Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Feb 20, 2024

Economic implications of trade rerouting since Russia–Ukraine war

Learn more about our Supply Chain Console

Since the outbreak of the Russia-Ukraine war, EU export flows have been increasingly reoriented towards other economies in Eastern Europe and Central Asia. This reorientation has boosted associated trade and transport services, cut competition for native exports to Russia, and awakened previously dormant investment in the region.

Since March 2022, EU trade sanctions have nearly halved the bloc's goods exports to Russia and Belarus. Over the same period, the share of EU exports captured by the rest of Eastern Europe and Central Asia (EECA, excluding Ukraine) has grown from 0.8% to 1.2%, worth around €25 billion of additional goods flowing to the region.

The likelihood of a negotiated settlement to the Russia-Ukraine war remains low over the short term, pointing to a prolonged conflict and trade sanctions. The trade diversion and influx of economic activity will have a longer-lasting impact beyond the current war. Previously dormant investment in infrastructure, IT, and production is awakening. Any improvements in infrastructure and/or local production boost longer-term growth potential. The governments must walk a thin line between reaping the added economic benefits of maintaining connections with Russia and the rest of the world while avoiding secondary sanctions.

Kyrgyzstan

Diverted trade has had a relatively large impact on the small Kyrgyz economy, driving increases in trade and transportation services and buoying investment in the country. Kyrgyz national bank data reflects the uptick of imports from Europe as well as a rise from Georgia. Exports to Russia also jumped in 2022 and 2023 compared to previous years.

The new trade activity passing through Kyrgyzstan is adding prominently to local economic growth. We estimate diverted trade provided a 4% net positive boost to 2022 overall nominal GDP. The additional activity contributed to an increase in the value added to GDP from the transportation and storage service sector and in the value added to GDP from wholesale and retail trade.

Kyrgyz authorities, looking to seize upon the opportunity that the new trade affords, are pushing forward with efforts to build out the Chinese-Kyrgyz-Uzbek rail line to increase its connections and, eventually, reach new trade markets. This would likely further boost Kyrgyzstan's position as a transit point of trade into Russia, while simultaneously offering Kyrgyzstan new export markets, reducing trade dependence on Russia. Financing and planning for the project remains unclear with no set timetable in place.

Armenia

Since the start of the war in Ukraine, and the ensuing Russian economic troubles, Armenia's economic growth trajectory has dramatically decoupled from that of Russia for the first time in nearly three decades. The previous pattern of recession spilling over into Armenia from Russia is no longer the case. As Russian real GDP fell into contraction in 2022, Armenian real GDP growth peaked at 12.1%, and is likely to have expanded at an annual average rate of 8.9% in 2023. Increased exports helped Armenia narrow but not close its trade gap with Russia.

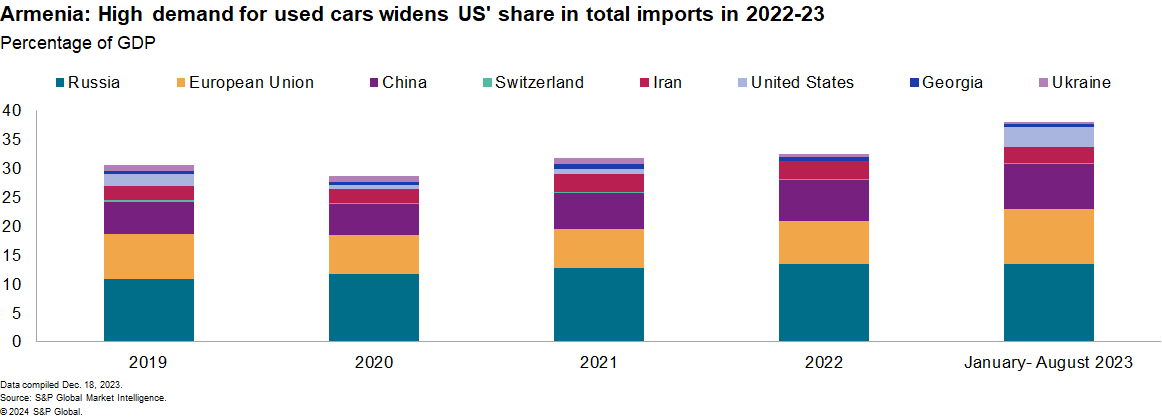

The key structural change has been the 95% increase in the number of registered IT companies. Since early 2022, according to Armenia's Ministry of Economy, over 2,000 IT firms and around 70,000 IT professionals have moved to Armenia from Russia. Apart from the inward migration of small businesses, several large Western firms have also located in Armenia. This influx of businesses has increased imports from the EU and US of communication and knowledge intensive goods, sanctioned for export to Russia, but not for Armenia's expanding IT sector. That said, in 2022 at least one company and a Russian subsidiary operating in Armenia were included in the US sanctions list.

Although the rerouting of trade in non-sanctioned goods presents new opportunities for Armenia, this may be short-lived as diplomatic acrimony between Russia and Armenia deepens. The diplomatic fallout with Russia risks undercutting the bilateral goods trade and tightening Armenian authorities' control over potential sanctions evasion. We expect minimum negative impact on the services and, especially, the IT sector, key benefactors of the structural shifts in Armenian economy.

Kazakhstan

In Kazakhstan, the impact on an already large energy economy is limited, even as the sheer volume of new trade flowing through the country is larger than through its peers. As the country with the greatest direct trade links to Russia, new transport and trade services are growing. An alternative east-west trade corridor is also emerging.

The Bureau of National Statistics is noting the uptick in foreign trade from Europe and to Russia. Imports from the EU increased to 4.9% of total Kazakh imports in January-September 2023 — up from less than 3% as of 2021. Russian imports were largely unchanged, resulting in higher overall imports to the country. The official Kazakh statistical bureau also registers an uptick of shipments to Russia, but only marginally. It is important to note that this data reflects officially registered trade only, and that unregistered trade is also likely. Kazakh authorities have repeatedly committed to cracking down on the trade of sanctioned goods with Russia.

The added trade has had a notable effect on the Kazakh transport and storage sector. In January-September 2023, the Bureau of National Statistics reported a 3.2% year-over-year increase in total freight traffic. Because the country exports so much energy via pipelines, however, the headline figure obscures a reported 10.4% year-over-year increase in road freight in the first three quarters of 2023. Higher imports from the EU and steady exports to Russia did result in a narrowing of the Kazakh trade surplus in 2023.

Georgia

Georgia's trade turnover with Russia has increased since the start of the Ukraine war. Although the two countries have not had diplomatic ties since the 2008 war, Georgia has refused to join Western sanctions against Russia. Georgian officials have said that the US$1 billion annual bilateral trade with Russia is critical for Georgia's economic stability and is insignificant to Russia.

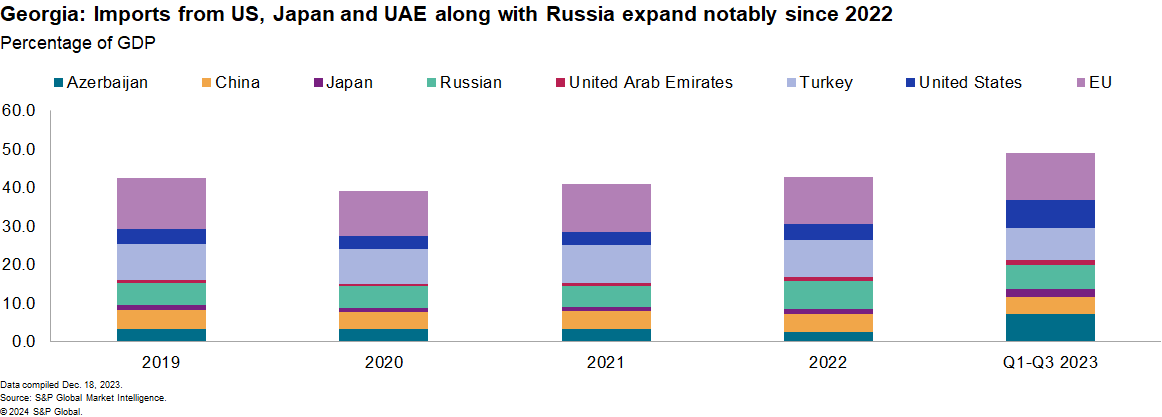

Georgia's real GDP has been posting robust growth since the start of the war, up by 10.1% in 2022 and estimated to have expanded by 7.8% in 2023. The economic boost has come by way of inflow of capital, skilled labor, and increased trade both in goods and services. Georgia is not part of the Russia-led Customs Union, but its geographic proximity to Russia has given the country a notable role in the rerouted trade, including for goods movement from Armenia and Turkey to Russia.

Georgia has emerged as a key destination for Russian business, including for the IT sector. In 2022, 15,000 Russian companies were registered in Georgia, marking a 16-fold increase from the previous year. Much like in the case of Armenia, this influx of business has also boosted imports of capital goods, especially from the EU.

Tensions over the sanctions' implementation has a direct impact on Georgia's relation with the IMF. The latter has already suspended its US$289 million stand-by arrangement with Georgia, and has signaled that its resumption will also depend on full adherence to the sanctions regime. Rerouting of non-sanctioned goods through Georgia and the country's robust services exports are likely to remain in place in the coming years, providing an important growth impulse to the economy.

Learn more about our economic data and forecasts

Check out our top 10 economic predictions for 2024

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feconomic-implications-of-trade-rerouting-since-ukraine-war.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feconomic-implications-of-trade-rerouting-since-ukraine-war.html&text=Economic+implications+of+trade+rerouting+since+Russia%e2%80%93Ukraine+war+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feconomic-implications-of-trade-rerouting-since-ukraine-war.html","enabled":true},{"name":"email","url":"?subject=Economic implications of trade rerouting since Russia–Ukraine war | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feconomic-implications-of-trade-rerouting-since-ukraine-war.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Economic+implications+of+trade+rerouting+since+Russia%e2%80%93Ukraine+war+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feconomic-implications-of-trade-rerouting-since-ukraine-war.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}