Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 12, 2020

Empirical analysis into the impact of COVID-19 on global trade relations

Key points:

- We estimate the impact of COVID-19 for bilateral trade relations of all monthly reporting states present in the IHS Markit GTA Forecasting database over the period 2019M1 - 2020M8 using a semi-mixed effects panel data model in the trade gravity framework

- The impact of COVID-19 on bilateral trade is statistically significant and adverse, ceteris paribus, on both the exporter's and importer's side

- The result holds for both monthly-reported new COVID-19 cases as well as new COVID-19 related deaths as a proxy for the severity of pandemic

- The impact is found to be asymmetric at the level of individual states as could have been expected taking into account the time-path and gravity of the pandemic

- The models re-estimated on a monthly basis show that the impact globally becomes adverse and statistically significant in March 2020 and endures. This coincides with the escalation of COVID-19 from Asia to Western Europe and then globally

- The stringency of governments response to the COVID-19 pandemic as measured by Oxford COVID-19 Government Response Tracker index it has a statistically significant and negative impact on the importer's side only in a global sample model which could be indicative of the creation of significant hindrance to trade and weaker consumer demand

Introduction

2020 proves to be the most challenging year on record for global trade and the global economy in a century. The COVID-19 pandemic has destroyed hopes for a strong global upturn.

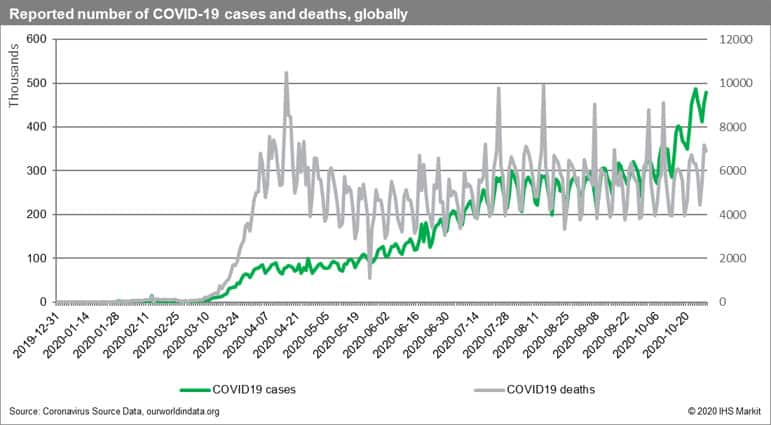

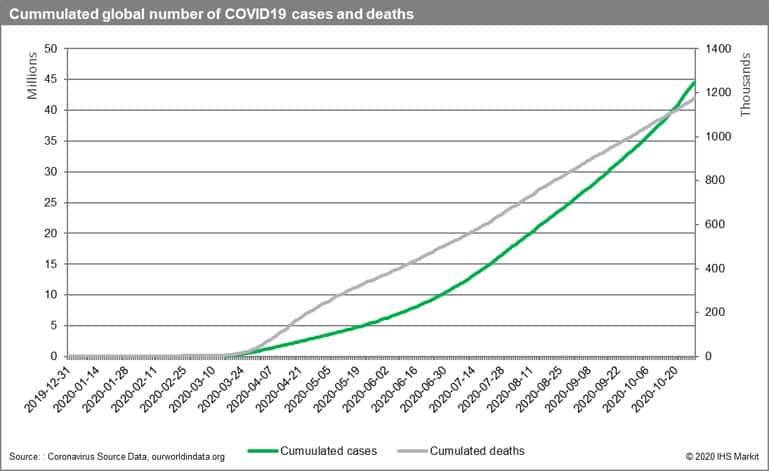

As of 1 November, 46 million cases and 1.2 million deaths have been reported globally by the WHO. The further acceleration in the incidence of new cases was most notable in the European Region, which reported half of the global new cases (over 1.7 million cases - a 22% increase from the previous week). Moreover, the European region also reported a substantial rise in the number of new deaths (a 46% increase compared with the previous week), with Europe and the Americas now each reporting over 17,000 new deaths in the last week. Europe seems to be experiencing a second wave of the pandemic.

The COVID-19 pandemic is the worst health crisis in more than a century and potentially without precedent if we take the globalized nature of the current economy. It's a simultaneous supply and demand shock that led to a global recession and unprecedented contraction in global trade (affecting both the export potential of nations and their demand for imports). The contraction is by now far larger than the effects of the global financial crisis in 2008-09 (referred to as the Great Trade Collapse) or any other recent health crisis (e.g. SARS, Ebola, or MERS).

The effects of COVID-19 form a theoretical perspective

The direct trade effects of COVID-19 (Baldwin & Toimura, 2020) are related to direct supply disruptions hindering production (local/ regional lockdowns & forced production stoppages), increased transport cost due to implementation of stricter rules, supply-chains contagion effect which amplified the direct supply shocks (manufacturing sectors in less-affected nations found it harder and more expensive to acquire the necessary imported inputs from hard-hit nations) and finally to demand disruptions due to a decrease in the aggregate demand (recession), and precautionary or wait-and-see purchase delays (delayed purchases & investments).

Reporters most adversely affected are the ones struck by the pandemic itself as well as economies most dependent on the trade with these nations through export/import linkages (forward/backward linkages in global value chains, GVCs). Increased defragmentation of production chains and certain management principles (just-in-time and lean production with low stockpiles of inputs) increased the susceptibility of the global economy to the shock. The impact is, however, asymmetric due to the nature of the individual (sector-level) value-added chains. Some GVCs dependent on adversely affected regional or global hubs such as China, Italy, Spain, or Germany were more affected (e.g. automotive industry, electronics). Some industries or sectors gained on the crisis (e.g. pharmaceuticals, IT services).

Global uncertainty levels skyrocketed with an adverse impact on financial markets. Increased uncertainty and falling demand decrease the level of investments by firms which could have dire dynamic consequences (lower accumulation, lower growth rates).

Individual economies and groups of economies once again took unprecedented steps to mitigate the crisis, which could have similarly to 2007-08 negative consequences for public finances and global debt levels. This increases the probability of the W-shape scenario (the initially assumed V-shape with a strong recession followed by sharp recovery is already highly unlikely).

The pattern of trade collapse reflects the spread of the pandemic and the steps taken by individual governments. The overall impact will depend critically on the duration, severity, and spatial pattern of the pandemic. The remedy would be the introduction of a successful vaccine or global herd immunity.

It has to be stressed here that the impact of the pandemic on the global economy is extremely complex and takes place through a large number of potential direct & indirect channels. Formal economic models have been utilized to analyze past pandemics (e.g. Bloom et al. 2005). In order to account for the complexity of the phenomenon usually complex computable general equilibrium frameworks are applied. The CGE model of Maliszewska, Mattoo, & Van Der Mensbrugghe (2020) for instance took into account the direct impact of a reduction in employment, the increase in costs of international transactions, the sharp drop in trade and the decline in demand for services. It shows clearly that the effect on the global economy will depend on the severity of the pandemic and the duration of containment efforts with particularly adverse effects for developing states.

Unfortunately, the spread of COVID-19 resembles the infamous Spanish Flu pandemic of 1918-20 that lasted two years and had three major waves with the second one particularly sinister (Johnson & Mueller, 2002). The incoming data provides the first signs of the second wave in a growing number of reporters. The economic impact will now depend on actions taken - judging from the overreaction in spring they are unlikely to introduce tough and economically harmful measures unless the situation significantly deteriorates (e.g. Israel recently has reintroduced a three-week long national lockdown).

We already understand that the impact of a pandemic won't be limited to the short run. It is likely to have long-term consequences as well. We are likely to observe more pronounced adjustments to GVC/trade patterns (trade diversion effects) the larger, the longer the pandemic lasts. COVID-19 has already led to an acceleration in digital transformation, adjustments in work patterns, and an increase in the role of RPA/AI in numerous sectors. Health security issues are going to be taken more seriously are likely to modify decision making of MNEs and, this could affect their location choices and thus lead to the reconfiguration of GVC/logistic chains. We are likely to see a trend towards onshoring or backshoring, more nearshoring, and thus the transformation of GVC towards more regionalized value chains. Reversal from globalization is however unlikely.

An empirical investigation of the impact of COVID-19 on global trade

To empirically identify the impact of COVID-19 on the trade we have built an econometric model in the gravity tradition explaining the intensity of bilateral trade relations between all monthly reporting states present in the Global Trade Atlas Forecasting database.

The period analyzed covers monthly observations from January 2019 to August 2020. We utilize data from IHS Markit on bilateral exports from the GTA Forecasting database (cleaned and after the application of country ranking scheme) available for all monthly reporting economies and data on GDP from IHS Markit Comparative World Overview. This gives us approximately 360,000 observations. We intentionally take the whole 2019 into account in order to account for the pre-COVID-19 period and detect the impact of the pandemic itself.

In addition, we utilize standard trade gravity variable from the CEPII gravity database supplementing it with data on daily reported new cases of COVID-19 and COVID-19 related deaths aggregated to months. The data on COVID-19 has been adopted from the Coronavirus Source Data provided by Our World in Data. The variables were transformed separately for an exporter and an importer and were zero-adjusted to take zero observations into account (the variables are coded as x_l_newc, m_l_newc for the log of new cases, as well as x_l_newd & m_l_newd for new COVID-19 related deaths).

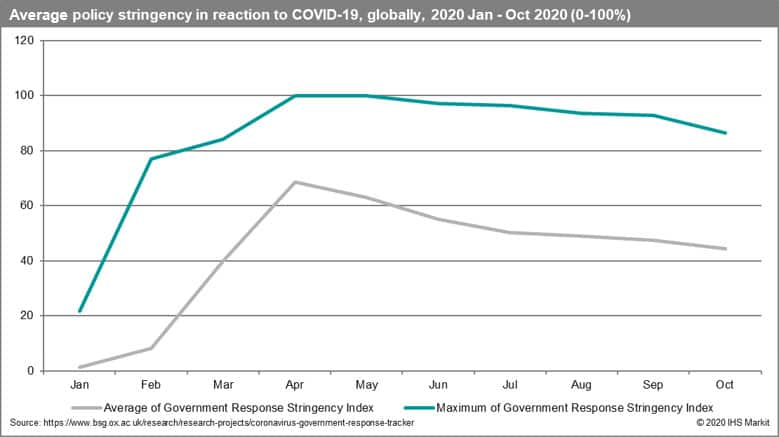

Furthermore, as the impact on trade critically depends on the stringency of actions of individual governments taken in response to the escalating pandemic, we take into account monthly averages of the Oxford COVID-19 Government Response Tracker (OxCGRT) - for both exporters and importers (asi_x, asi_m). The OxCGRT (Hale, Petherick, Phillips, & Webster 2020) collects information on different common policy responses that governments have taken to respond to the pandemic on 18 different indicators such as school closures and travel restrictions. The value of the index varies between 0 (no measures) to 100 (complete lockdown). The global average of the stringency of response is presented in the following graph with a clear peak in April 2020. We also plot the maximum level of stringency globally with a similar peak in April-May 2020.

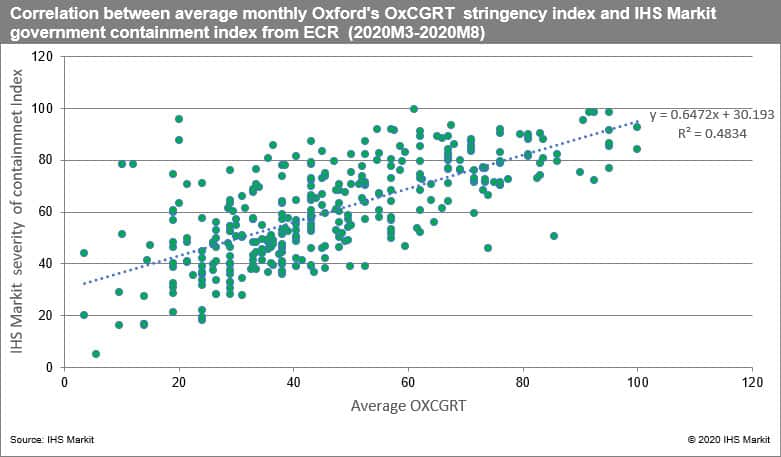

As is clearly visible, the monthly average of the OxCGRT is correlated with IHS Markit's ECR Division COVID-19 Government Containment index available for selected countries since March 2020 and forecasted forward till June 2021. The containment index takes values from 0 - no measures in place to 100 - extreme measures.

We estimate the model using a semi mixed-effects panel model (Lombardía and Sperlich, 2012; Proença, Sperlich, and Savaşcı 2015) estimated with the use of PPML or Pseudo Poisson maximum likelihood method as suggested by the Silva & Tenreyro (2011). All floating variables utilized in the model apart from the explained variable enter the model in logs. All binary variables are introduced as dummies.

The data on new COVID-19 cases represents the severity of the pandemic in each economy. The data on COVID-19 related deaths to us takes into account the burden of the pandemic on a given reporter's health system and thus takes into account the efficiency of a given health system and could be considered an even better approximation of the pandemic. Naturally, the number of cases and deaths is related to the size of the population of a given economy.

The list of explanatory variables includes the standard variables utilizing the gravity equations approach that is the log of real GDP of the exporter (l_x_gdp), the log of real GDP of an importer (l_m_gdp) as well as the log of distance in kilometers between the capital cities of both trade partners (l_distance_cap). The distance is measured using the "as the crow flies" approach. The standard variables have been supplemented with other traditional variables from CEPII gravity dataset (Head, Mayer & Ries 2010) such as contingency of trade partners or common border (contig), common official language (comlang_off), a binary variable depicting a former colony status for a given country pair (colony) as well as the presence of RTA or regional trade agreement notified to WTO between a given pair of countries (rta).

In order to account for a common business cycle we have introduced time fixed effects and in line with the suggestions of Silva & Tenreyro (2011).

The obtained results prove the viability of the gravity approach in explaining the intensity of bilateral trade. The coefficient of determination is high in many cases exceeds 0.9 thus 90% or more of the variation in the explained variable, namely the value of exports, is explained by the factors included in the model.

The coefficients on key variables are in line with economic theory and prove the robustness of the gravity approach. The coefficients on exporter's and importer's size are positive and statistically significant. The impact of distance, in line with theory, is adverse and statistically significant. The impact of contingency is positive as expected. In many specifications of the model, the impact of, the commonality of language is positive. The former colony status isn't statically significant in the general specifications; however, its impact is significant in exporter-specific specifications of the model. Last but not least, the impact of RTA between a pair of countries is significant and positive as could have been expected.

In the following empirical analysis of the impact of COVID-19 on trade, we follow the succeeding empirical strategy. We first estimate the model for the global sample introducing our two proxies, new COVID-19 cases and deaths, in separate specifications. Secondly, we show the results for models estimated for separate months from January to August 2020 to depict the changing elasticity of the reaction to COVID-19. Thirdly we estimate the models for selected top global exporters to show the asymmetry of the reaction at the level of states. Fourthly, we account for the impact of stringency of government reaction to COVID-19.

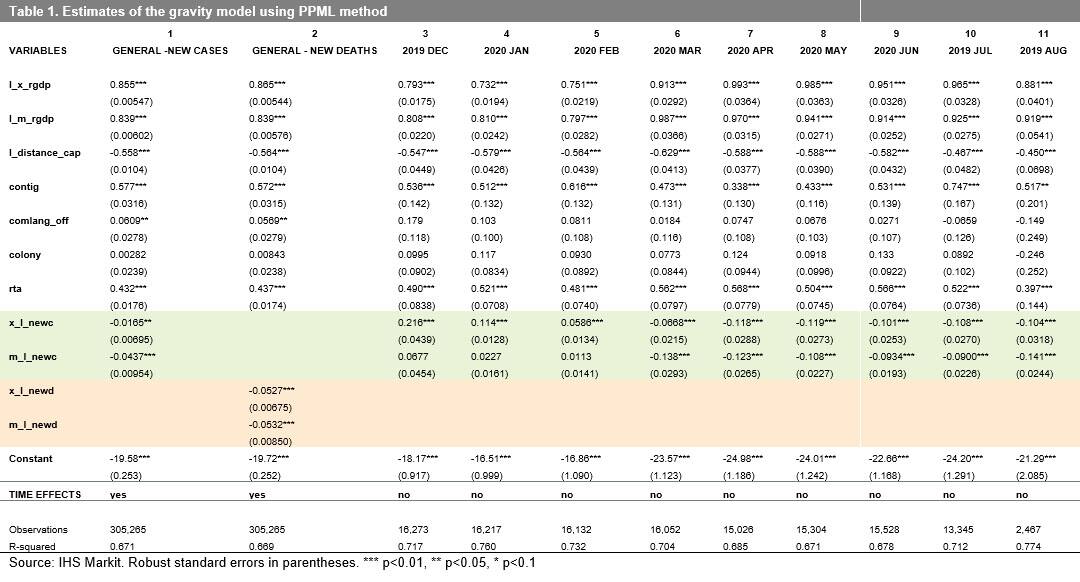

At first, in accordance with the above strategy, we estimate the general model for the global sample introducing simultaneously the COVID-19 specific variables for both exporter and importer. In the first specification, we account for the new COVID-19 cases while in the second one we introduce the COVID-19 related deaths. As can be seen (please refer to Table 1), the impact of the COVID-19 pandemic on bilateral exports is statistically significant and adverse. The impact does not seem to depend on the proxy utilized - both new COVID-19 cases, as well as COVID-19 deaths, harm bilateral exports, however, the magnitude of the effect is higher for new COVID-19 related deaths. It could be related to the nature of the variable which accounts, at least partially in our understanding, for the efficiency of a particular national health system to the COVID-19 pandemic. The magnitude of the reaction to COVID-19 new cases in the exporter is weaker than on the importer's side. The magnitude of the effects for new COVID-19 related deaths is on the other hand similar on the exporter's and importer's side. Please take into account that the method utilized allows us to interpret the coefficients as elasticities. Thus, an increase in monthly COVID-19 related deaths by 100% for both exporter and importer decreases the trade between them by approx. 5.3%, ceteris paribus.

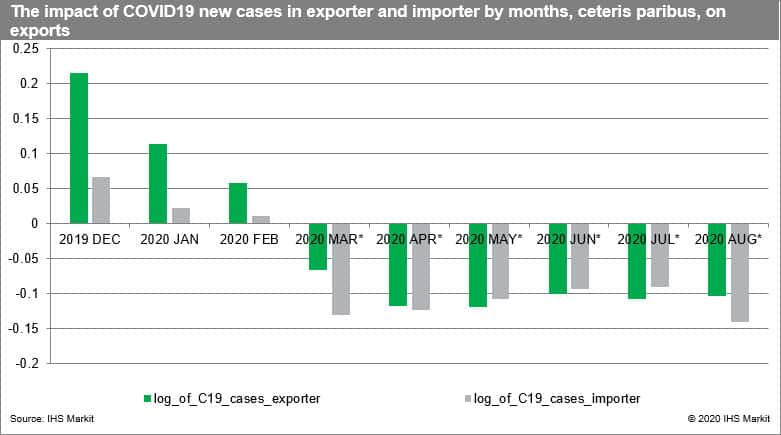

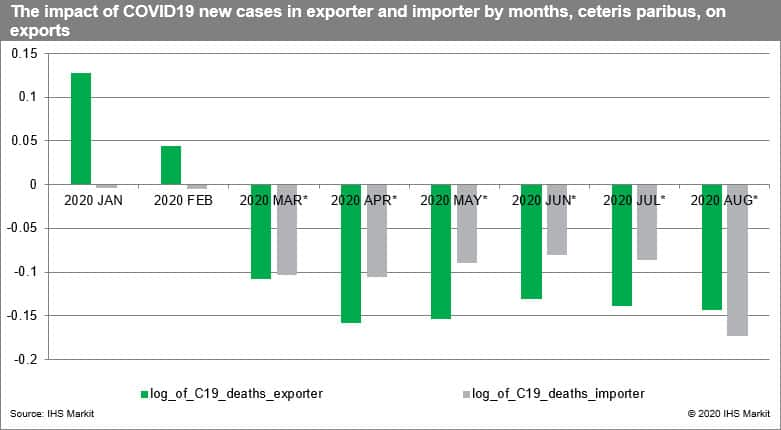

In the next phase of our empirical analysis, the models on a global sample are estimated separately for each month of the pandemic that is starting from December 2019 till August 2020. For obvious reasons, the model does not include fixed time-specific effects. As can be seen, starting from March 2020 the elasticities of reaction to COVID-19 cases both on the exporters and importer side become statistically significant and negative. The effect endures till the end of our sample which indicates the adverse impact of COVID-19 on global trade starting from the global escalation of the first wave, ceteris paribus. The effect is also present and of similar magnitude if we control for new COVID-19 deaths. We visualize the elasticities of the reaction in the following two graphs.

We expect the above effect to endure in the forthcoming months if we consider the escalation of the pandemic in recent weeks pointing to a clear second pandemic wave. Unfortunately, the effect could last further with the expected third wave of the pandemic in the next year unless the effective vaccine is found and globally distributed and applied. It will be a very costly and arduous process in itself requiring global coordination to bring the desired effect.

Looking from that perspective, 2020 as well as 2021 can be predicted to be the worst two years for global trade relations on the record and in particular since the Second World War. The impact of COVID-19, a major simultaneous supply and demand shock due to the health crisis, proves to be adverse and significantly larger than the prior outbreaks including HIV, Ebola, SARS, or MERS in recent years.

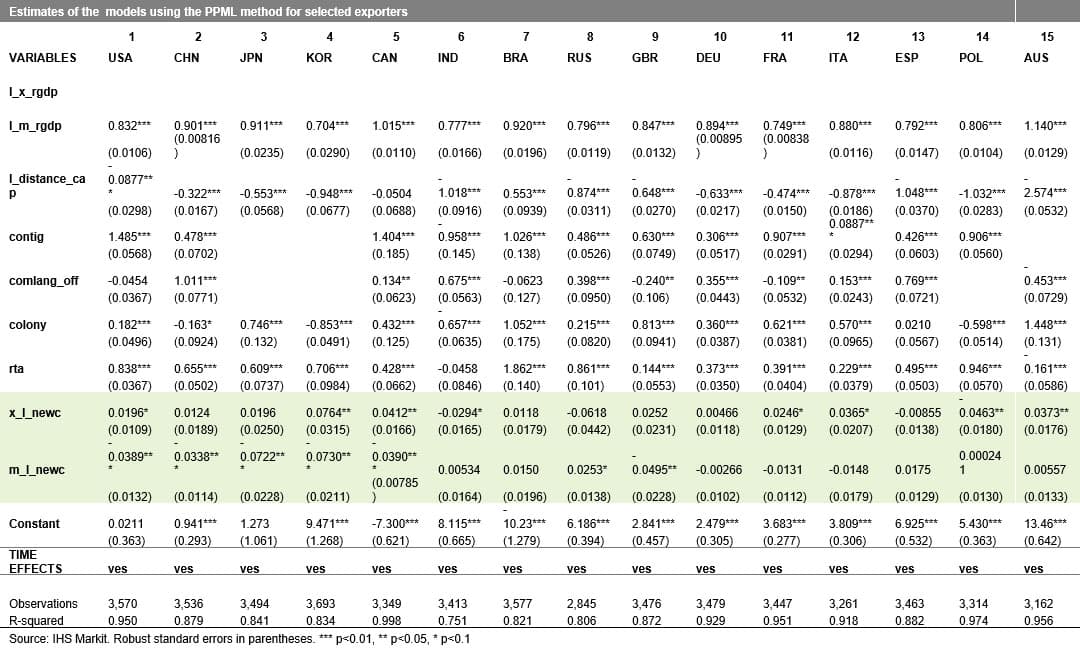

In the next set of models (please refer to Table 2), we estimate the models separately for selected top global exporters. The group includes, in particular, the US, China (mainland), Japan, South Korea, Canada, Brazil, India, Russia, Australia, and a selection of European states including the United Kingdom and the largest of the EU states, namely: Germany, France, Italy, Spain, and Poland. The list thus includes several countries particularly adversely affected by COVID-19. The aim is to identify a potential asymmetry of reactions

The first set of models accounts for the new COVID-19 related cases and the second set of models accounts for COVID-19 related deaths. As can be seen, the elasticity of the reaction to COVID-19 cases or deaths differs between reporters. For several countries, the impact of COVID-19 on the value of exports is statistically insignificant on both sides. We observe it for Brazil, Spain, and Germany. On the other hand, for India and Poland, the number of cases in the exporter plays a negative role. For the US, China, Japan, South Korea, Canada, and the UK the number of COVID-19 cases on the importer side plays an adverse and statistically significant role. The existence of a positive impact of the number of COVID-19 related cases for some of the reporters on the exporter side could be due to the specific time sequence of the pandemic in individual countries. It is worth stressing that in most of the cases, the impact disappears when we utilize the new COVID-19 related deaths.

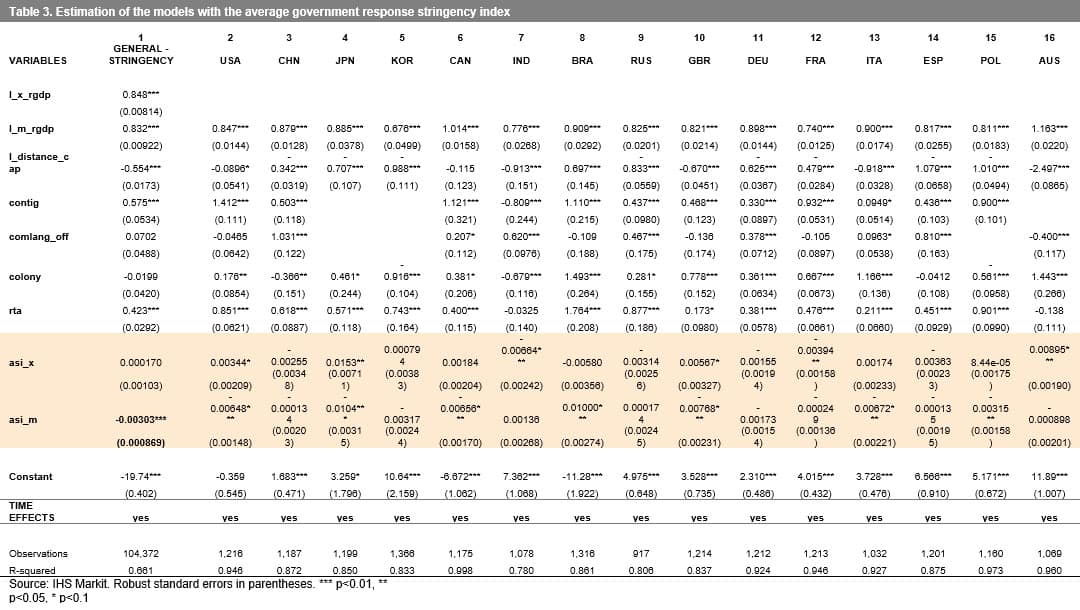

In the last set of models (please refer to Table 3), we depict the impact of COVID-19 by introducing the average Oxford COVID-19 Government Response Tracker (OxCGRT) for the exporter and importer (shown here as asi_x & asi_m). The government response stringency index has a negative and statistically significant impact on the value of exports in the global sample only on the importer's side. Thus, a more stringent response on the importer's side seams to create significant trade barriers. It could be due as well to the weakening demand for imports. On the supply side, the exporter, the impact is insignificant. The individual governments try to limit the harm caused by policy responses to their export potential.

It is worth stressing that in a batch of models in which we utilized the IHS Markit ECR's stringency of containment index for exporter and importer (not shown here, available in the extended version of the article) the impact was negative for the policy response on both sides.

In the next set of specifications, we show once again the asymmetry of the effect between countries. In seven countries, the stringency of the importer's policy response has an adverse and statistically significant impact on the value of trade. In India and France, the impact is negative for the stringency of home country reaction. Surprisingly, the impact of stringency of home country measures is statistically significant and positive at the usually applied level of 5% in the case of Japan and Australia. On the other hand, for China, South Korea, Russia, Germany, and Spain we identify no statistically significant effect of policy response to COVID-19 on their exports. That could be related to the pattern of their trade-in terms of most significant trade partners as well as the product structure of their exports.

Summing up, the conducted analysis proves the existence of the negative impact of COVID-19 on global trade relations. The effect seems to endure from March 2020 onwards and now with the second wave is likely to endure till the containment efforts and potentially global vaccination will be effectively introduced.

This column is based on data from IHS Markit Maritime & Trade GTA Forecasting database.

Subscribe to our monthly newsletter and stay up-to-date with our latest analytics

References

Baldwin, R., & Tomiura, E. (2020). Thinking ahead about the trade impact of COVID-19. Economics in the Time of COVID-19, 59.

Hale, T., Petherick, A., Phillips, T., & Webster, S. (2020). Variation in government responses to COVID-19. Blavatnik School of Government Working Paper, 31.

Head, K., Mayer, T. & Ries, J. (2010), The erosion of colonial trade linkages after independence Journal of International Economics, 81(1):1-14.

Johnson, N. P., & Mueller, J. (2002). Updating the accounts: global mortality of the 1918-1920" Spanish" influenza pandemic. Bulletin of the History of Medicine, 105-115.

Lombardía, M. J., & Sperlich, S. (2012). A new class of semi-mixed effects models and its application in small area estimation. Computational Statistics & Data Analysis, 56(10), 2903-2917.

Maliszewska, M., Mattoo, A., & Van Der Mensbrugghe, D. (2020). The potential impact of COVID-19 on GDP and trade: A preliminary assessment. Policy Research Working Paper 9211.

Proença, I., Sperlich, S., & Savaşcı, D. (2015). Semi-mixed effects gravity models for bilateral trade. Empirical Economics, 48(1), 361-387.

Silva, J. S., & Tenreyro, S. (2011). Further simulation evidence on the performance of the Poisson pseudo-maximum likelihood estimator. Economics Letters, 112(2), 220-222.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fempirical-analysis-into-the-impact-of-covid19-on-global-trade.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fempirical-analysis-into-the-impact-of-covid19-on-global-trade.html&text=Empirical+analysis+into+the+impact+of+COVID-19+on+global+trade+relations+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fempirical-analysis-into-the-impact-of-covid19-on-global-trade.html","enabled":true},{"name":"email","url":"?subject=Empirical analysis into the impact of COVID-19 on global trade relations | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fempirical-analysis-into-the-impact-of-covid19-on-global-trade.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Empirical+analysis+into+the+impact+of+COVID-19+on+global+trade+relations+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fempirical-analysis-into-the-impact-of-covid19-on-global-trade.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}