Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 09, 2023

Monthly PMI Bulletin: November 2023

The following is an extract from S&P Global Market Intelligence's latest Monthly PMI Bulletin. For the full report, please click on the 'Download Full Report' link.

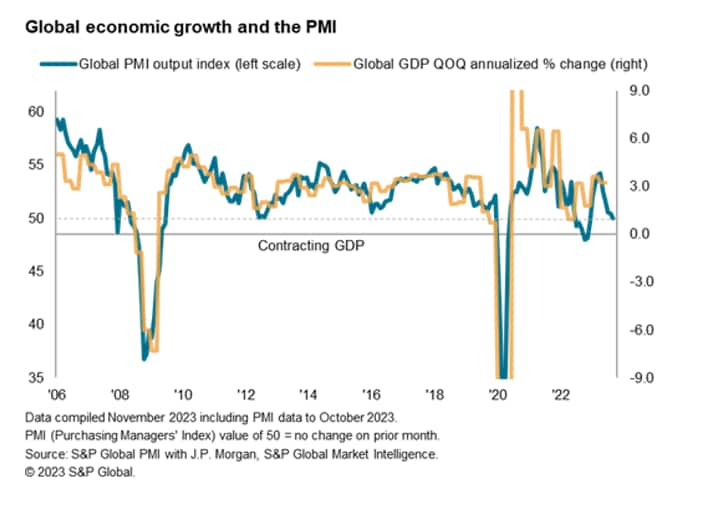

The global economic expansion stalled at the start of the fourth quarter, concluding the eight-month growth streak. This was as new orders recorded a second consecutive, and sharper, fall in October. An easing of price pressures was a more welcome development.

The J.P.Morgan Global PMI Composite Output Index - produced by S&P Global - fell to the neutral mark of 50.0 in October, down from 50.5 in September. This signalled the conclusion of the growth streak that had commenced February 2023. The current reading takes the PMI further below the survey's long-run average of 53.2 and is broadly consistent with annualized quarterly global GDP growth of just under 1%, which is well below the pre-pandemic ten-year average of 3.0%.

The manufacturing sector continued to underperform relative to services. Global factory production shrank for a fifth straight month, and at a more pronounced pace, at the start of the fourth quarter. An absence of demand growth remained the key factor weighing on goods production. This was as softening economic conditions and high interest rates limited purchases from clients and destocking policies remained widespread. Additionally, global trade conditions continued to worsen, adding to the prolonged deterioration in manufacturing sector operating conditions.

Meanwhile service providers continued to see business activity grow, but at the softest pace since the sector's expansion renewed in February. The factors dampening the demand for goods have increasingly affected services going into Q4, leading to the sharpest fall in services new business in ten months.

Amidst cooling demand, however, the global PMI revealed that selling prices were found to have risen at the slowest rate since December 2020. The easing of inflationary pressures bodes well for customer spending power in the coming months, though price levels remain high, contributing to a further dampening of business confidence in October, bringing the focus back to demand to watch for any turnaround. The next release of flash November PMI will be on November 23-24.

© 2023, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmonthly-pmi-bulletin-november-2023.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmonthly-pmi-bulletin-november-2023.html&text=Monthly+PMI+Bulletin%3a+November+2023+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmonthly-pmi-bulletin-november-2023.html","enabled":true},{"name":"email","url":"?subject=Monthly PMI Bulletin: November 2023 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmonthly-pmi-bulletin-november-2023.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Monthly+PMI+Bulletin%3a+November+2023+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmonthly-pmi-bulletin-november-2023.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}