Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jul 27, 2022

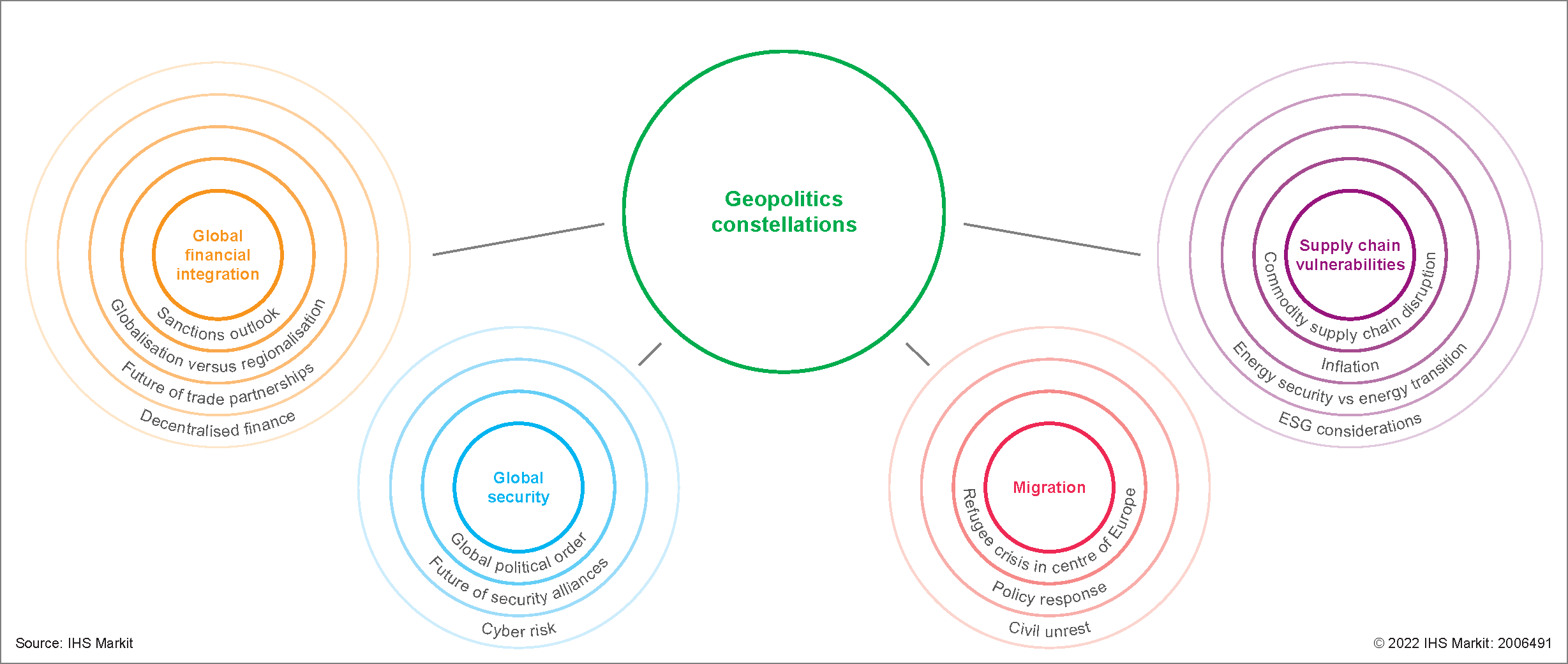

What is driving global volatility: Geopolitical constellations

Looking ahead, the world is painted as becoming more fragmented and brittle. Yet the challenges stakeholders face will be increasingly interlinked and reverberating: Climate change, supply chain interdependencies, making the energy transition, public health, and inequities will impact on each other, requiring coordinated responses. We expect the global political system, including trade and security alliances, to become more fluid and flexible as states co-operate across spheres of mutual interest and contest across spheres of national security.

Geopolitical ripple effects

Global financial integration

- Sanctions imposed on Russian individuals and entities raised reputational risks for businesses operating there, prompting a wave of corporate self-sanctioning. Prospects for Russian sanctions removal and corporate self-sanctioning reviews will depend on conflict trajectories, with additional Russian escalation increasing the risks further.

- Inflationary pressures amplified by the Russia-Ukraine conflict and monetary policy tightening in developed markets led central banks to adopt a broad rethink of monetary policy. A wide range of Sub-Saharan Africa (Botswana, Ghana, Kenya, Malawi, Nigeria, South Africa, Uganda plus member states of the West African Economic and Monetary Union), is also seeing tighter monetary policy, with higher inflation likely to drag on overall economic activity.

Supply chain vulnerabilities

- As a major agricultural producer, including among the world's largest corn and wheat exporters in 2021, damage to Ukrainian infrastructure, blockades of the country's ports arising out of the conflict with Russia, raised anxiety around global food security, particularly for key import markets in the Middle East.

- Concerns over energy security arising out of Russia's invasion of Ukraine has elevated questions over the energy transition timeline. In the nearer term, we expect to see a widening gap between those that can accelerate energy transitions and those less well-positioned. Still, financial markets and the private sector are likely to be key drivers toward net-zero in the pivotal window up to 2035 which will determine whether mid-century targets will be achievable.

- China's ongoing COVID containment policy has driven down its trade volume with knock-on impacts for global supply chains, ahead of this year's consequential 20th Chinese Communist Party (CPC) Congress. We expect the "swift and decisive" regional COVID-19 containment responses to remain through 2022.

- The United States' supply chain resilience strategy for key sectors - semiconductors, critical minerals, high-capacity batteries and pharmaceutical - is accelerating efforts to relocate production away from mainland China and into geographies closer to the US market or considered by the US administration to be allies.

Global Security

- The United States placing high importance on its Indo-Pacific strategy has generated a series of intelligence-sharing, security, and trading proposed initiatives including the Indo-Pacific Economic Framework and a proposed Partnership for Global Infrastructure and Investment to offset growing Chinese influence in the region.

- The Russia-Ukraine conflict contributed to the establishment of a new North Atlantic Treaty Organization (NATO) Strategic Concept and drove Sweden and Finland to seek alliance membership, with accession for the two likely to be ratified on an accelerated basis.

- The negative economic effects of COVID-19, combined with the economic shocks caused by high inflation, supply chain disruptions and high energy costs, is likely to raise global political and unrest risks over the coming six months. Countries such as Ecuador and Sri Lanka have already experienced such instability with others such as Peru, Argentina, Pakistan, Tunisia and Lebanon amongst the countries facing the highest risks.

Migration

- Russia's invasion of Ukraine produced a mass population exodus with more than 5.5 million individual refugees recorded across Europe and up to a further 10 million internally displaced within Ukraine, leaving the international community to address a migration crisis at the center of Europe, likely to impact continental policy response, labor markets with sectoral impacts in the years ahead.

With analysis from Natznet Tesfay, Alex Kokcharov, Todd Lee, Yating Xu, Lei Yi, Thea Fourie, Laurence Allan, Petya Barzilska, Dijedon Imeri, Carlos Cardenas, Rafael Amiel, Emily Crowley, Jose Sevilla-Macip, Deepa Kumar, Asad Ali, Jack Kennedy, Blanka Kolenikova

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-volatility-geopolitical-constellations.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-volatility-geopolitical-constellations.html&text=What+is+driving+global+volatility%3a+Geopolitical+constellations+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-volatility-geopolitical-constellations.html","enabled":true},{"name":"email","url":"?subject=What is driving global volatility: Geopolitical constellations | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-volatility-geopolitical-constellations.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=What+is+driving+global+volatility%3a+Geopolitical+constellations+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-volatility-geopolitical-constellations.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}