Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jul 26, 2022

Mexico nearshoring potential for critical minerals

Mexico is particularly well placed to benefit from companies relocating their operations closer to their main destination markets (nearshoring), a response to recent supply chain shocks from the Russia-Ukraine conflict to China's dynamic COVID containment policy. Given Mexico's strong interdependence with the US economy, materialization of the nearshoring potential across key sectors including semiconductor manufacturing and advanced packaging, critical minerals and pharmaceuticals, would have sizeable impacts and significantly improve Mexico's economic standing beyond the five-year outlook.

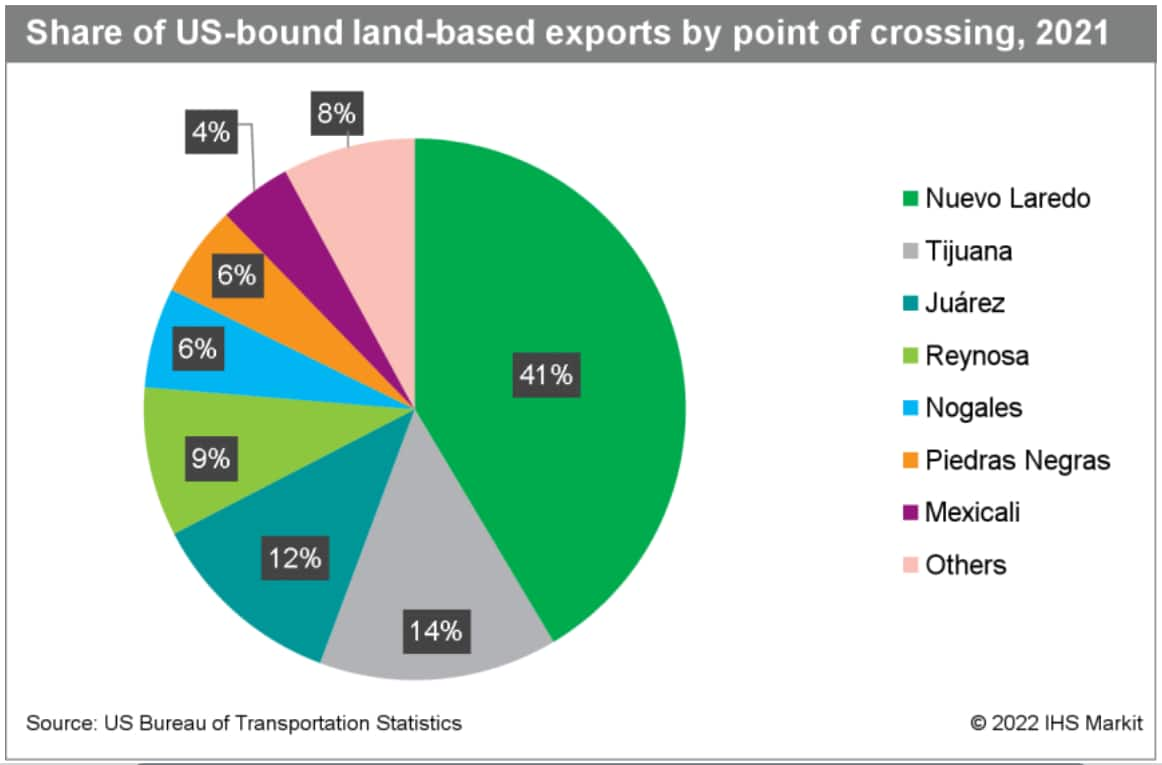

The development of integrated supply chains between Mexico and the US, which cover diverse economic sectors such as manufacturing, automotive, aerospace, agriculture, and textiles, have contributed to Mexico retaining its place as the second largest US trade partner in 2021 (USD661.2 billion) behind Canada's USD664.8 billion and ahead of China's USD657.4 billion. As the two countries share a land border, this has allowed bilateral trade to avoid dislocation from the container and port-related disruptions that have affected global seaborne trade over the past year as almost 88% of US-bound Mexican exports are currently transported by road to the US.

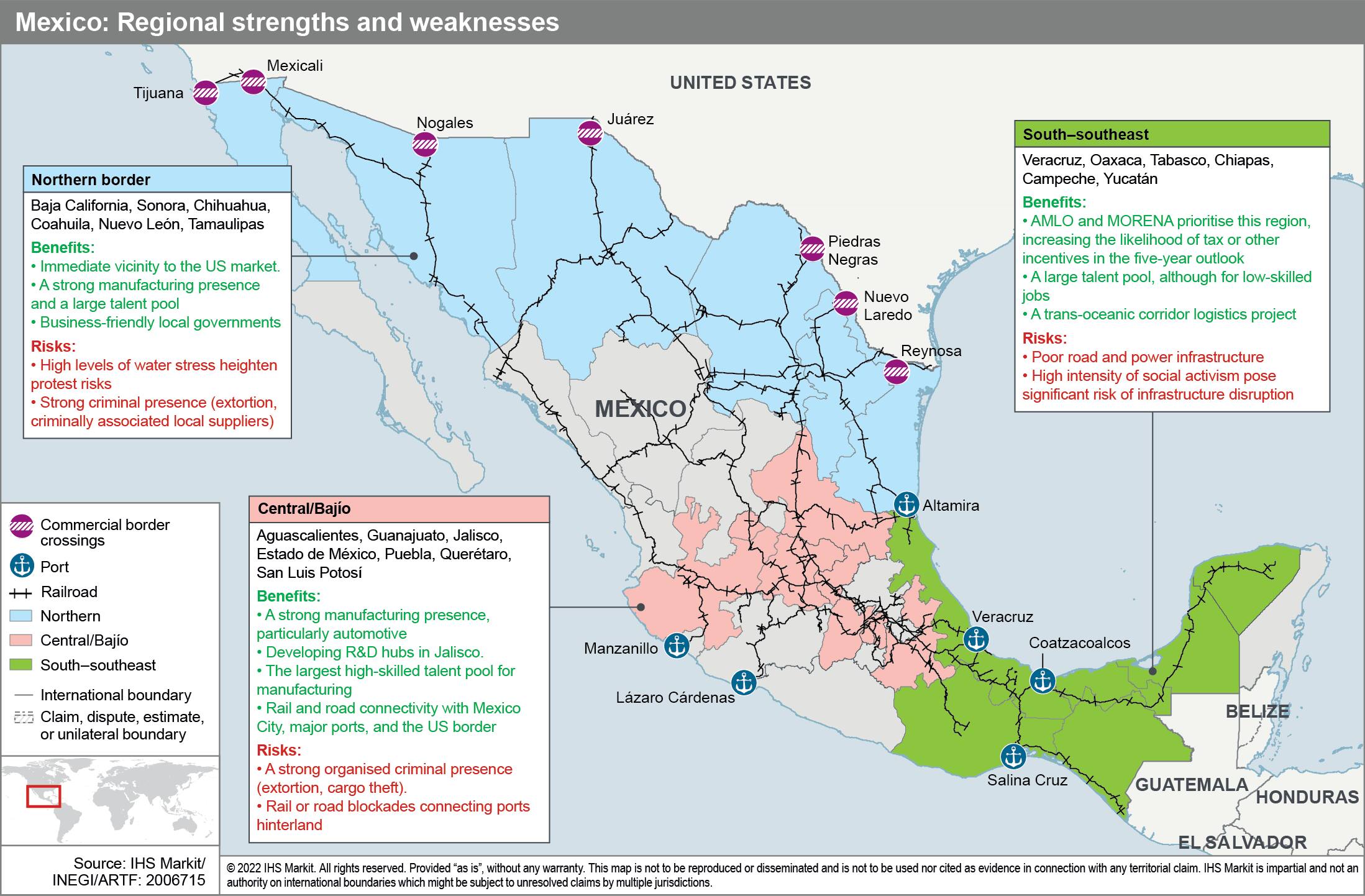

Companies relocating to Mexico in the five-year outlook, however, are still likely to face security-related risks, particularly road cargo theft and extortion. Reported cases of extortion rose by 28% year on year (y/y) nationwide during the first half of 2022, with manufacturing hubs Guanajuato and Nuevo León reporting the greatest increase in incidence. The states of Mexico and Puebla, both part of the Central/Bajío region, account for roughly 70% of all incidents of road cargo theft, whereas automotive components account for more than one-third of all stolen rail cargo. Although criminal hotspots are likely to vary during the next decade in response to security force deployments and regional criminal dynamics, national levels of criminal activity are likely to remain elevated.

Balancing Mexico's strengths and its inherent operational risks, the incentives for nearshoring to Mexico are likely to remain high for companies serving the US market, reflecting US President Joe Biden's supply chain resilience strategy, which aims at securing reliable suppliers in four strategic sectors: 1) semiconductor manufacturing and advanced packaging; 2) high-capacity batteries; 3) critical minerals and rare earth elements; and 4) pharmaceuticals and active pharmaceutical ingredients (API).

Besides Mexico, the US has considered more than a dozen countries, including Canada, India, and the UK as strategic partners for supply chain resilience. Out of those, Mexico is one of only two countries in located in the Western hemisphere (alongside Canada) and its geographical advantage should become increasingly relevant if US security concerns in the East and Southeast Asian Pacific rim deteriorate over the next decade.

Snapshot - Critical minerals

As of 2020, the US Department of Defense identified 58 strategic and critical minerals for which the country was import-reliant.

Mexico has opportunities to carve out a bigger, and more profitable, role for itself as the US seeks to shore up its supplies of these minerals:

- Mexico is among the top three suppliers for 14 of these minerals - and its largest supplier for fluorspar, strontium, and gold.

- Mexican production of most of these minerals has risen in the past five years. That gives Mexico the ability to increase its market share of US imports, particularly for minerals for which the US relies on mainland China, such as graphite, lead and selenium.

- Mexican production of some of these minerals can be integrated into other critical supply chains: examples of where this applies include bismuth for pharmaceutical ingredients and graphite for semiconductor manufacturing.

Potential headwinds include:

- The mining sector faces threats including organized criminal activity, civil unrest, and contract risks. Of these, only contract risks are likely to diminish in the five-year outlook, once current Mexican president Andres Manuel Lopez Obrador (AMLO) leaves office in 2024.

- Out of the four critical minerals - nickel, cobalt, lithium, and manganese - that the Biden administration's resilience strategy lists for the high-capacity battery sector, Mexico only produces manganese, and its current output is modest compared to major global producers.

- Mexico's exploitation of its lithium reserves is underdeveloped versus other Latin American peers like Argentina or Chile. In April 2022, Mexico approved legislation to ban private lithium mining and processing activities and reserve such activity for the state. AMLO has pledged to honor lithium concessions granted before the passage of this legislation. The government's strategy so far is limited to the creation of a state-owned firm.

If AMLO's MORENA party retains power beyond 2024, the policy direction for lithium will almost certainly remain on its current state-oriented path. Although opportunities for international companies directly to mine lithium in Mexico would remain closed, there are still lithium-related opportunities at other stages of the high-capacity batteries supply chain. Roughly, this supply chain has five stages:

- raw material production

- refinement

- battery cell manufacturing

- pack and end-use product manufacturing

- end of battery life and recycling

Beyond the five-year outlook, as Mexico becomes a lithium producer (even if a state-owned company mines and refines the metal), incentives for high-capacity battery manufacturers and end-use product manufacturers to build a domestic supply chain to source the US market are highly likely to increase.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmexico-nearshoring-potential-for-critical-minerals.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmexico-nearshoring-potential-for-critical-minerals.html&text=Mexico+nearshoring+potential+for+critical+minerals+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmexico-nearshoring-potential-for-critical-minerals.html","enabled":true},{"name":"email","url":"?subject=Mexico nearshoring potential for critical minerals | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmexico-nearshoring-potential-for-critical-minerals.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Mexico+nearshoring+potential+for+critical+minerals+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmexico-nearshoring-potential-for-critical-minerals.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}