Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 12, 2023

Monthly PMI Bulletin: July 2023

The following is an extract from S&P Global Market Intelligence's latest Monthly PMI Bulletin. For the full report, please click on the 'Download Full Report' link.

The global economic expansion decelerated at the end of the second quarter as a renewed contraction in manufacturing output was accompanied by the slowest growth of service sector activity growing for four months. Diverging sector prices trends also persisted, keeping overall global price inflation elevated, albeit moving lower.

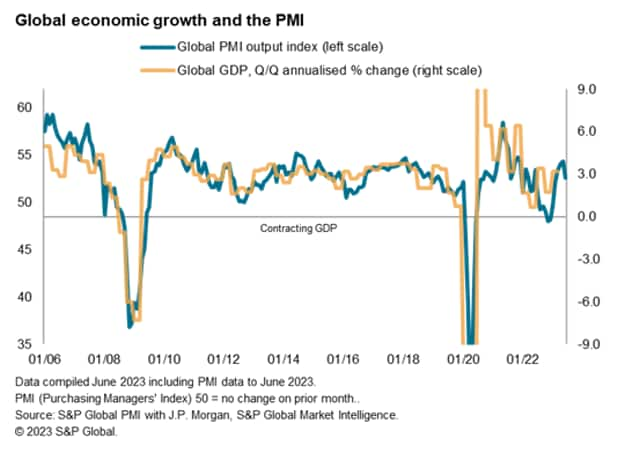

The J.P.Morgan Global PMI Composite Output Index - produced by S&P Global - posted 52.7 in June, down from 54.4 in May. This marked the first slowdown in the expansion of the global economy since growth commenced in February. The current reading is broadly consistent with solid annualized quarterly global GDP growth of 3%.

The service sector remained the primary driver of the global economic expansion in June. That said, the pace of global services growth slipped to a four-month low amid signs of weaker consumer demand growth. Slower new business inflows for service providers underpinned the latest change, though demand was sufficiently strong to drive prices charged for services higher at a historically elevated rate.

The state of weakening demand conditions is far more severe among goods producers, however, as new order inflows into factories declined globally for a twelfth consecutive month in June and at the sharpest rate since January. A dearth of demand, coupled with the exhaustion of backlogged orders into the mid-year, led to global goods producers paring back production for the first time since January. This weak demand led to increasing numbers of producers offering discounts, driving factory gate prices lower for a second straight month.

Amid this slowdown in services in supporting growth and renewed weakness in manufacturing production, we will be keeping an even closer eye on the global growth trajectory starting with flash July PMI from July 24th.

© 2023, S&P Global Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmonthly-pmi-bulletin-july-2023.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmonthly-pmi-bulletin-july-2023.html&text=Monthly+PMI+Bulletin%3a+July+2023+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmonthly-pmi-bulletin-july-2023.html","enabled":true},{"name":"email","url":"?subject=Monthly PMI Bulletin: July 2023 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmonthly-pmi-bulletin-july-2023.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Monthly+PMI+Bulletin%3a+July+2023+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmonthly-pmi-bulletin-july-2023.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}