Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jan 28, 2022

Japan IFRS Adoption, Opportunity or Cost for Private Equity Fund Managers?

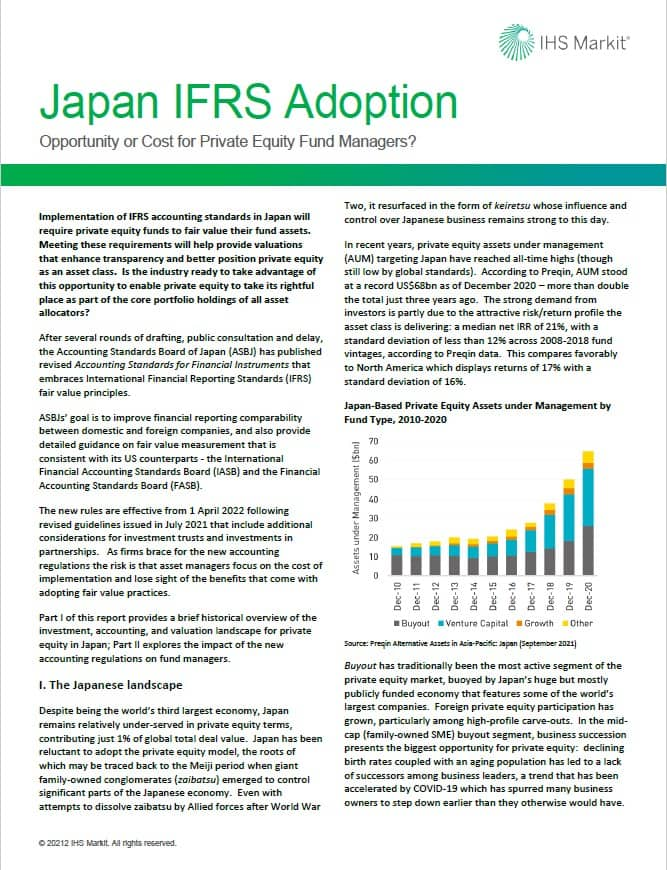

This report discusses the impact of the ASBJs' decision to implement IFRS Fair Value reporting standards in Japan, specifically the valuation consideration for managers of private & illiquid investments.

The report looks into the following areas:

- Background and motivation behind the ASBJs' decision

- Historical overview of the investment, accounting and valuation landscape for private equity in Japan

- Impact of the new accounting regulations on the valuation of fund investments

| Download the report (English) | |

|  |

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapan-ifrs-adoption.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapan-ifrs-adoption.html&text=Japan+IFRS+Adoption%2c+Opportunity+or+Cost+for+Private+Equity+Fund+Managers%3f+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapan-ifrs-adoption.html","enabled":true},{"name":"email","url":"?subject=Japan IFRS Adoption, Opportunity or Cost for Private Equity Fund Managers? | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapan-ifrs-adoption.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Japan+IFRS+Adoption%2c+Opportunity+or+Cost+for+Private+Equity+Fund+Managers%3f+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapan-ifrs-adoption.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}