Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Mar 29, 2021

Five things to know about China’s new five-year plan

At the recently concluded National People's Congress annual meeting, the Chinese government released more details of the Fourteenth Five-Year Plan (14th FYP) that will guide China's development policies from 2021 to 2025. Here are five noteworthy elements from the latest five-year plan.

- No growth target was set for the 14th FYP.

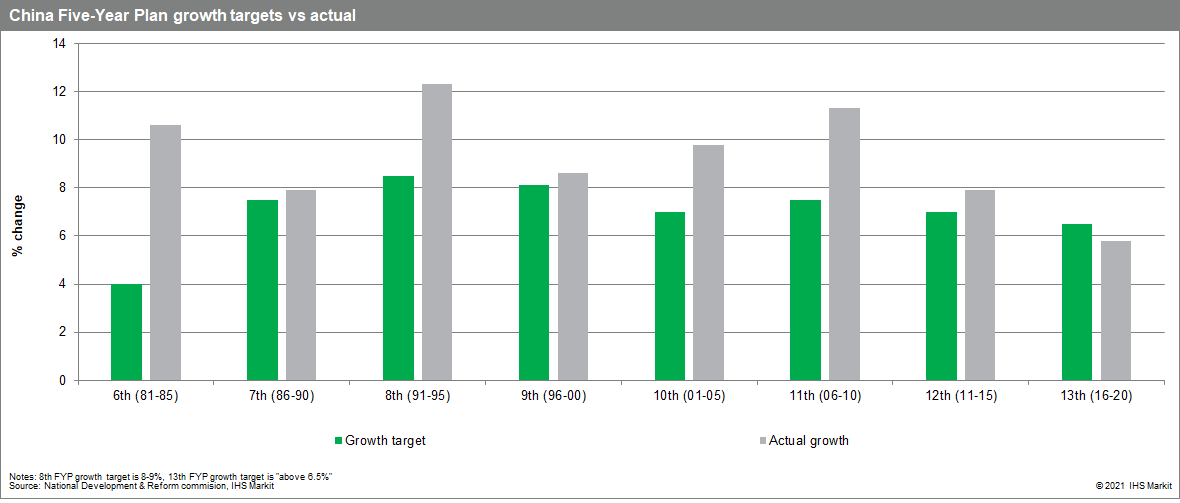

Unlike in previous five-year plans, the Chinese government did not set a growth target for the 14th FYP. The lack of a definitive growth goal in the latest five-year plan is not entirely surprising, as China's economic growth has consistently decelerated during Xi Jinping's tenure as China's top leader. China's GDP growth during the 12th FYP (2011-15) exceeded the growth target by 0.9 percentage point (7.9% vs 7.0%), far narrower than the margins with which China exceeded the growth targets of the previous two five-year plans. For the just concluded 13th FYP (2016-2020), China's growth failed to meet the growth target for the first time since reform and opening-up began in 1978 (5.8% vs "above 6.5%"). Although economic growth during the 13th FYP was hampered by the severe downturn cause by COVID-19, excluding 2020, China's growth in 2016-2019 still only averaged 6.6%, barely meeting the growth target.

- Economic reform agenda of the 14th FYP resemble the

2013 Third Plenum's reform program.

The new FYP's reform agenda largely mirror the sweeping and substantive 2013 Third plenum reform programs. In the new five-year plan, market system reform is again emphasized, including land market reform and improve market competition framework. Financial system reform is also featured in the 14th FYP. Specific areas of the financial system reform in the 14th FYP include improving the market interest rate formation and transmission, as well as establishing a market exit mechanism. State owned enterprise (SOE) reform appeared in the new five-year plan again, including Improving the state asset management system, as well as imposing accountability in SOE management. The key to the reform agenda, no matter how substantive, rests on implementation. As the Chinese authorities failed to follow through with execution of the 2013 Third plenum reform programs, China's productivity growth trended down, which led to China's persistent economic growth slowdown. - Primacy of state-owned sector remains in the 14th

FYP.

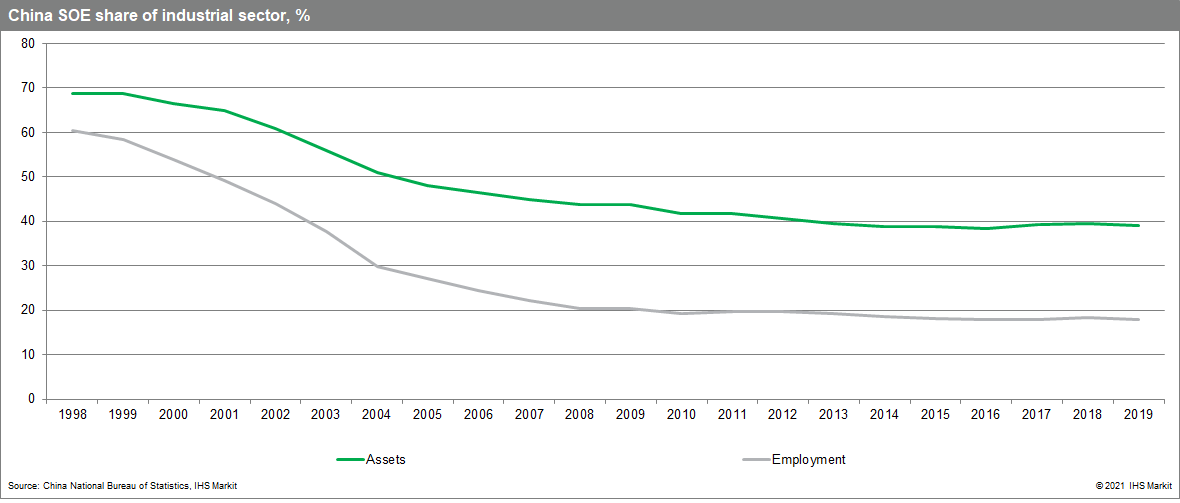

The new five-year plan declared the Chinese government will "not at all waver in solidifying and developing state ownership economy" and "unleash state-owned economy's strategic support effect". Clearly, the Xi Jinping led government has no intention of diminishing the role SOEs plays in China's economy. This should not be a surprise, as the more than a decade long trend of shrinking SOE footprint that began with SOE reforms of the late 1990s halted after Xi Jinping became China's leader in late 2012. The Chinese authorities' insistence that SOE retaining a key role in the economy is problematic to China's long-term economic growth prospects, considering the current leadership's poor record in SOE reform. State-owned sector has remained inefficient and become an increasing drag on China's growth. Maintaining SOE primacy also has implications on China's external economic relations, especially on the already strained economic relationship with the US.

- The priority sectors in the 14th FYP are similar to

"Made in China 2025".

The 14th FYP identified the strategic sectors the government aims to promote and develop. Unsurprisingly, these sectors mostly coincide with the strategic sectors included in the Made in China 2025 industrial policy that the Chinese government rolled out in 2015. As Made in China 2025 was a key grievance that the US cited in the trade war it waged against China, Made in China 2025 has all but disappeared from the Chinese government's policy parlance. Nevertheless, the Chinese government has never abandoned this long-term strategic industrial policy. The latest five-year plan provides further proof of Beijing's continued pursuit of such policy. Thus, while the uncertainty of the US trade policy under the new Biden administration has abated, due to Beijing's intent to maintain existing industrial policy and SOE primacy, the fundamental tension in the US-China economic relation will remain. - "Dual Circulation" is the new element of the 14th Five

Year Plan.

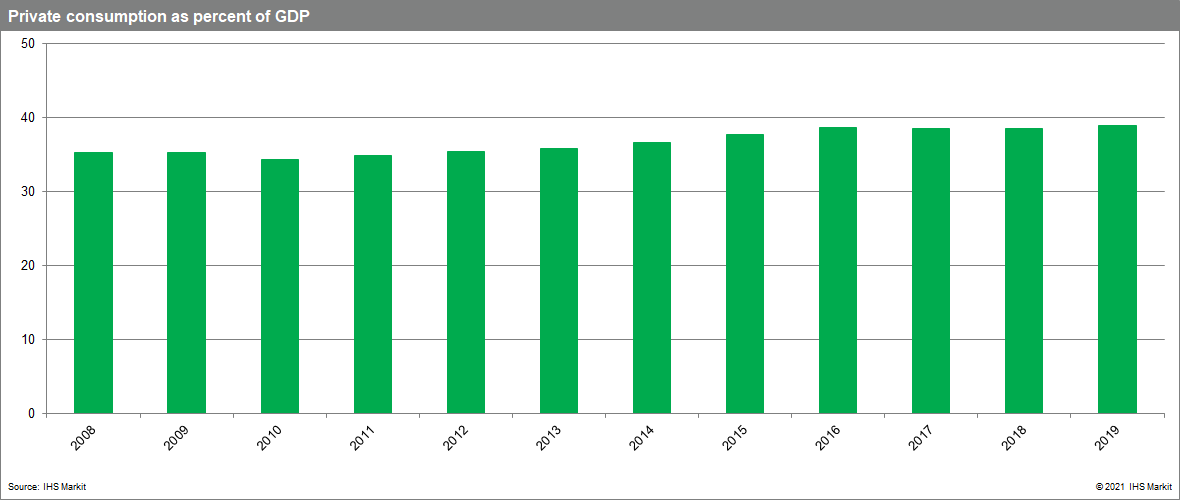

A major new element in the 14th FYP is the "Dual Circulation strategy" (DCS). DCS aims to expand China's domestic demand (internal circulation), and, with internal circulation as the core, develop the export market (international circulation). The motivation of DCS is to reduce China's exposure to the increasingly uncertain external market conditions brought about by the rising economic tension with the US. Expanding domestic demand essentially involves stimulating private consumption, given China's already high investment. Private consumption has long been suppressed, due to various structural factors such as insufficient social safety net. Stimulating private consumption is not a new policy, as it has been part of the Chinese government's rebalancing strategy since the Global Financial Crisis in 2008-2009. However, the rebalancing policy only produced limited success. The share of private consumption in China's GDP rose by less than four percentage points between 2008 and 2019.

Bottom line

The 14th FYP is part of Xi Jinping's long-term strategy of

transforming China into an advanced economy. The key to China's

long-term economic success rests on revitalizing productivity

growth. Without reversing the productivity growth downtrend of the

last decade, China's economic growth will continue to decelerate.

Reinvigorating China's productivity growth requires substantive

economic reforms, for which the 14th FYP has laid out a solid

blueprint. Equally if not more crucial Is the execution of the

reform programs, which the Xi government still has room to

improve.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffive-things-to-know-about-chinas-new-fiveyear-plan.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffive-things-to-know-about-chinas-new-fiveyear-plan.html&text=Five+things+to+know+about+China%e2%80%99s+new+five-year+plan+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffive-things-to-know-about-chinas-new-fiveyear-plan.html","enabled":true},{"name":"email","url":"?subject=Five things to know about China’s new five-year plan | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffive-things-to-know-about-chinas-new-fiveyear-plan.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Five+things+to+know+about+China%e2%80%99s+new+five-year+plan+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffive-things-to-know-about-chinas-new-fiveyear-plan.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}