Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Feb 28, 2024

Logistics disruptions’ impact on apparel supply chains

Learn more about our Supply Chain Console

The sourcing patterns and seasonality of the apparel industry have left firms exposed to the shipping disruptions caused by violence in the Red Sea.

Shipments from Asia by sea that may need to use the Suez or Panama Canals accounted for 51.0% of EU imports of apparel and footwear in the 12-months to Nov. 30, 2023. In the case of the US, the ratio is lower at 30.7% as only shipments to US east coast counted.

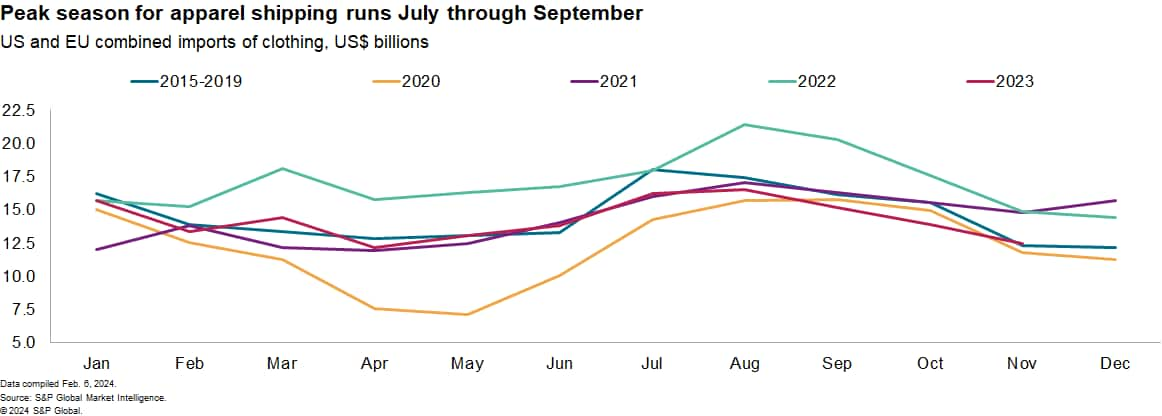

The seasonality of apparel supply chains means delays will become a bigger factor during the July-September peak season for sales running from back-to-school to Black Friday. Given shipping times of around five to six weeks normally have likely increased to at least eight weeks, that would suggest winter peak season shipments need to leave Asian ports from mid-May 2024, requiring purchase and production decisions to be made in April at the latest.

Analysis of S&P Global CapitalIQ machine-readable, corporate earnings call transcripts using ProntoNLP's no-code natural language processing tools shows the proportion of firms discussing supply chains in a neutral light —suggesting a "don't yet know" stance — rose to the highest level since the first quarter of 2020 in the first quarter of 2024. The proportion flagging positive supply chain effects fell to 39% from 50% in the fourth quarter. The proportion of firms mentioning supply chains in a negative manner has also fallen, to 12% in the first quarter from 19% in the fourth quarter. That may indicate a "watching brief" whereby firms have recognized the emerging challenges but are not yet willing to enumerate the impact.

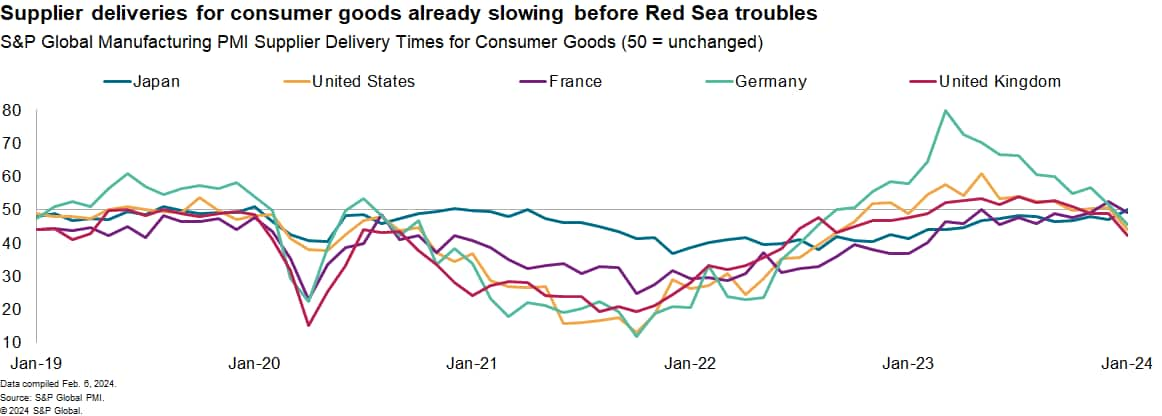

Manufacturers are already experiencing slower supplier delivery times, according to S&P Global Purchasing Managers' Index (PMI) data. Supplier delivery times for consumer goods manufacturers' more broadly have fallen to their slowest since June 2022.

A detailed review of 10 firms that have made a directional call on the impact of disruptions shows higher costs are a bigger challenge than delays at this stage. Spot container rates on Asia-to-US east coast routes have increased by 165% on Feb. 5 from Dec. 1, 2023, S&P Global Commodity Insights data shows. Long-term contracts may mitigate the impact of short-term container rate rises, but also run the risk in embedding higher costs for longer should spot rates remain elevated.

Options to tackle the higher costs, delays and uncertainty include absorb the costs against earnings, change transportation routes or modes, carry more inventories, and alter sourcing practices. Comments from other consumer goods industries suggest firms may be willing to offset higher shipping expenses against reduced costs elsewhere (see Fewer shelves on the shelf: Red Sea disruptions' impact on furniture supply chains). However, there are prospects for higher underlying costs just as logistics expenses start to rise. While cotton is expected to drop by another 2% in 2024, synthetic fiber costs are expected to increase, leading producer prices higher.

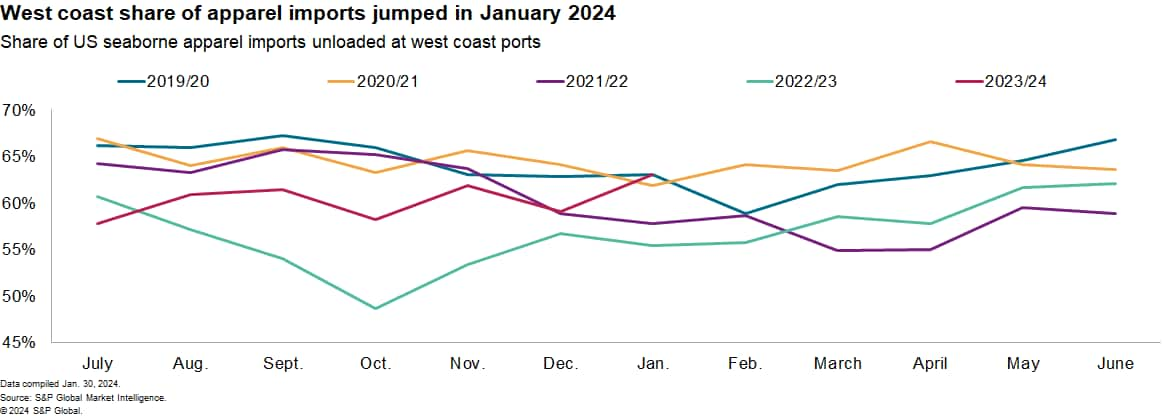

Managing future inventory risk can involve adapting logistics strategies. Importers in the US have the option to ship into the west coast from Asia, thereby avoiding both sets of canal challenges. The proportion of US apparel imports headed to the west coast ports already increased to 63.1% in January 2024, the highest since November 2021. There had previously been a downturn in shipments to the US west coast due to concerns about strikes, which crystallized in summer 2022. East coast ports face strike risk later in 2024.

Air freight is another option, though the proportion of apparel imported to the US and EU fell in 2023 to below the pre-pandemic era. The use of air freight tends to be highest during the spring/summer peak, so it may be a few months before the true picture of air freight adoption becomes clear. Shippers into Europe also have the option of using land transportation from Asia, most notably using rail freight. The capacity on such alternatives is minimal and apparel firms will need to compete for capacity with potentially deeper-pocketed automotive sector users.

Shifting sourcing strategies includes boosting inventories and diversifying supplies, though those add costs while cutting risk, leaving them out of favor in a high-cost environment. The inventory-to-sales ratio of the 50 largest apparel firms globally fell to 73.6% in the past quarter, down from 78.1% a year earlier but above the pre-pandemic level. Diversification, measured by suppliers per buyer in US import data, fell to 81% of the 2019 level in 2023 from 129% in 2022. That reduction is likely linked to cost cutting.

Diversification is more effective if combined with adding additional geographies for sourcing, i.e., reshoring. That process can take years rather than months and is a dynamic process as costs and operational risks shift.

Sign up for our Supply Chain Essentials newsletter

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2flogistics-disruptions-impact-on-apparel-supply-chains.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2flogistics-disruptions-impact-on-apparel-supply-chains.html&text=Logistics+disruptions%e2%80%99+impact+on+apparel+supply+chains+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2flogistics-disruptions-impact-on-apparel-supply-chains.html","enabled":true},{"name":"email","url":"?subject=Logistics disruptions’ impact on apparel supply chains | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2flogistics-disruptions-impact-on-apparel-supply-chains.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Logistics+disruptions%e2%80%99+impact+on+apparel+supply+chains+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2flogistics-disruptions-impact-on-apparel-supply-chains.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}