Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Mar 09, 2023

Banking risk monthly outlook: March 2023

Our banking risk experts provide insight into events impacting the financial sector in emerging markets in March.

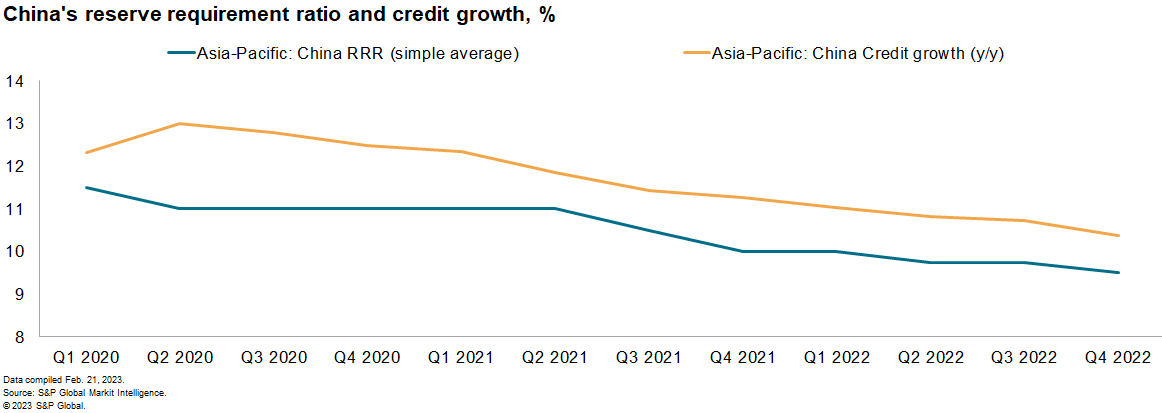

- Further credit boosting policies including reserve requirement ratio cut is likely in mainland China

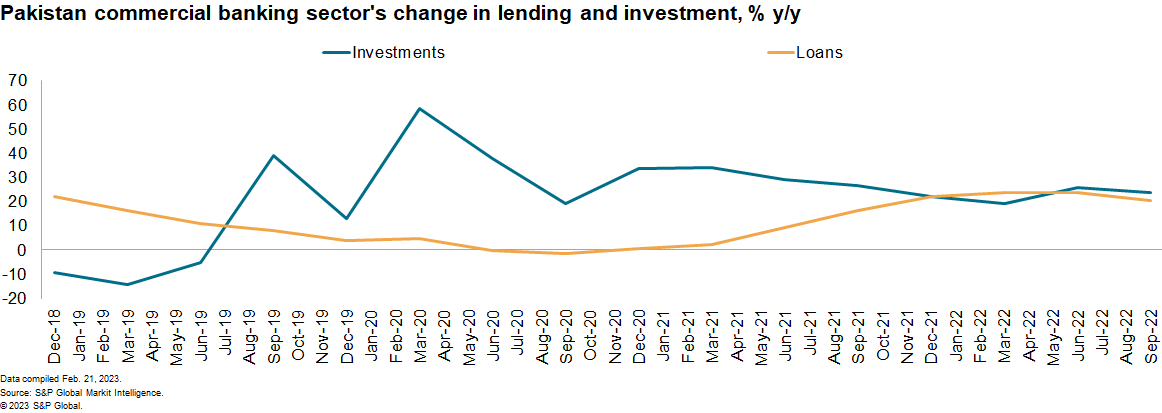

- Pakistani banks are likely to issue more letters of credit soon after restrictions are lifted

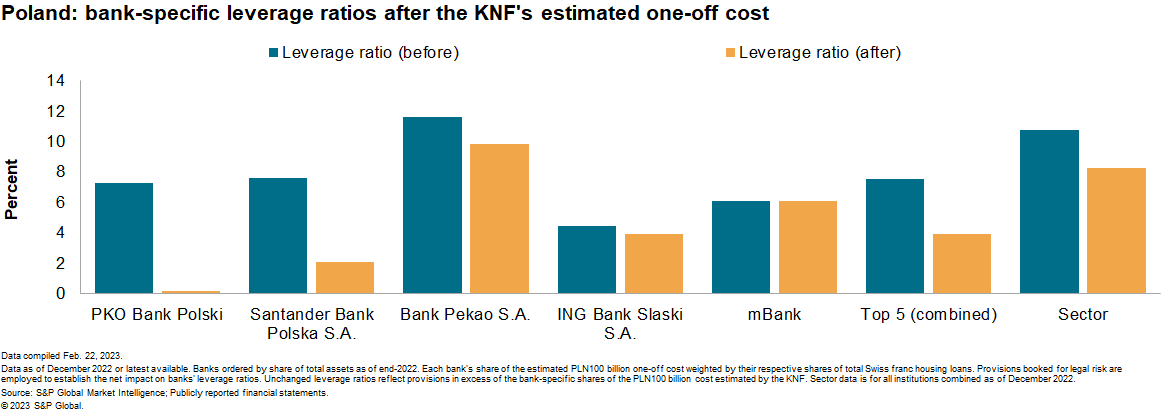

- Upcoming EU court ruling threatens Polish sector's capital adequacy and bank insolvencies

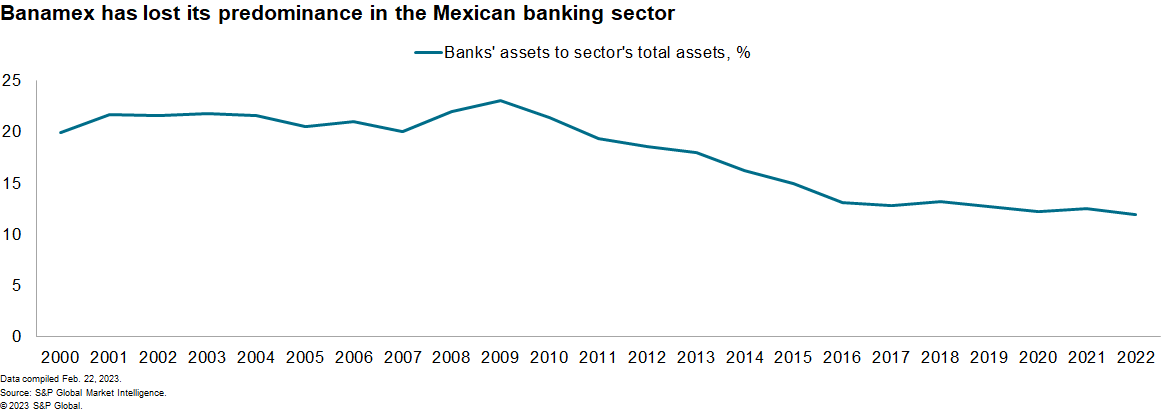

- Sale of Citibanamex being finalized, changing the structure of the Mexican sector

- Privatization plan for the Egyptian state-owned banks to generate non-debt cash for the government

Cutting the reserve requirement ratio will boost lending to the Chinese economy.

The People's Bank of China last lowered the reserve requirement ratio (RRR) by 0.25% in November 2022. Since the withdrawal of the COVID-19 restrictions at the end of 2022, the rate of loan disbursements has improved; however, as China's inflation remains low and deposits remain high, it is likely that the authorities will embark on further stimulus, including a RRR cut in Q1 and Q2 of 2023. A 1 percentage point cut in RRR will release liquidity equivalent to around CNY2 trillion (USD290 billion) or 1% of total loans as of 2022.

Pakistani banks are likely to issue more letters of credit soon after restrictions were lifted.

The restrictions on issuing letters of credit (LC) were lifted in January 2023 after being introduced in 2022. There are still complaints in the country about the lack of ability to obtain an LC, which are likely to ease in the coming quarters, but this is conditional on IMF funding. Notably, the LCs are not loans but are considered liabilities on the banks' balance sheets, this is unlikely to impact on banks' loan disbursements.

Forthcoming EU court verdict on legacy Swiss Franc mortgages threatens the Polish sector's capital adequacy and potentially bank insolvencies.

The Court of Justice of the European Union is expected to make a final ruling over the course of 2023, potentially before the July judicial recess. An adverse ruling would entail an estimated one-time PLN100 billion cost for the banking sector to be recognized immediately, according to the Polish sector's bank supervisor. Costs of this magnitude threaten the capital buffers of the sector but more acutely those of the largest, most systemically important institutions that have a much larger stock of Swiss Franc mortgages left on their balance sheets. Our analysis suggests the largest two banks could breach minimum regulatory requirements, reflecting their current capital levels, legal risk provisions, and share of the sector's total Swiss franc housing loans. S&P Global Market Intelligence changed Poland's banking risk score from Stable to Negative, as a result.

The sale of Citibanamex is being finalized, changing the structure of the Mexican banking sector.

After announcing the sale of its Mexican branch in the beginning of 2022, Citi has received several offers for Citibanamex. The last years had been difficult for the branch, which has been reduced to the third-largest bank by assets, from being the largest in 2017. The sale has not been frictionless, with the president pronouncing itself against any foreign actor purchasing the bank and offers for the bank being limited and below the expected price. The media has been speculating about an announcement of the buyer coming soon. We expect that there will be further details about the acquisition over March, bringing greater detail about the future of the structure of the Mexican banking sector.

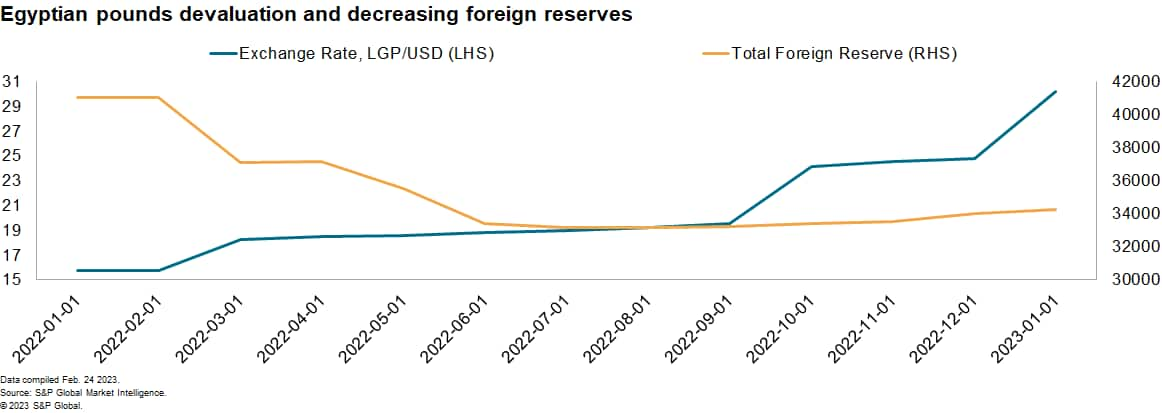

Sales of government stakes in banks will be prioritized by the Egyptian authorities to free up non-debt cash for upcoming debt repayments.

Acquiring fresh cash via the privatization of state-owned entities will be critical for the government to meet upcoming (external) debt repayments and IMF targets in light of foreign currency shortages and local currency depreciation of more than 50% over 2022. Upon revealing its plans to sell stakes held in 32 state-owned companies, the Egyptian government has begun serious talks with various international buyers, including for the stakes held in the United Bank and Bank of Alexandria. We expect numerous transactions to be announced or finalized over the first half of 2023. Banque du Caire and Arab African International Bank (AAIB) will be the next two banks to be privatized by the Egyptian government. We expect more details about sales of mentioned banks and resolutions of transaction hurdles in March 2023.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanking-risk-monthly-outlook-march-2023.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanking-risk-monthly-outlook-march-2023.html&text=Banking+risk+monthly+outlook%3a+March+2023+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanking-risk-monthly-outlook-march-2023.html","enabled":true},{"name":"email","url":"?subject=Banking risk monthly outlook: March 2023 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanking-risk-monthly-outlook-march-2023.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Banking+risk+monthly+outlook%3a+March+2023+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanking-risk-monthly-outlook-march-2023.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}