pressure on prices.

Markets continue to grapple with mixed signals on global economic growth. In the US, seasonally adjusted initial claims for unemployment insurance decreased 2,000 to 190,000 in the week ended 25 February. After falling to multi-month lows in January—in line with January's unexpectedly strong employment report—initial claims continued to remain at a very low level in February. This was taken as a sign that central banks will continue to implement aggressive interest rate rises in 2023. In the US, S&P Global Market Intelligence expects three more quarter-point rate hikes that will take the top of the target range for the federal funds rate to 5½% by midyear. There was some support for commodity prices last week as global manufacturing output returned to growth in February after six months of decline, according to the JPMorgan Global Manufacturing Purchasing Managers' Index™ (PMI™) compiled by S&P Global. This is still only indicating a modest increase in production. This, combined with falling energy costs for producers, will ultimately lead to lower commodity prices overall this year.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpricing-pulse-marginal-gain-commodities-subdued-trading.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpricing-pulse-marginal-gain-commodities-subdued-trading.html&text=Weekly+Pricing+Pulse%3a+Marginal+gain+for+commodities+amid+subdued+trading+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpricing-pulse-marginal-gain-commodities-subdued-trading.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Marginal gain for commodities amid subdued trading | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpricing-pulse-marginal-gain-commodities-subdued-trading.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Marginal+gain+for+commodities+amid+subdued+trading+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpricing-pulse-marginal-gain-commodities-subdued-trading.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}