Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 02, 2023

Electronics sector reports greatest improvement in supply chains since 2001

Improving supply chains are helping global electronics companies fulfil backlogs of orders and stabilise production after substantial output losses incurred late last year. The supply of semiconductors, for example, is now almost back to normal.

Price pressures in the electronics sector are also coming down, notably for consumer electronics, amid the combination of reduced supply chain cost pressures and still-weak demand, which should help further moderate the broader global inflation trend in the months ahead.

Electronics industry stabilising

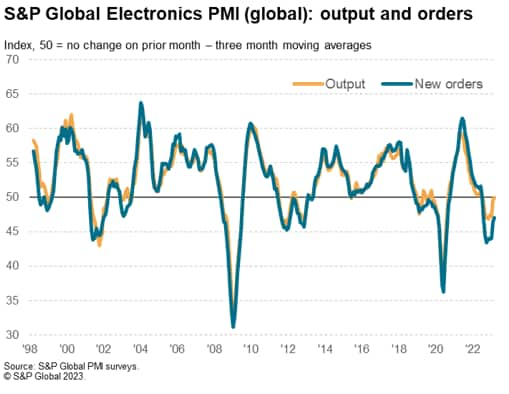

S&P Global's Electronics PMI™ signalled a stabilisation of production among electronics firms around the world in the first quarter of 2023. Albeit showing some monthly volatility, specifically with March seeing some payback after a steep rise in February, the average factory output trend in the first quarter was flat, representing a marked improvement on the steep declines seen throughout the second half of last year.

The Electronics PMI is compiled by S&P Global from responses to questionnaires sent to purchasing managers in electronics manufacturers worldwide. The sample of around 750 firms, of varying sizes, is selected from S&P Global's PMI survey panels which notably include mainland China, the US, the eurozone, Japan, South Korea, Singapore and Taiwan. All firms are electronics manufacturers and provide goods to consumer, industrial, computing and communications markets.

Depleting backlogs of work

Part of the improved production trend can be traced to a moderation in the rate of loss of new orders at electronics manufacturers. Although new orders fell globally across the sector over the first quarter, the rate of decline has eased sharply compared to that seen in late 2022. However, new orders nevertheless continue to fall at a steeper rate than production, a gap which is explained by producers relying on orders placed in prior months to help sustain the relatively stronger production trend in the face of the disappointing inflows of new business.

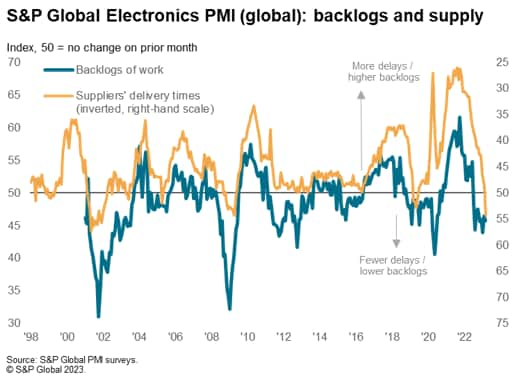

Backlogs of orders accumulated in the electronics sector from late-2020 through to mid-2022 largely due to widespread shortages of components, in turn linked to issues with supply chains combined with surging demand for computers, communications equipment and consumer goods, created by the COVID-19 lockdowns and containment measures. Since mid-2022, these backlogs have fallen continually, linked to a reversal of these factors: the reopening of economies has meant demand for electronics goods has been falling (in part due to consumer spend shifting to services) and supply has been improving.

Supply improves to greatest extent since 2001

Average supplier delivery times for inputs to electronics firms improved worldwide in March for the first time since June 2019, with lead times shortening to an extent not seen since the bursting of the dot-com bubble in 2001.

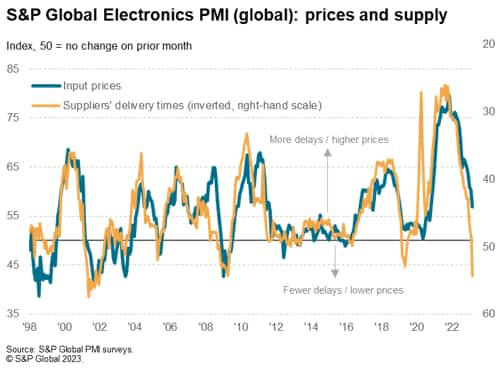

Cooling price pressures

This improvement in supply has been accompanied by a cooling of price pressures, as suppliers have been less able to pass though higher prices in recent months (in effect reflecting a shifting of buying power from the seller to the buyer). Average input prices paid by electronics manufacturers rose globally in March, but at the slowest rate since October 2020. The resulting rise was only modestly higher than the average increase seen in the decade leading up to the pandemic.

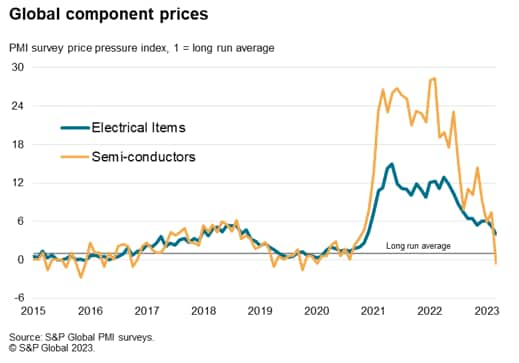

Tracking price and supply conditions

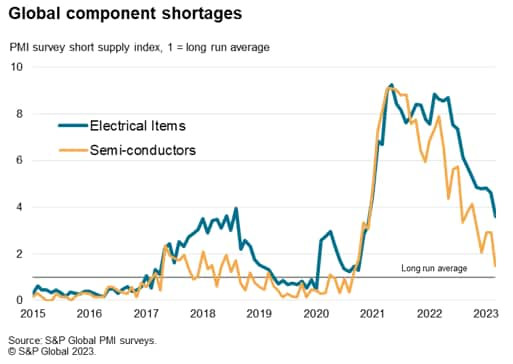

The surveys allow further insights into supply and demand conditions for individual inputs by analyzing the reporting of items that have risen or fallen in price, or which have become in short supply. S&P Global builds time series data for these changing price and supply pressures, which are presented relative to their long run averages. Any values in excess of 1.0 therefore represent higher than normal price pressures or supply shortages and vice versa.

These data reveal how shortages of semiconductors are currently running at just 1.5 times normal, down from over nine-times normal levels at the height of the pandemic. While a broader group of all electrical items is now shown to be seeing supply constraints at four-times the long run average, that's also down from a peak of over nine-times normal levels seen at the height of the pandemic two years ago.

The data also indicates how price pressures for semiconductors fell below their long run average in March for the first time since June 2020. Price pressures for all electrical items have meanwhile cooled to a 28-month low.

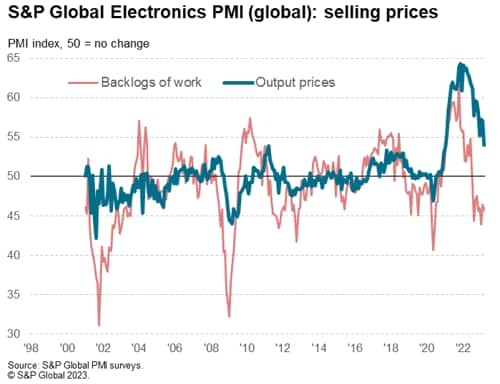

Selling price inflation at 26-month low

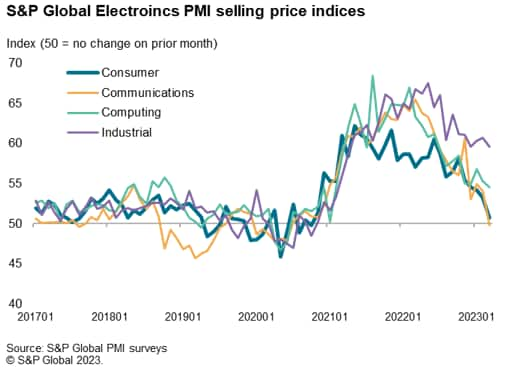

With input costs pressures easing amid improving supply chains and falling demand, selling price inflation has moderated from the unprecedented rates seen during the height of the pandemic. A steep downward trend in the rate of inflation of selling prices for electronics goods has been evident over the course of the past year, resulting in March's data signalling the smallest monthly increase since January 2021.

Most pronounced has been a reduction of selling price inflation for consumer goods and communications equipment. The former saw only a marginal rise in prices on average worldwide in March to register the smallest increase for nearly two-and-a-half years. The latter saw selling prices fall in March for the first time since June 2020.

While rates of selling price inflation for computing equipment and industrial electronics kit remains stickier, these sectors have likewise reported lower rates of selling price inflation in recent months.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2felectronics-sector-reports-greatest-improvement-in-supply-chains-since-2001-may23.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2felectronics-sector-reports-greatest-improvement-in-supply-chains-since-2001-may23.html&text=Electronics+sector+reports+greatest+improvement+in+supply+chains+since+2001+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2felectronics-sector-reports-greatest-improvement-in-supply-chains-since-2001-may23.html","enabled":true},{"name":"email","url":"?subject=Electronics sector reports greatest improvement in supply chains since 2001 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2felectronics-sector-reports-greatest-improvement-in-supply-chains-since-2001-may23.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Electronics+sector+reports+greatest+improvement+in+supply+chains+since+2001+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2felectronics-sector-reports-greatest-improvement-in-supply-chains-since-2001-may23.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}